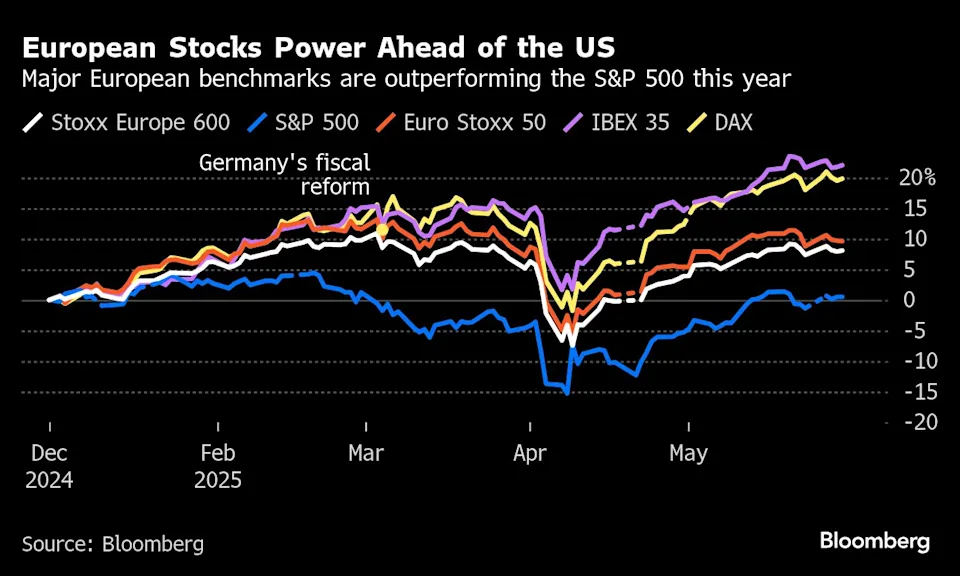

European equities are having a standout year in 2025, leaving US markets—and investors—in the dust. As of late May, eight of the world’s ten best-performing stock markets are in Europe, led by Slovenia (+42%), Poland (+40%), Greece (+37%), and Germany’s DAX (+32%), according to Bloomberg data. Meanwhile, the S&P 500 has advanced by only 0.5% year-to-date, lagging significantly behind both global peers and historical averages. (Related: Where the Stock Market Stands Now After a Wild Start to the Year)

But why is Europe, long considered the underdog, suddenly outperforming?

Let’s unpack the full picture, backed by analysis from Bloomberg, the Bank for International Settlements (BIS), and recent earnings data.

