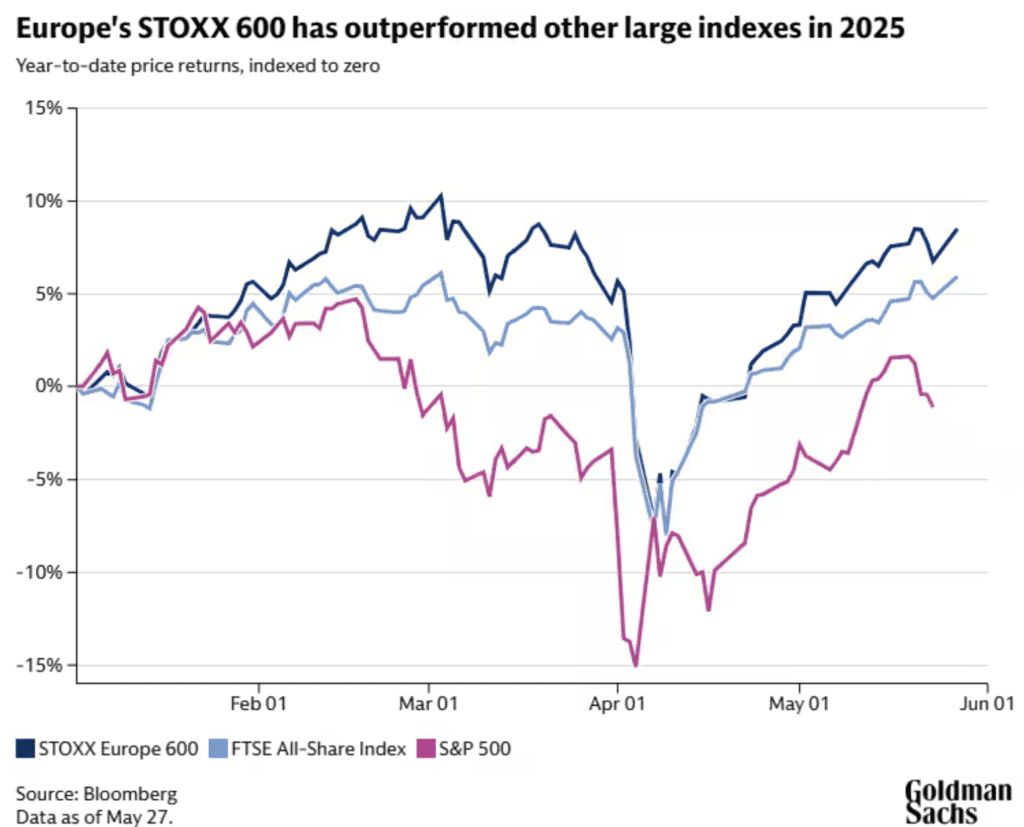

European equities have already delivered a standout performance in 2025 (as covered in Part 1), outpacing the S&P 500 by historic margins. But the bigger question now looms: can they keep going? The data pouring in from Goldman Sachs, JPMorgan, and others suggests the rally may not be over yet – and may even widen. (Related: Why European Stocks Are Beating S&P 500 in 2025?)

JPMorgan’s Bold Prediction: +25 Percentage Point Outperformance

According to a May 2025 Bloomberg survey of major investment banks, JPMorgan projects European stocks could outperform the US by up to 25 percentage points this year – a record margin. The S&P 500’s stagnation amid Trump’s tariff drama and Moody’s credit downgrade is expected to continue dragging on American assets, while Europe’s relative political calm, undervaluation, and policy shifts offer runway for further gains.

“The US exceptionalism appears to be peaking,” said Michele Morganti of Generali Asset Management, “while monetary and fiscal policy looks increasingly supportive for the EU.”

