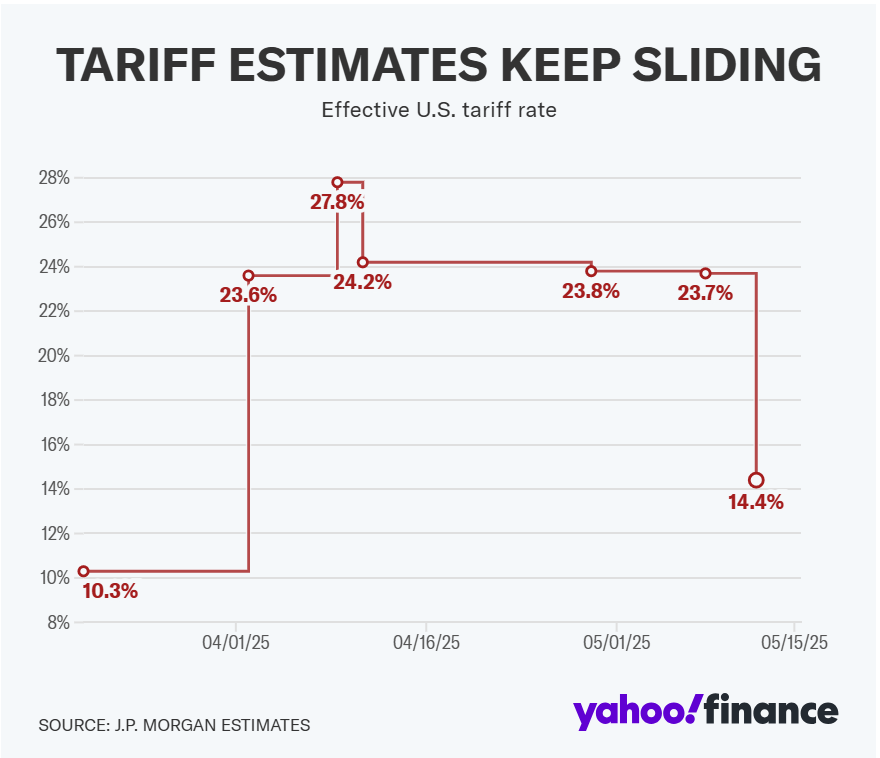

Markets roared back last week as investor optimism over U.S. trade policy fueled a broad rally across sectors, pushing key indexes to multi-month highs and turning year-to-date performance green. With Wall Street digesting the 90-day U.S.-China tariff pause, the week ahead will be pivotal as investors weigh earnings from major retailers, Fed commentary, and fresh economic data.

Market Recap: Best Week in Months

The S&P 500 gained 5.3%, its strongest weekly performance in over two months, while the Nasdaq Composite surged 7.2% and the Dow Jones rose 3.4%. Both the S&P and Nasdaq have fully recovered from the tariff-driven slump in early April, with tech stocks leading the charge.

The rebound follows optimism sparked by President Trump’s announcement of a temporary tariff reprieve with China. Trump also confirmed that the U.S. will begin assigning tariff rates individually to countries in the coming weeks — a move that could trigger more clarity or further volatility, depending on the outcome of trade negotiations.

Fundstrat’s Tom Lee reiterated his S&P 500 year-end target of 6,500, noting that “if tariff deals are soon announced, equities can further recover.”

Still, some strategists warn that the truce isn’t a resolution. “We still need a more cemented agreement, not just with China but also with Europe,” said Victoria Fernandez of Crossmark Global.

The Fed’s Patience Game

The trade thaw has also altered expectations for Federal Reserve rate cuts. Markets now expect just two 25 bps rate cuts this year, down from three previously, according to the CME FedWatch Tool. The first cut is now projected for July, delayed from earlier forecasts of June.

The Fed’s “wait-and-see” approach will be in focus this week with nine scheduled Fed speeches. But Bank of America’s Aditya Bhave says not to expect much change:

“Most speakers will emphasize patience, highlighting uncertainty and focusing on total policy impact — not just tariffs,” Bhave wrote.

Notably, Bhave forecasts no rate cuts at all in 2025, citing a still-strong labor market and sticky inflation.

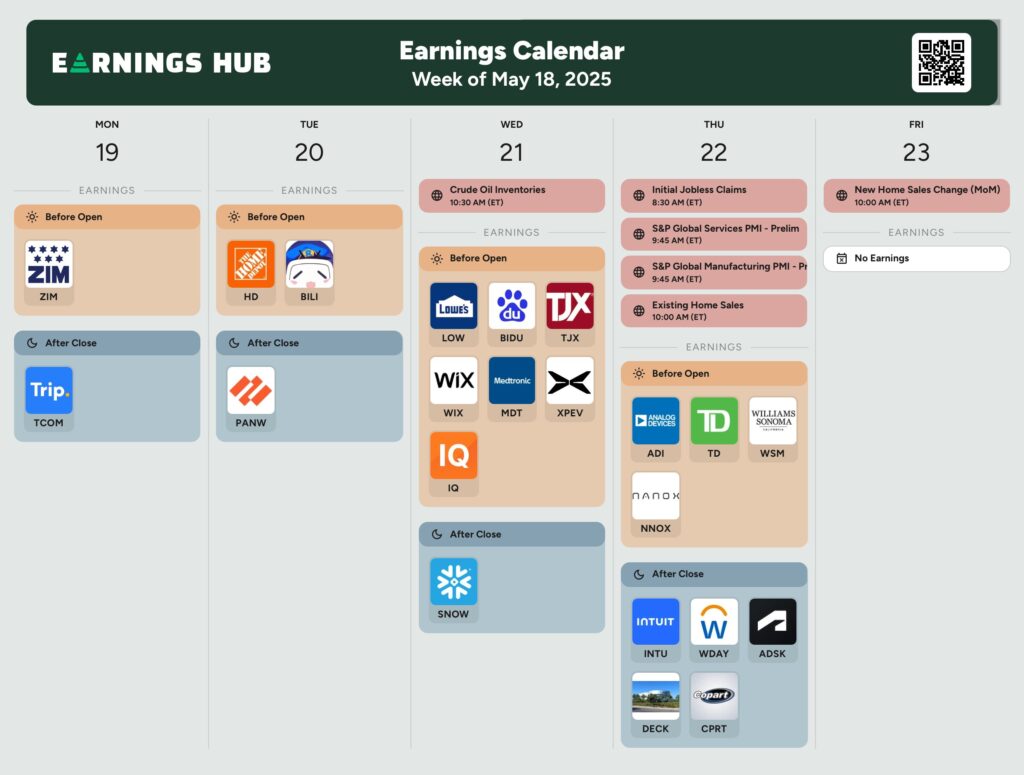

Earnings to Watch: Target, Home Depot, Palo Alto

With most Q1 reports already out, attention turns to Target (TGT), Home Depot (HD), Palo Alto Networks (PANW), and Workday (WDAY) this week. Analysts are watching closely to gauge how retailers and enterprise tech firms are navigating inflation, supply chain issues, and shifting consumer trends.

Earnings schedule highlights:

- Tuesday: Home Depot, Palo Alto, Toll Brothers

- Wednesday: Target, Zoom, Snowflake, Baidu, TJX, Urban Outfitters

- Thursday: Workday, Autodesk, Intuit, Ralph Lauren, Ross Stores

- Friday: No major earnings

Economic Calendar: Housing & Manufacturing in Focus

Key data this week includes:

- Monday: April Leading Index (expected: -0.8%)

- Wednesday: MBA mortgage applications

- Thursday:

- Jobless claims (prior: 229,000)

- Manufacturing PMI (prior: 50.2)

- Existing home sales (expected: +3.2%)

- Services PMI (prior: 50.8)

- Friday:

- New home sales (expected: -3.7%)

- Final building permits

These updates will offer a snapshot of the economy’s health amid renewed optimism — but also underline how fragile recovery still is.

The “Magnificent Seven” Are Back

After dragging the S&P 500 in Q1, the “Magnificent Seven” — Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia — are once again powering gains.

According to DataTrek’s Nicholas Colas, these seven stocks accounted for the entire Q1 decline of the S&P. Without them, the index would have been +2%.

But since early May:

- Nvidia and Tesla are both up 30%+

- Microsoft has climbed 20%

- The group now accounts for 60% of the index’s May gains

Goldman Sachs strategist David Kostin raised his S&P 500 target from 5,900 to 6,100, citing stronger-than-expected earnings from Big Tech and growing interest in AI-exposed stocks.

“Investors are being drawn to secular growth stories amid modest economic growth,” Kostin wrote.

What to Watch This Week — Summary

Top themes:

- Tariff negotiations with China and others

- Target, Home Depot earnings

- Fed speeches (9 scheduled)

- Housing and PMI data

- Watch for market reaction to potential tariff reinstatements or unexpected Fed shifts

Main risks:

- Tariff pause is temporary — a breakdown in talks could spark renewed volatility

- Delayed Fed rate cuts may weigh on sentiment if inflation remains sticky

- Retail and housing data could signal cracks in consumer strength

Markets are celebrating, but under the surface, policy uncertainty lingers. The tariff truce, Fed hesitation, and Big Tech revival all set the stage for a critical stretch heading into summer. Investors would do well to stay nimble — this week may be light on headlines, but heavy on signals.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

UK overtakes China as second-largest US Treasury holder

CERN Scientists Turn Lead into Gold — Why This Is Bigger Deal for Bitcoin Than You Think

Nvidia, Cisco, Oracle and OpenAI are backing the UAE Stargate data center project

Trump vs. Tim Cook: Apple’s Global Strategy Sparks Debate Over Economic Patriotism and AI Security

US and EU break impasse to enable tariff talks

China Tightens Control Over AI Data Centers

Trump: US will set new tariff rates, bypassing trade negotiations

Sundar Pichai Interview on AI, Search, and Future of Google

Billionaire Investors Reveal Q1 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More