1. Valuations and Risk Premium Compression: The Core Driver

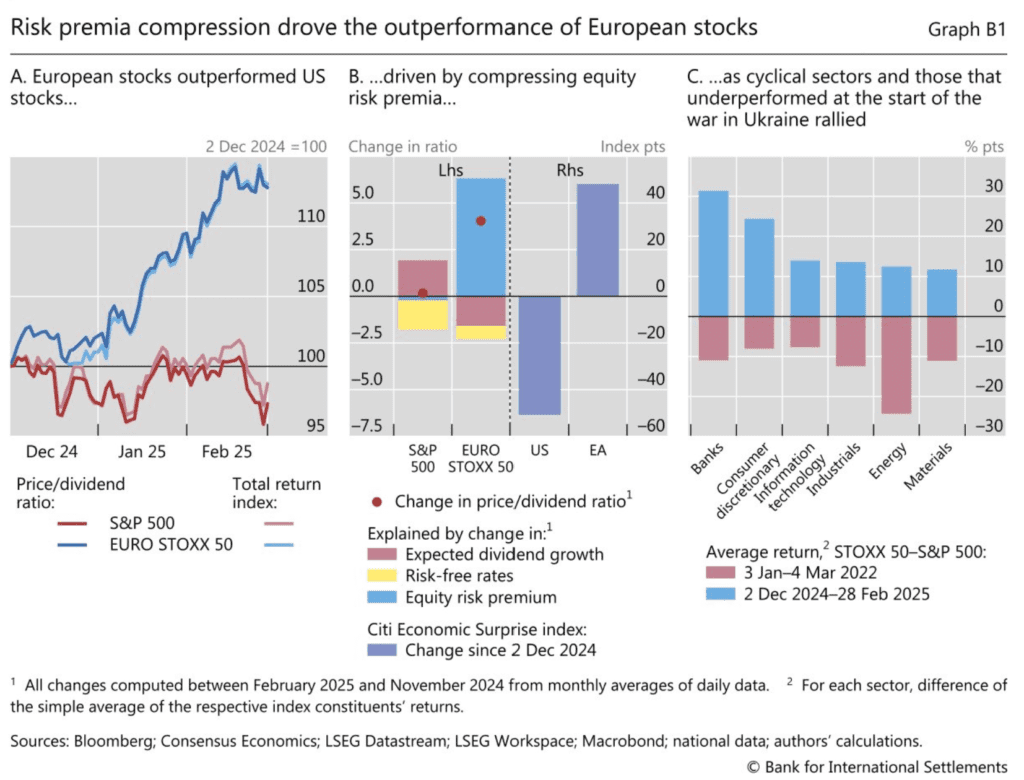

According to the BIS Quarterly Review, a sharp compression in equity risk premia—the return investors demand for holding riskier assets, such as stocks—has been the primary driver behind Europe’s equity outperformance. This shift signals growing confidence in the region’s economic and geopolitical outlook.

Key data from BIS:

- Since early December 2024, the EURO STOXX 50 has outpaced the S&P 500 by roughly 15 percentage points in terms of total return.

- The price/dividend ratio (a valuation measure) for EURO STOXX 50 climbed, while it remained flat for the S&P 500.

- This change was primarily driven by falling equity risk premia in Europe—not changes in dividend growth or interest rates.

In short, investors are demanding less compensation for holding European stocks than before—reflecting lower perceived risk and higher trust in regional policy stability.

2. Germany’s Fiscal Reform and Policy Shift

A crucial turning point came in Q1 2025, when Germany—historically a symbol of fiscal restraint, announced a bold multibillion-euro package aimed at infrastructure and defense spending. The reform is projected to drive eurozone growth from late 2026 onward.

“Europe is back on the map,” said Frederique Carrier of RBC Wealth Management. “We are getting more questions about Europe now than we did over the last ten years.”

UBS forecasts that this momentum could trigger a €1.2 trillion ($1.4 trillion) shift in capital flows away from US assets and into European stocks over the next five years.

3. Sector Outperformance: Defense, Banks, and Industrials

Europe’s rally is also more broad-based than the US, where growth is still narrowly concentrated in a few big tech names.

BIS data shows that cyclical sectors like:

- Banks

- Consumer discretionary

- Industrials

- Energy

…have strongly outperformed their US counterparts in 2025.

In particular, defense stocks have dominated. In the Stoxx 600, 7 of the top 10 performing stocks year-to-date are in defense, including:

- Renk Group AG

- Rheinmetall AG

- Hensoldt AG

Each of them has surged over 90%.

Meanwhile, banks and insurers have benefited from elevated interest rates and relative political calm.

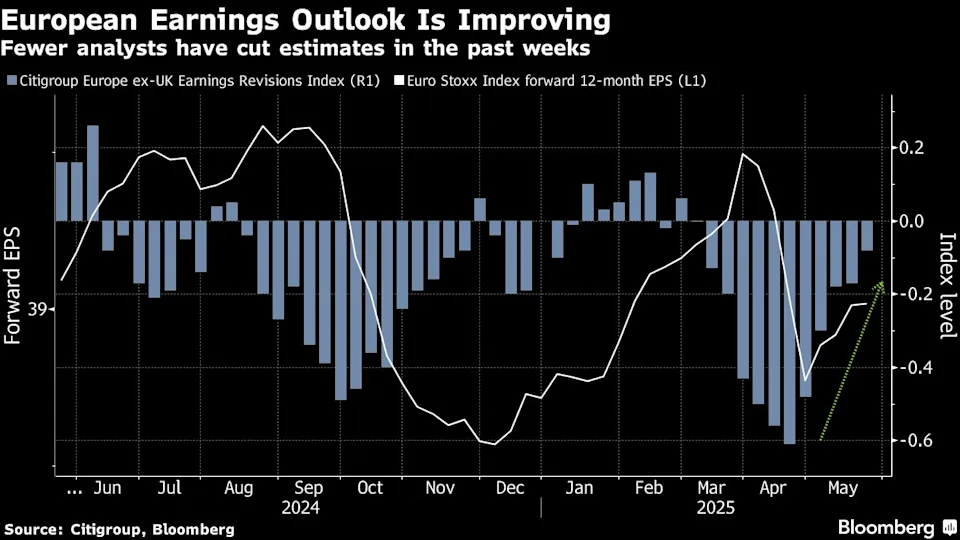

4. Improving Earnings Momentum

Contrary to 2024’s weak earnings expectations, Europe’s corporate profits are rebounding sharply.

According to Bloomberg Intelligence:

- Q1 2025 earnings for MSCI Europe companies rose 5.3%, far exceeding the expected 1.5% decline.

- Fewer analysts are cutting earnings estimates, signaling growing optimism (see Citigroup revisions chart).

This has helped sustain the rally and restore confidence in sectors that had previously lagged during the pandemic and energy crisis.

5. Geopolitical Resilience and Trade War Spillovers

While Trump’s trade war has shaken global markets, it’s been particularly disruptive for US equities. Tariff chaos, policy whiplash, and fiscal uncertainty are all contributing to risk aversion. In contrast, European markets—though not immune—appear more insulated.

In fact, Trump’s tariff push may be inadvertently pushing capital into Europe.

The S&P 500 ranks 73rd out of 92 global indices in performance this year, per Bloomberg. It’s being outpaced even by Spain’s IBEX 35 and Austria’s ATX, both up 32%.

Moreover, a federal court ruling recently challenged the legality of Trump’s sweeping tariff policy—adding another layer of uncertainty to the US outlook.

6. A Sectoral Shift in Market Leadership

The shift in leadership isn’t just regional—it’s structural. US markets, still dominated by tech, are more vulnerable to rate hikes, policy volatility, and narrow concentration risk.

Meanwhile, Europe’s advantage is that its rally is driven by sectors that had been deeply undervalued—and now, with better earnings and global demand (especially for defense, industrials, and energy), they are catching up fast.

According to BIS:

- Banks and industrials have rebounded thanks to lower risk premia and improving macro conditions.

- Energy and materials—heavily hit during the Ukraine war—are now recovering, thanks to easing geopolitical pressures and better commodity pricing.

What This Shift Means for Global Investors

Europe’s equity comeback isn’t just a rebound—it’s a structural re-rating in the eyes of global investors. With record risk premium compression, a fiscal revolution in Germany, and earnings surprising to the upside, capital is flowing into sectors and markets long ignored.

US equities still dominate in innovation and tech leadership—but in a world shaped by tariffs, fiscal fatigue, and political friction, Europe’s diversified, undervalued, and policy-fueled rally is giving global investors a serious reason to rebalance.

As Francois Rimeu of La Francaise Asset Management put it:

“For the first time in a really long time I do believe there’s a chance that European stocks can outperform the US market.”

—

Next: Part 2 – Can EU Stocks Keep Outperforming the S&P 500? Top Picks for 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

US pushes countries for best offers by Wednesday as tariff deadline looms

China Rejects Trump’s Allegations And Accuses US Of Violating Trade Pact

Where the Stock Market Stands Now After a Wild Start to the Year

What To Expect in Markets This Week: Earnings, Fed, and More Tariff Drama