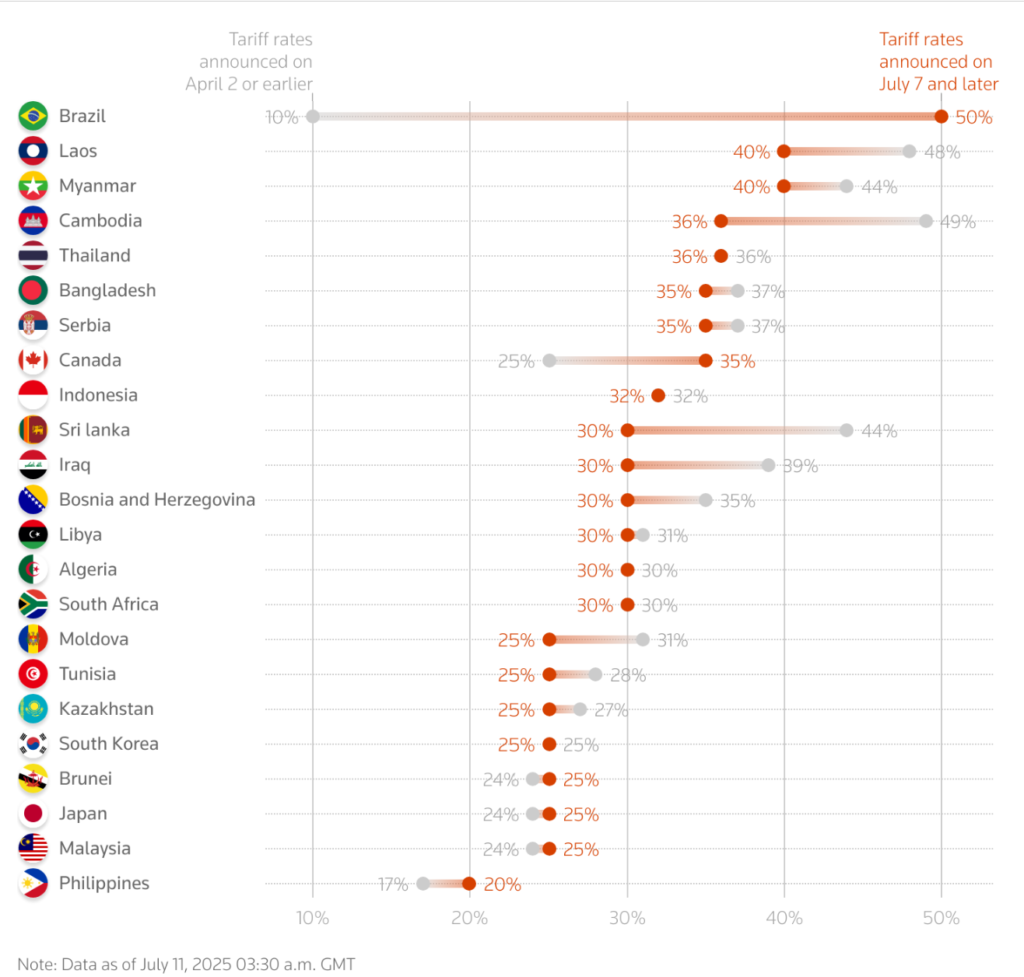

President Donald Trump told TV networks he will mail tariff letters to Canada and the EU “today or tomorrow.” He floated a universal 15%–20% baseline duty on any country that doesn’t get a deal, up from the current 10%. Within hours, he posted a letter to Ottawa imposing a 35 % tariff on all Canadian goods starting 1 August, with a carve-out likely for USMCA-covered products.

An administration aide said USMCA items should be exempt, but even that clarification couldn’t stop a quick wobble: S&P 500 and EUROSTOXX 50 futures fell about 0.8 % before trimming losses to –0.3 %. Currency markets flickered too, with the US dollar up 0.3 % on the loonie and 0.2 % on the euro.

Trump also warned that any Canadian firm routing goods to dodge the 35 % rate will face higher penalties, and he repeated plans for a flat global tariff if talks stall.

Yen & Asia FX Slide

With hopes fading for a last-minute US-Japan trade deal, the yen weakened to ¥147.12 per dollar, on course for its worst week of 2025. Emerging-Asia currencies followed: the rupee, ringgit and won led regional declines after Trump signalled a 15–20 % blanket levy.

Kazakhstan Joins the Watch-List

Trump’s tariff net also snared Kazakhstan: a letter threatens 25 % duties from 1 August unless Astana reaches a deal. President Kassym-Jomart Tokayev responded that he is ready for “constructive dialogue,” noting that most Kazakh exports to the US — uranium, ferro-alloys, silver and oil — are already exempt.

Analysts warn that squeezing a critical-minerals supplier could push Central Asia closer to China and Russia, undermining Washington’s long-term strategy to diversify raw-materials supply.

UK GDP Surprise

Across the Atlantic, the UK economy shrank 0.1 % in May, wrong-footing economists who expected a 0.1 % rise. The Office for National Statistics blamed weaker manufacturing — especially oil & gas and autos — offsetting a small rebound in services. It is the second straight monthly contraction.

Corporate & Market Notes

- Fast Retailing (Uniqlo) warned US tariffs will “significantly impact” its business and said it will raise prices later this year; shares slid almost 7 % in Tokyo.

- BMW reported Q2 sales up 0.4 %, but German automakers continue to lobby Washington for relief from the existing 25 % auto tariff.

- Commodity desks are on alert ahead of the previously announced 50 % copper tariff and the White House’s musings about 200 % pharmaceutical duties.

Global Snapshot

| Asset | Level / Move |

|---|---|

| S&P 500 futs | -0.3 % |

| EUROSTOXX 50 futs | -0.3 % |

| Nvidia (NVDA) | $164.10 → $4.004 tn m-cap |

| BTC-USD | $113 200 (record intraday) |

| USD/JPY | ¥147.1 (+0.6 %) |

| USD/CAD | 1.362 (+0.3 %) |

| EUR/USD | 1.075 (-0.2 %) |

| Brent crude | $77.05 (+0.4 %) |

| Gold | $2 346/oz (flat) |

- EU–US talks: Brussels still hopes for a deal before 1 Aug., but Trump’s impending letter suggests widening rift.

- Japan: Trade-deal prospects fading; yen heads for worst week this year.

- Emerging Asia: Blanket-tariff risk hammers FX; regional central banks on watch.

- Canada: Ottawa leans on USMCA carve-out after 35 % threat; dairy quotas back in the spotlight.

- Earnings season: US Q2 reports start next week, first real read-through on tariff impact.

What to Watch Today

- UK May GDP reaction in gilts & FTSE

- Canadian June jobs data vs. tariff headlines

- Euro-area final CPI (June)

- Possible Trump letters to the EU (and others) before the weekend

- Follow-through in Bitcoin and chip stocks after record prints

A sleepy Friday turned lively as Trump’s tariff machine whirred back to life, rattling currencies and futures while adding a new twist — Canada now in the firing line and Kazakhstan on notice. With macro calendars thin and US earnings season looming, traders are bracing for more tweet-driven whiplash into the weekend.