Earnings Momentum and Sector Rotation Fuel Optimism

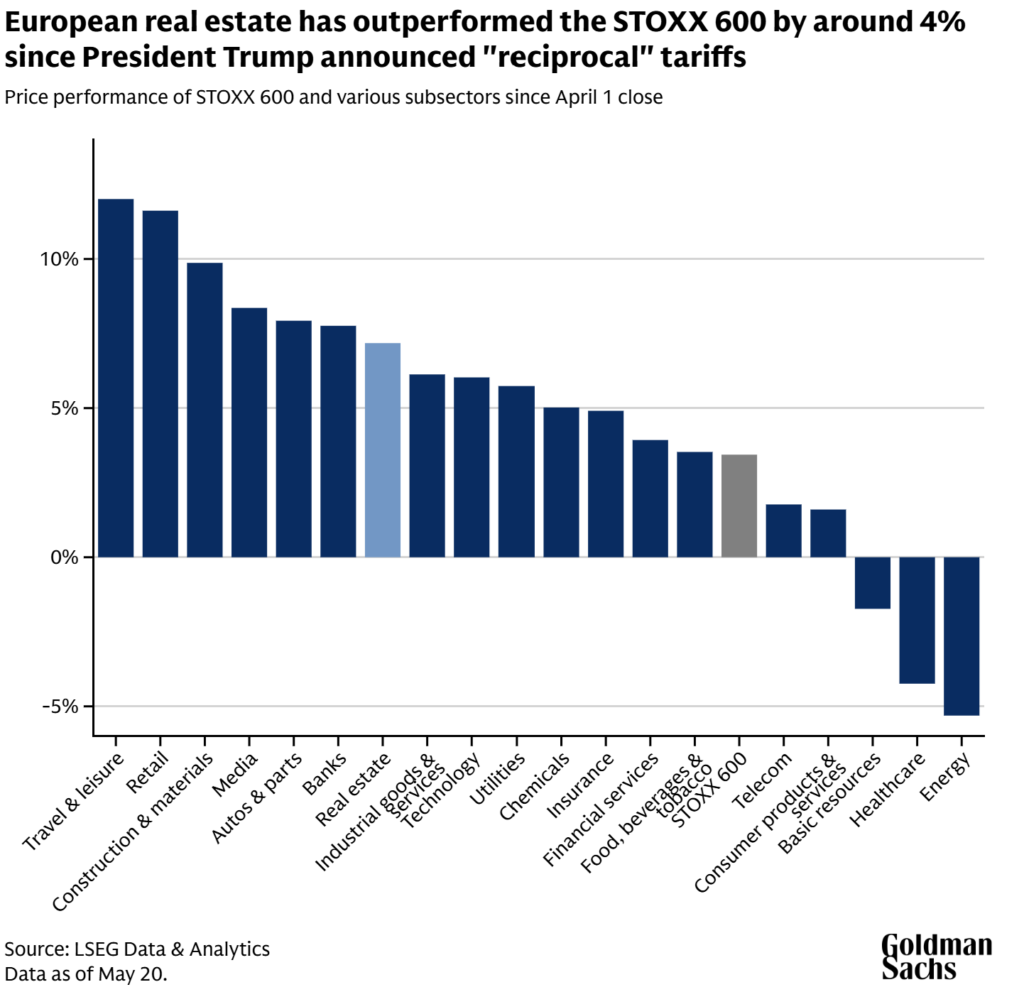

Europe’s corporate earnings are finally beating expectations. Q1 earnings growth for STOXX 600 companies is expected to hit 2.3%, with names in utilities, real estate, and food retail showing unexpected strength.

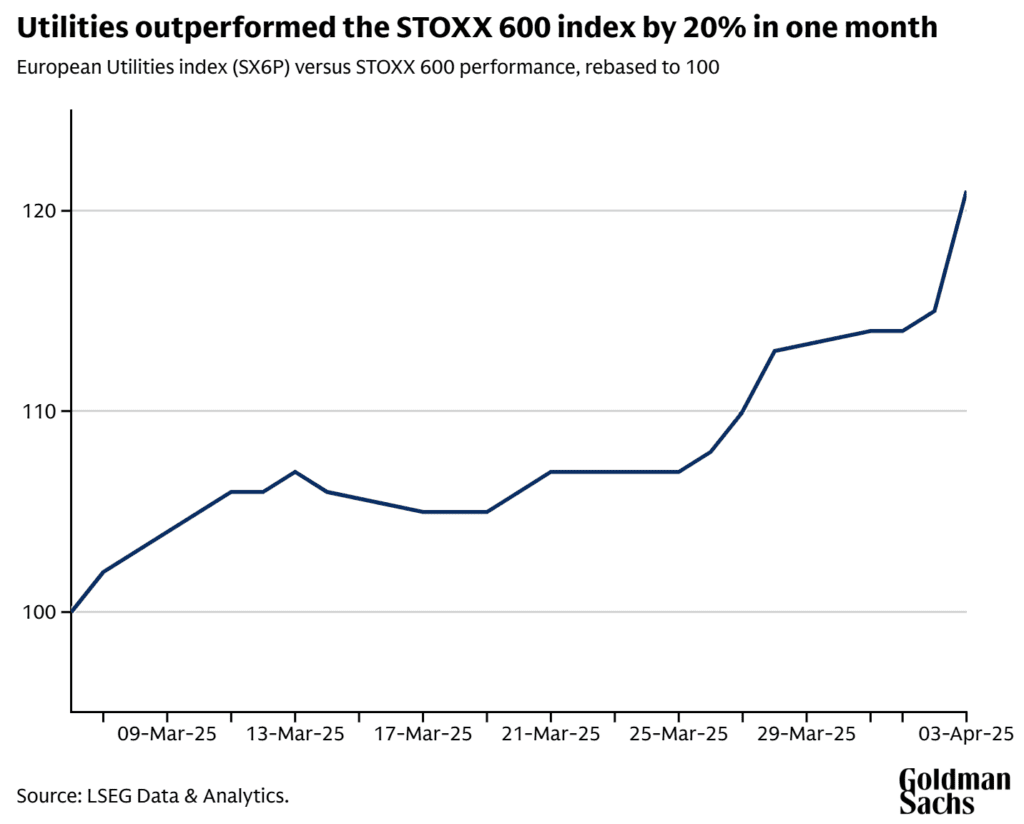

- Utilities have outperformed the STOXX 600 by 20% in one month alone (Goldman Sachs), driven by rising power demand across Germany, Italy, and Spain and investor flight to “defensive” stocks.

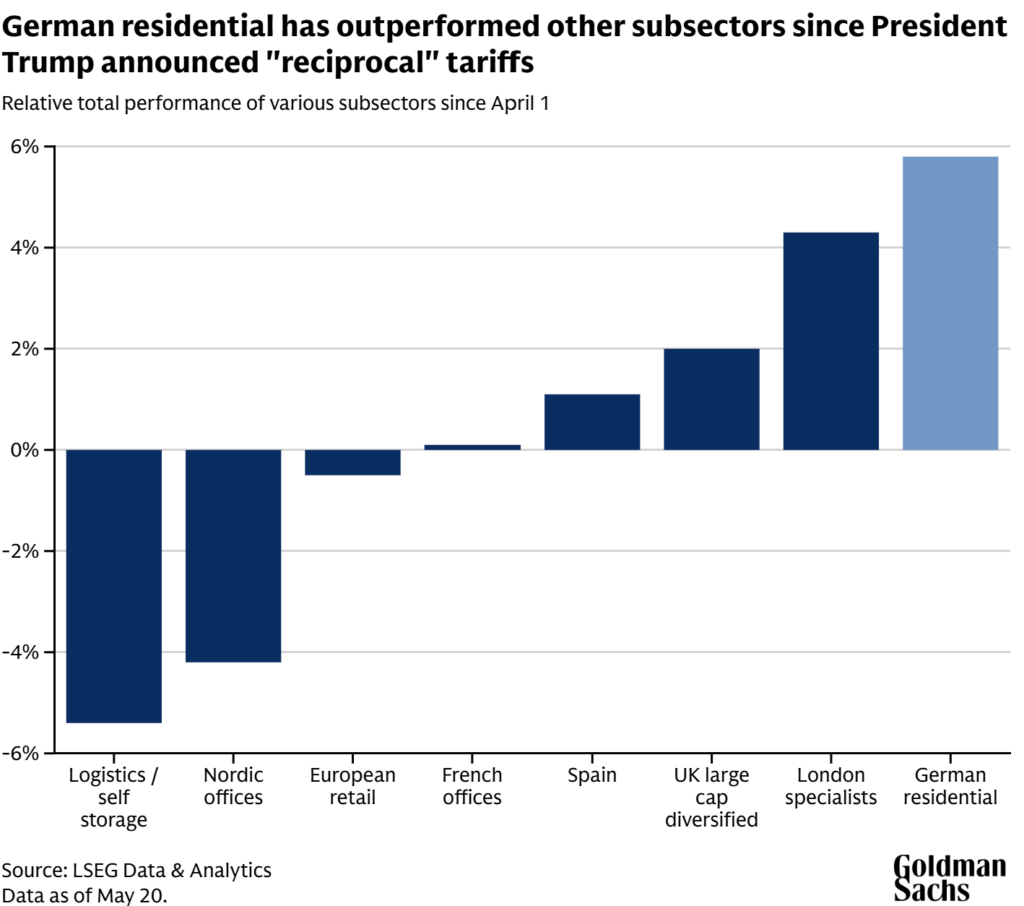

- Real estate stocks, historically beaten down, have seen renewed investor interest. Since Trump’s reciprocal tariff announcements, European real estate has outpaced the STOXX 600 by 4%, with German residential showing the most resilience (up over 5.5%).

The driver? According to Jonathan Kownator at Goldman Sachs: “The sector’s correlation to bond yields, rate sensitivity, and lack of direct tariff impact makes it an attractive shelter.”

Valuations Still Look Favorable

Despite recent gains, European equities remain cheaper than their US counterparts. Based on the CAPE ratio, the S&P 500 is trading at a 30% premium to its historical average. Europe? Just 10%.

- STOXX 600: ~14x earnings

- S&P 500: ~25x earnings

Michael Field of Morningstar notes that investors are finally rotating capital into Europe’s “cheaper” markets – a move that has been value-driven but is now sentiment-led due to US policy risks.

ECB Cuts, Germany’s Fiscal Stimulus, and Defense Budgets Ahead

Forecasts from both Goldman Sachs and Neuberger Berman indicate that the European Central Bank (ECB) is expected to begin rate cuts in 2025. This adds more fuel to the equity upside, especially in rate-sensitive sectors like real estate and infrastructure.

Germany’s €500 billion fiscal plan and a projected €800 billion boost in EU defense spending over the next 4 years could drive industrial and defense-sector profitability.

“Infrastructure spending, monetary easing, and better industrial balance sheets are giving Europe a second wind,” said Raheel Siddiqui of Neuberger Berman.

Sector Forecasts: Where the Heat Is

Goldman Sachs and Bloomberg data highlight the sectors with the most momentum in 2025:

- Defense: Top performers in STOXX 600; led by Renk Group, Rheinmetall, Hensoldt

- Utilities: Best-performing sector YTD, up 20% vs STOXX 600 baseline

- Real Estate: Catching up fast, esp. in Germany and UK

- Retail: UK grocery sector sees 4.5% growth, driven by home consumption habits

Which European Stocks Could Lead Rally?

As it is mentioned, fueled by fiscal stimulus, rate cut expectations, and capital rotation out of US assets, a wave of investor interest is now flowing into specific European stocks across defence, utilities, real estate, retail, and industrials.

According to Goldman Sachs and Bloomberg data, these are the sectors leading Europe’s 2025 equity surge:

- Defense: Among the top STOXX 600 performers, boosted by EU-wide military expansion. Standouts include Renk Group, Rheinmetall, and Hensoldt

- Utilities: 2025’s best-performing sector so far, up 20% YTD, far outpacing the STOXX 600 baseline

- Real Estate: Mounting a comeback, especially in Germany and the UK, amid easing bond yields and rate expectations

- Retail (Food/Grocery): UK food retail is seeing 4.5% growth, driven by post-tariff shifts from dining out to home consumption

Here’s a closer look at the standout European stocks riding those macro tailwinds — and what’s driving their rise:

| Stock (Ticker) | Sector | Why It Matters |

|---|---|---|

| Rheinmetall (ETR: RHM) | Defense | Up 90%+ YTD. Key supplier for Germany’s €500B military push and EU’s €800B modernization plans. |

| Hensoldt (ETR: HAG) | Defense | Specializes in radar/optics. Closely tied to NATO and EU surveillance programs. Stock has doubled in 2025. |

| BAE Systems (LON: BA.) | Defense | UK leader in naval, cyber, and AI combat systems. Riding momentum from the Strategic Defence Review. |

| Enel (BIT: ENEL) | Utilities | Italy’s largest utility. Benefits from ECB rate cuts and power demand growth (+1.5%). |

| RWE (ETR: RWE) | Utilities | German energy major. Renewable focus + 1% power demand rebound after 15-year decline. |

| Iberdrola (BME: IBE) | Utilities | Spain’s renewable leader. Gaining from 4% electricity demand growth and EU green subsidies. |

| Vonovia (ETR: VNA) | Real Estate | Largest German landlord. Defensive play with high rate sensitivity. |

| LEG Immobilien (ETR: LEG) | Real Estate | Rising urban rental demand + rate cut expectations fueling upside. |

| Tesco (LON: TSCO) | Retail & Food | UK grocery giant. Food inflation and home-dining trend boosting revenue. Price-match strategy defending market share. |

| Sainsbury (LON: SBRY) | Retail & Food | Outperforming retail peers. Strong Easter sales and inflation-linked growth. |

| Siemens (ETR: SIE) | Industrial/Exporters | A play on EU infrastructure, automation, and digital manufacturing. Cautiously exposed to trade flows. |

| Airbus (EPA: AIR) | Industrial/Exporters | Major beneficiary of aircraft demand, EU defense contracts, and limited tariff exposure vs. US-China tensions. |

