China’s BYD is rapidly transforming the global auto landscape — leading a global EV pricing war that’s boosting sales, shaking legacy automakers, and straining suppliers.

China’s Car Export Boom Is Reshaping the Global Market

Chinese automakers are projected to capture 30% of global car sales by 2030, up from 21% in 2024, according to AlixPartners. The most dramatic gains are expected in emerging markets across Latin America, the Middle East, Southeast Asia, and Africa.

Fueled by overcapacity at home and soft domestic demand, Chinese manufacturers — led by BYD ($BYDDF) — are exporting record volumes of affordable, high-tech EVs across the globe. China has already overtaken Japan and Germany to become the world’s largest car exporter.

In the first five months of 2025:

- UAE imports from China surged 551% to $2.7B

- Mexico imported $2.4B, becoming a key gateway to the North American market

- Russia took in $2.2B despite geopolitical friction

BYD Dominates Domestically — But Faces Pressure

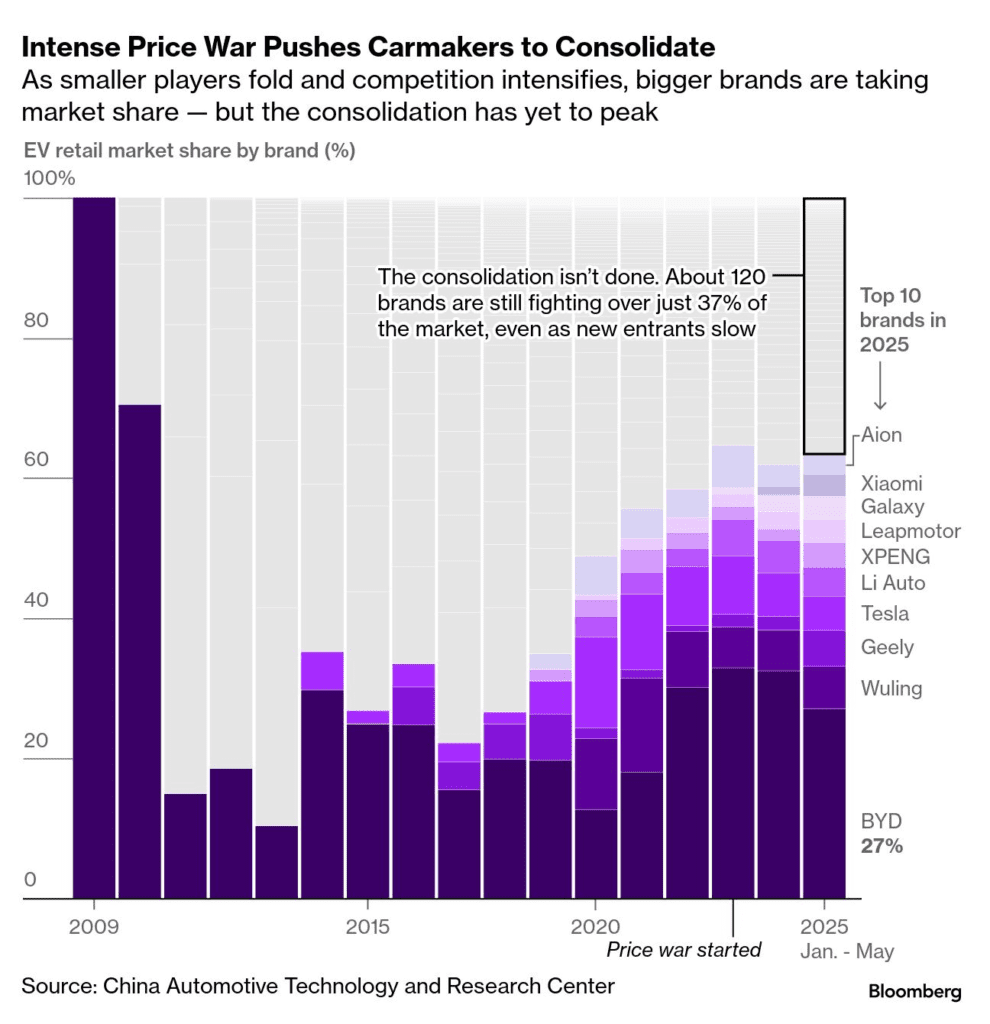

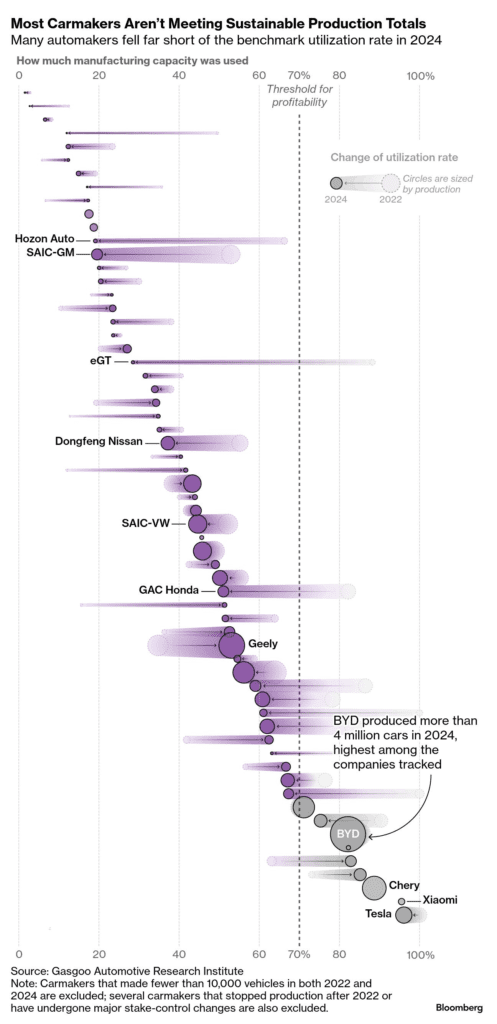

At home, BYD commands 27% of China’s retail EV market and has consistently operated its factories at 80%–85% utilization — a rare level of efficiency in a saturated domestic industry. For comparison, only 15% of China’s 70 automakers met the 70% benchmark in 2024.

