Risk assets are proving remarkably resilient in the face of the White House’s ever-larger trade volleys. Overnight, President Donald Trump — fresh from sending tariff warning letters to more than 20 capitals — formally slapped 50 % duties on US copper imports and on all goods from Brazil, effective 1 August. Yet beyond a 1 – 2 % dip in copper prices and a sharper slide in Brazil’s real, global benchmarks are again trading higher, buoyed by a record-setting AI rally and a bitcoin surge above $112 000. Investors, it seems, are sticking with the acronym now popular on trading desks — “T-A-C-O” (Trump Always Chickens Out).

Global Market Snapshot

| Asset / Region | Level | 1-Day Move | Notes |

|---|---|---|---|

| S&P 500 futures | 6 292 | −0 .25 % | Drifting after Wednesday’s tech-led rebound |

| Nasdaq-100 futures | 23 318 | −0 .29 % | Nvidia exuberance priced-in |

| Dow futures | −107 pts | −0 .24 % | Tariff drag on heavy-industrials |

| DAX (cash) | 19 764 | ▲ 1 .4 % | Frankfurt follows Nvidia glow |

| CAC 40 (cash) | 8 427 | ▲ 1 .5 % | Luxury & banks firm |

| FTSE 100 (cash) | 8 358 | ▲ 0 .2 % | Miners lag on copper hit |

| MSCI Asia ex-JP | 567 | ▲ 0 .4 % | Seoul & Taipei outperform |

| USD Index | 101 .8 | ▼ 0 .2 % | Risk-on, real tumbles 2.8 % |

| Bitcoin | $111 900 | ▲ 2 % | New all-time high $112 052 |

| LME Copper | $9 490/t | ▼ 1 .4 % | First response to 50 % duty |

Why the Shrug? Four Forces Offsetting Tariff Angst

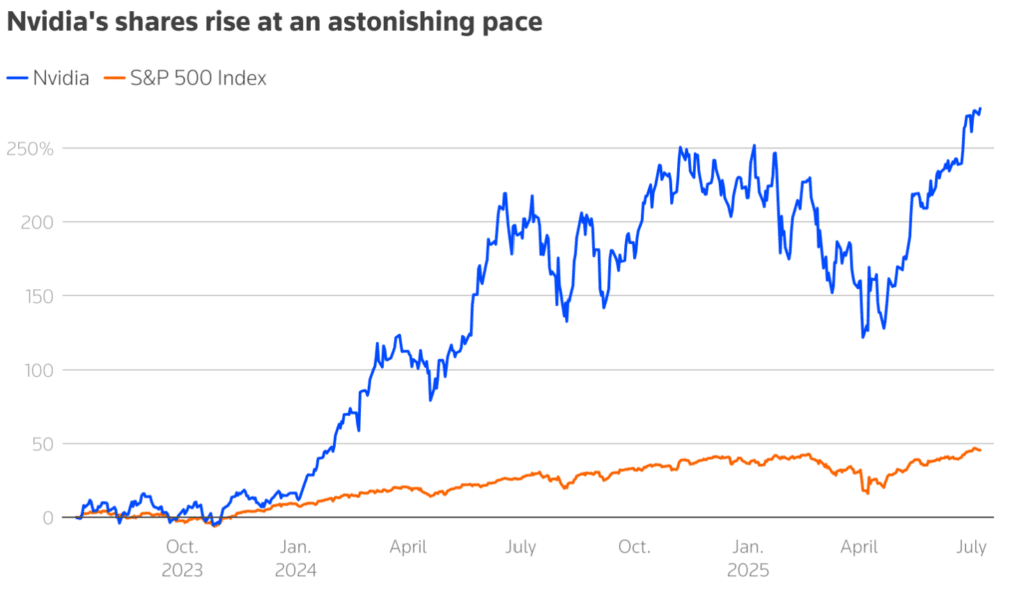

- AI Euphoria: Nvidia briefly became the first listed firm ever valued above $4 trn on Wednesday, lifting S&P tech to a record close.

Microsoft says AI now writes 35 % of its new code and has already saved $500 m in costs; Oppenheimer lifted its PT to $600.

CoreWeave rolled out the first cloud racks with Nvidia RTX PRO 6000 “Blackwell” GPUs, a 5.6× inference speed-up.

2. Bitcoin Breakout: Institutional flows, a friendlier US regulatory tone and “digital-gold” scarcity narrative propelled the token to $112 k, eclipsing its 22 May peak.

3. Faith in “T-A-C-O”: Traders note Trump’s past pattern of headline threats followed by partial climb-downs. Betting markets still price <40 % odds the full copper duty stays in place beyond Q4.

4. Fed Tailwinds: June FOMC minutes showed officials edging toward rate cuts despite split views. Swap curves imply a first 25 bp trim in November and 50 bp total by January 2026.

Sector & Asset Moves Overnight

| Winner | Move | Driver |

|---|---|---|

| Tech (S&P sector) | +0 .9 % | Nvidia +1.9 %, Palantir +2.5 % |

| Industrials | +0 .7 % | Boeing +3.7 %, Caterpillar +2 % |

| Bitcoin | Record | Scarce-asset bid, ETF inflows |

| Brazilian real (BRL) | −2.8 % | 50 % tariff retaliation risk |

| Loser | Move | Cause |

|---|---|---|

| Copper miners | −1 – 3 % | Duty overhang, China demand worries |

| Solar stocks (ENPH, SEDG) | −4 – 6 % | Goldman downgrades + Trump executive order cutting tax-credit certainty |

| SMCI | −5 % (after hours) | BofA “Underperform” initiation, PT $35 |

Europe Opening Playbook

- Equities: Futures signal mild gains; energy & miners may lag on copper weakness.

- FX: EUR/USD edging above 1.09 as dollar softens; watch GBP jobs next week.

- Rates: Bund yields steady at 2.29 %; Italian–Bund spread 155 bp.

- Commodities: Brent clings to $88/bbl; OPEC+ compliance report due tomorrow.

The Day Ahead

| Time (GMT+3) | Event | Expectation |

|---|---|---|

| 15:30 | US Weekly Jobless Claims | 235 k (prev. 233 k) |

| 17:00 | Fed Gov. Alberto Musalem speaks | Guidance on balance-sheet runoff? |

| 22:00 | SF Fed’s Mary Daly | Q&A — tariff inflation chatter |

| — | Possible tariff letters to India, EU, Taiwan | Any surprise targets = headline risk |

For now, AI momentum + dovish-leaning Fed signals + faith in tariff dilution keep the bull narrative intact. But with copper and the Brazilian real flashing stress, and smaller exporters still in limbo, complacency may be fragile. Today’s jobless claims and any new White House letters will show whether the market’s trademark 2025 resilience can extend into Q3.

Stay tuned, and trade safe.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump