On Wednesday, a poorly received auction of 20-year U.S. Treasury bondssent shockwaves through financial markets, triggering a broad selloff in equities and pushing long-term yields to their highest levels of the year.

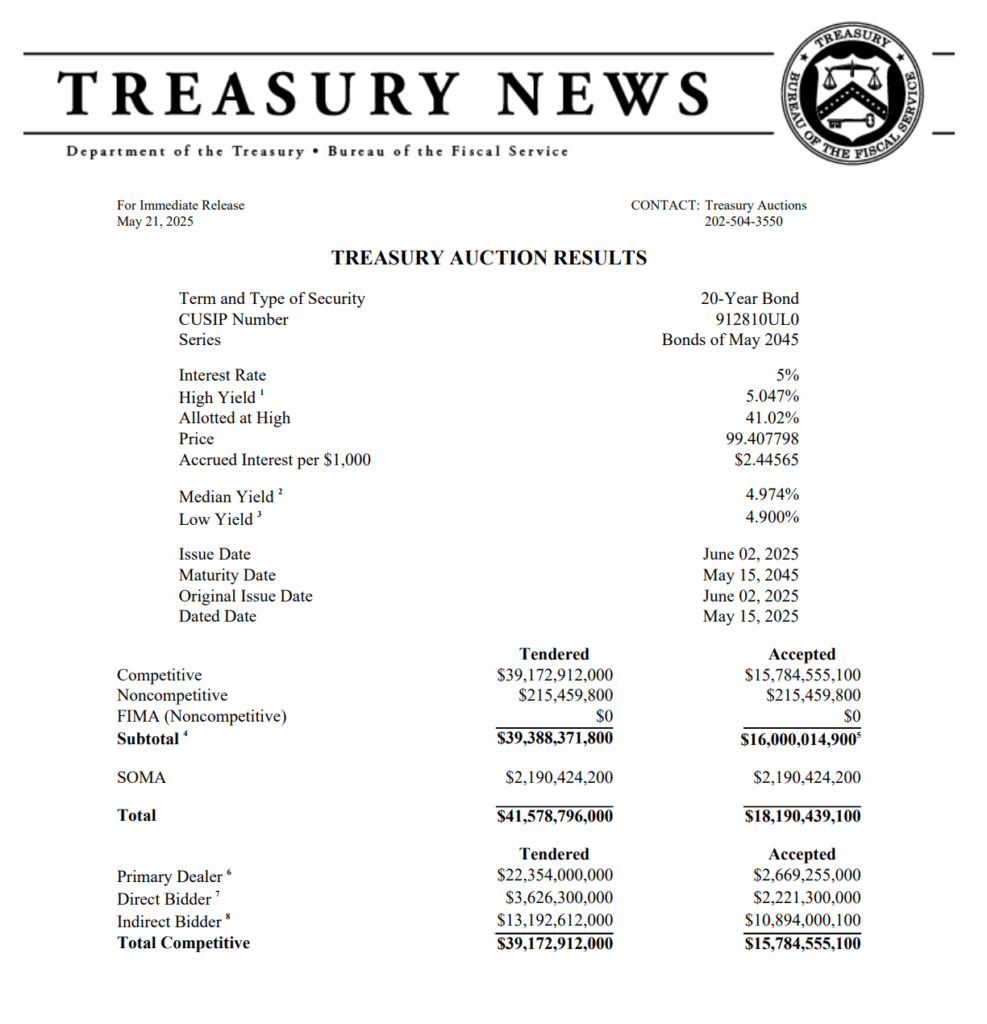

The U.S. Treasury Department sold $16 billion in 20-year bonds at a yield of 5.047%, sharply above the average yield of 4.613% from the past six auctions. This marked the first 20-year bond sale to clear above 5% since October 2023, underscoring growing investor reluctance to hold U.S. debt amid rising fiscal uncertainty.

The auction’s bid-to-cover ratio — a key measure of demand — fell to 2.46, well below last month’s 2.63 and the 10-auction average of 2.58, signaling subpar interest from investors.

“The auction was weak, and bond yields across the curve are at the highs of the day in response,” wrote Peter Boockvar, CIO at Bleakley Financial Group.

“I never write about the 20-year auction… but Treasuries are again getting ‘yippy.’”

Market Reaction: Stocks Slide, Yields Spike

The fallout was immediate on Wall Street. The Dow Jones Industrial Average plunged 800 points, marking its worst session in over a month. The S&P 500 dropped 1.6%, and the Nasdaq Composite slid 1.4%, as traders reacted to the sharp rise in long-term borrowing costs.

- The 20-year yield spiked to 5.103%, its highest in 2025.

- The 30-year yield also hit a new high of **5.071%.

- The 10-year note traded at 4.605%.

The selloff reflects rising anxiety that soaring government borrowing needs, coupled with limited investor appetite, could push interest rates higher for longer — a development that would weigh heavily on both corporate profits and consumer spending.

Why It Matters: Debt, Deficits, and Demand

This weak auction comes at a time of growing scrutiny over U.S. fiscal policy. Moody’s recently downgraded U.S. long-term debt, citing persistent deficits and political gridlock.

Simultaneously, the Republican-controlled Congress is advancing a tax plan that analysts say could add $3.3 trillion to the national debt by 2034. That prospect has spooked bond investors, who are demanding higher yields to compensate for the risk of lending to a government with mounting fiscal obligations.

Unlike the 10- or 30-year notes, 20-year Treasuries are less liquid, and investors often avoid them due to their pricing oddities. The 20-year bond often yields more than the 30-year, defying traditional interest rate logic and reducing its appeal to institutions seeking smooth duration exposure.

The 20-year security was eliminated in 1986 and only reintroduced in 2020 by then-Treasury Secretary Steven Mnuchin, during the Trump administration.

Looking Ahead

The Treasury is set to announce the details of upcoming 2-year, 5-year, and 7-year auctions on Thursday, which may offer a clearer view of overall demand trends across the curve.

But for now, the 20-year auction’s poor showing serves as a warning shot. With U.S. borrowing needs still growing, and fiscal clarity elusive, investors may continue to demand a higher risk premium for holding long-dated U.S. debt — a dynamic that could ripple through housing, equities, and the broader economy.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia CEO Slams Biden’s AI Chip Export Curbs as a “Failure,” Backs Trump’s Reversal

White House: China Will ‘Absorb’ Tariffs — Not US Consumers

Bostic Warns on Moody’s Downgrade, Inflation Risk — Leans Toward One Cut

Nvidia Expands in China & Taiwan as US Export Rules Tighten

Earnings Calendar, Fed Speech, Housing Data: What to Watch This Week

UK overtakes China as second-largest US Treasury holder

CERN Scientists Turn Lead into Gold — Why This Is Bigger Deal for Bitcoin Than You Think

Nvidia, Cisco, Oracle and OpenAI are backing the UAE Stargate data center project

Trump vs. Tim Cook: Apple’s Global Strategy Sparks Debate Over Economic Patriotism and AI Security

US and EU break impasse to enable tariff talks

China Tightens Control Over AI Data Centers

Trump: US will set new tariff rates, bypassing trade negotiations