The Eurodollar system is a powerful but often overlooked force shaping global finance.

This sprawling network of offshore dollar markets operates outside the direct oversight of the US Federal Reserve, yet it plays a crucial role in global liquidity, credit distribution, and financial system stability.

To better navigate today’s interconnected financial world, it’s vital to grasp the Eurodollar system’s influence, its role in past crises, and the potential direction it’s heading.

What Is the Eurodollar System?

The Eurodollar market refers to U.S. dollars held in banks located outside the U.S.—primarily in Europe, Asia, and other offshore financial centers.

Because these dollars exist outside U.S. regulatory reach, they form a massive pool of unregulated global liquidity.

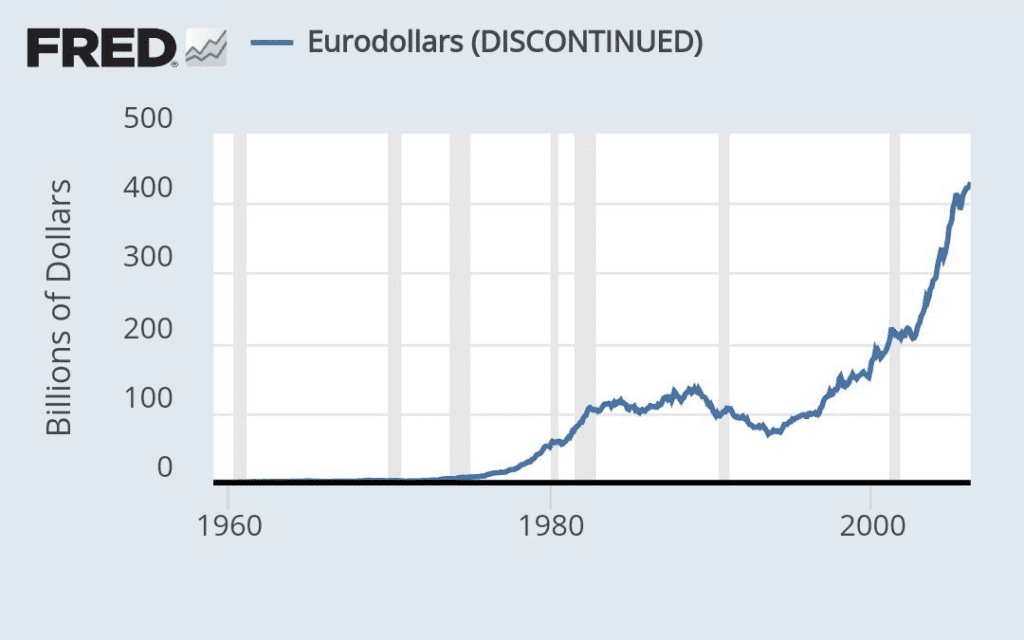

The scale is significant: as of 2023, offshore dollar liabilities exceeded $13 trillion, more than double the amount seen in 2008.

Corporations and banks around the world rely on Eurodollars to fund international trade, investment, and operations.

However, the lack of Federal Reserve oversight also introduces systemic risks, especially in times of market stress.

The Eurodollar System and Global Liquidity

For decades, the Eurodollar market has been a cornerstone of global liquidity.

Offshore institutions lend these dollars to governments, businesses, and financial entities, helping to finance international trade and operations.

Roughly 60–70% of global trade financing is supported by Eurodollar flows.

But this liquidity is not without fragility.

During the 2008 Global Financial Crisis, a freeze in Eurodollar funding caused severe liquidity shortages, disrupting trade and credit across the globe.

Lessons from Past Crises

The Eurodollar system has been at the epicenter of multiple financial shocks.

- In 2008, trust in counterparties evaporated, freezing dollar funding and prompting the Federal Reserve to inject over $580 billion via global swap lines.

- In the 2019 Repo Market Crisis, a sudden shortage of dollar liquidity sent overnight repo rates surging from 2% to 10%.

- Emerging economies, with $4 trillion in dollar-denominated debt, remain highly exposed to such disruptions.

The Future of the Eurodollar System

Several emerging trends are poised to reshape how the Eurodollar market functions:

- Higher U.S. interest rates, now above 5%, are making dollar-based borrowing more expensive—especially for emerging markets with large foreign debt burdens.

- Countries with major refinancing needs could face liquidity pressure if high rates persist.

- A shift toward local currency financing is underway. In 2023, 30% of China’s trade was conducted in yuan—up from 15% in 2020—signaling a gradual move away from the dollar, particularly in Asia.

- Digital innovation is accelerating change. Central Bank Digital Currencies (CBDCs), like China’s Digital Yuan, have already processed over $100 billion in transactions. These digital tools may eventually replace traditional Eurodollar channels with cheaper, faster cross-border payment systems.

- Demand for U.S. Treasuries is declining. Foreign ownership has dropped to 30% of total issuance, down from over 40% a decade ago—a potential warning sign for the Eurodollar foundation.

- Some emerging markets are bolstering their defenses. For example, India now holds $600 billion in foreign reserves, providing a cushion against future dollar shocks.

Implications for Investors

The transformation of the Eurodollar system presents both risks and new opportunities for global investors:

- Emerging markets with heavy dollar debts are more vulnerable to funding shocks.

- Nations shifting to local currency financing, such as China and India, may offer more stable long-term returns.

- CBDCs may disrupt traditional lending and payments by introducing faster, lower-cost systems.

- Safe-haven assets—like gold and short-term bonds—remain key hedges in a world of rising rates and dollar volatility.

Final Takeaway: Why the Eurodollar System Matters

The Eurodollar network reminds us that global financial stability often hinges on markets we don’t directly see.

With over $13 trillion in offshore liabilities, this market can act as both a catalyst for growth and a trigger for crisis.

As global debt rises, tech advances, and U.S. policy tightens, understanding this invisible engine of dollar liquidity becomes essential for anyone watching the markets.

Related: What the Market Isn’t Telling You: Gold, Bonds, Hedge Funds & Fed’s Next Move