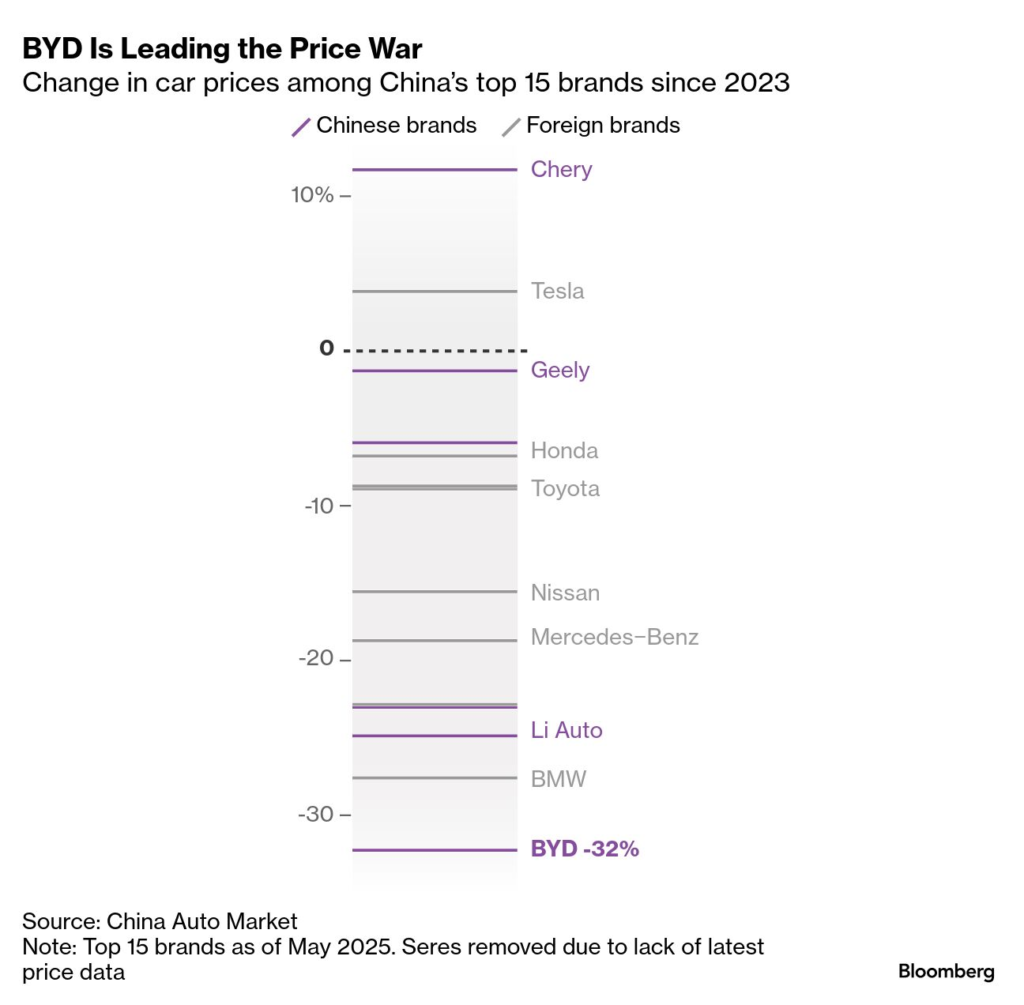

BYD sold 4.3 million vehicles in 2024 and has stayed profitable even while cutting prices by an average of 32%, according to China Auto Market data.

But this aggressive strategy is causing cracks:

- Price wars have slashed average margins in China’s auto industry to 4.3%

- Tesla ($TSLA), by contrast, raised prices by 3.8% in the past 2 years

- Suppliers report being paid via IOUs (D-chain) and waiting up to 8 months for payments

- BYD’s accounts payable surged 9x over five years, hitting $54 billion, or two-thirds of its total liabilities

Supplier Strain: BYD’s Expansion Is Fuelled by Cost Squeezes

According to the Wall Street Journal, BYD’s suppliers are under heavy financial strain, enduring:

- Delayed payments

- Forced cost cuts

- Intensive audits and factory inspections

One supplier, Guangdong Huazhuang Technology, disclosed in its IPO filing that it typically receives payment terms of 6–8 months via D-chain.

Despite pledges to pay suppliers within 60 days, skepticism remains. Chinese regulators revised competition laws in June to ban “unreasonably long payment terms”, but experts say the root cause—overcapacity and deflation—remains unaddressed.

Going Global: BYD Expands to Europe, UK, and Beyond

BYD is now taking its price war to Europe. It recently launched the Dolphin Surf, a compact EV priced at:

- £18,650 in the UK

- €23,000 across Europe

- Base version offers 203 miles WLTP range, while the Boost trim offers 305 miles

The Dolphin Surf competes directly with the Dacia Spring, Renault 5, and Citroën ë-C3, shaking up a segment long dominated by internal combustion engines due to tight margins.

Key stats:

- Chinese EVs now make up 4.8% of European EV sales (up from 2.9% in Q1 2024)

- UK alone accounts for nearly one-third of all Chinese EVs entering Western Europe

- Auto Trader UK reports a 10x increase in Chinese EV listings YoY

Despite EU tariffs, the UK remains open — giving BYD a strategic foothold.

Europe Eyes Price Controls as China Pushes Expansion

To avoid rising EU tariffs, Beijing has proposed a voluntary price floor of €35,000 per EV, which would exclude most of BYD’s entry-level models. The EU has yet to accept the deal.

Even with price cuts less aggressive than in China, BYD’s expansion is accelerating. S&P Global Mobility forecasts BYD will:

- Double sales in Europe to 186,000 units in 2025

- Reach 400,000 units by 2030

Meanwhile, Volkswagen ($VWAGY) and Renault ($RNLSY) are partnering with Chinese firms to lower costs and compete in the compact EV segment.

“Neijuan” and the Ethical Tension Behind BYD’s Growth

China’s EV price war is a symptom of a broader economic phenomenon called “neijuan”, or involution — a cycle where intense competition leads to unsustainable cost-cutting.

One supplier wrote in an open letter:

“I have a dream that one day in China’s auto industry, leading automakers and large suppliers will have a social conscience.”

While the price war benefits consumers and accelerates EV adoption, it risks long-term damage to supplier networks, wages, and innovation.

What’s Next? A Global Shakeout in the Making

Consolidation is coming, but slowly. China’s EV market still supports over 120 brands, despite clear signs that only a dozen strong players are likely to survive.

BYD, with its vertical integration (batteries, chips, motors in-house), remains ahead — but even it is being watched closely as signs of supply chain strain emerge.

As one analyst put it:

“BYD may win the price war — but can it survive the aftermath?”

Sources Used:

- Bloomberg: China Will Make Almost a Third of the World’s Cars by 2030

- FT: BYD brings EV price wars to small cars in Europe

- WSJ: How China’s BYD Is Squeezing Suppliers

- Electrek: BYD’s EV price war heads overseas with Dolphin Surf

- Bloomberg Graphics: 2025 China EV Global Price Cuts

- Fortune: China Car Market Shakeout: Tesla, BYD, Volkswagen