The Global Tilt: Less Dependence on the Dollar

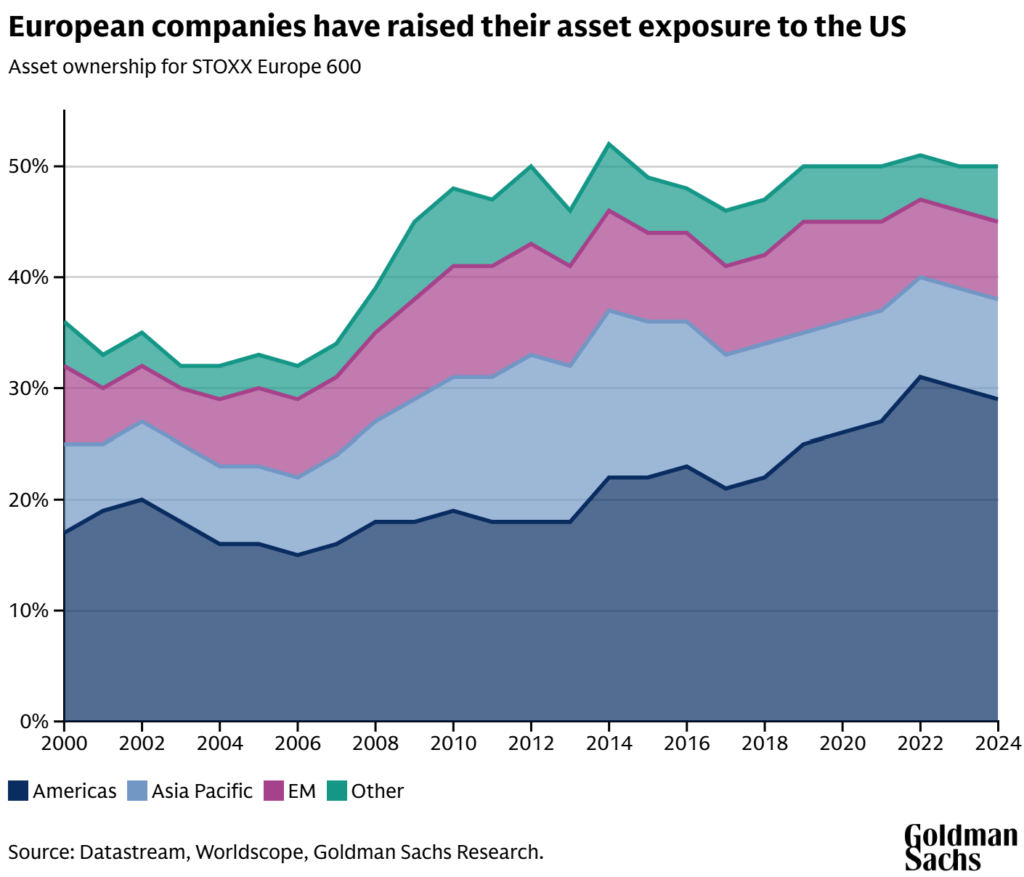

Another tailwind: European companies have increased their US asset exposure from 18% (2013) to 30% (2025), giving them dollar leverage. But analysts predict a coming rebalancing away from dollar exposure — a potential buffer as the euro strengthens and trade frictions deepen.

Buybacks Finally Catching On?

In a rare move for Europe, buybacks are rising. STOXX 600 firms repurchased €17 billion in shares in April 2025 – a record. Though still shy of US-style financial engineering, this marks a structural shift in how European firms may return value to shareholders going forward.

What Could Go Wrong?

Not all are convinced. L&G strategist Robert Griffiths warns: “Optimism has run ahead of earnings. If the new German coalition shows cracks or euro strength weighs on exporters, the narrative could change fast.”

And despite better relative performance, Europe still trails the US over the long term: Morningstar data shows US markets returned 556% since 2012, while Europe delivered 240%.

Outlook: Still Room to Run, but Eyes on Policy and Growth

Whether Europe can maintain its lead will depend on continued earnings delivery, policy support, and avoiding political volatility. But as the US faces a bond market scare, fiscal chaos, and stalled monetary flexibility, Europe’s relative calm — paired with strong sector rotation — makes it the surprise bull case of 2025.

“This isn’t just a relief rally,” said Sharon Bell of Goldman Sachs. “It’s the beginning of capital rotation — and Europe has the fundamentals to support it.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources: