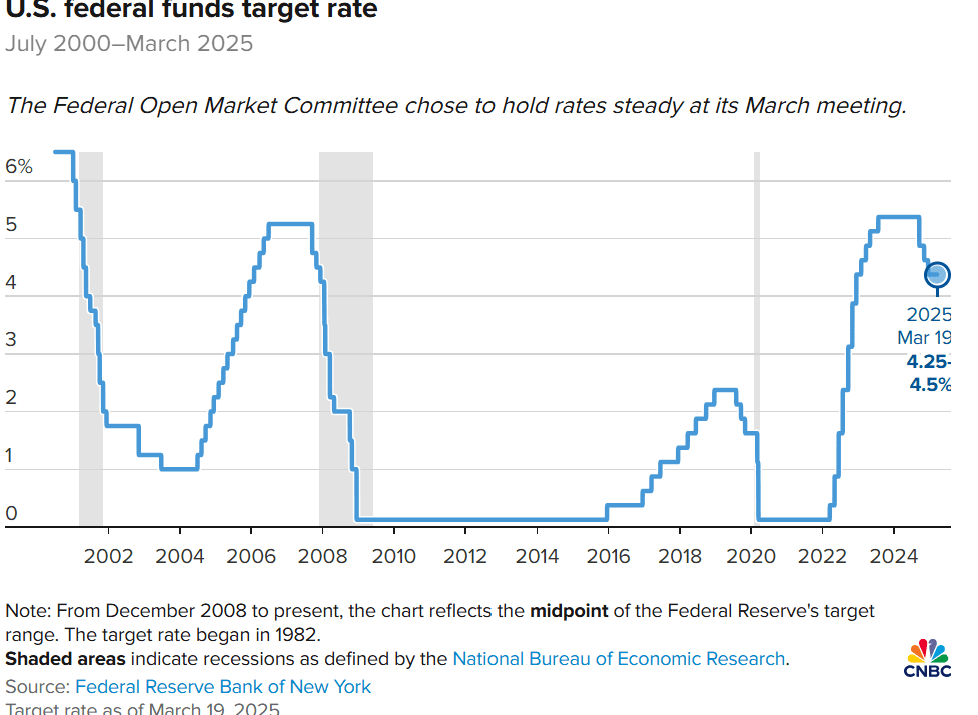

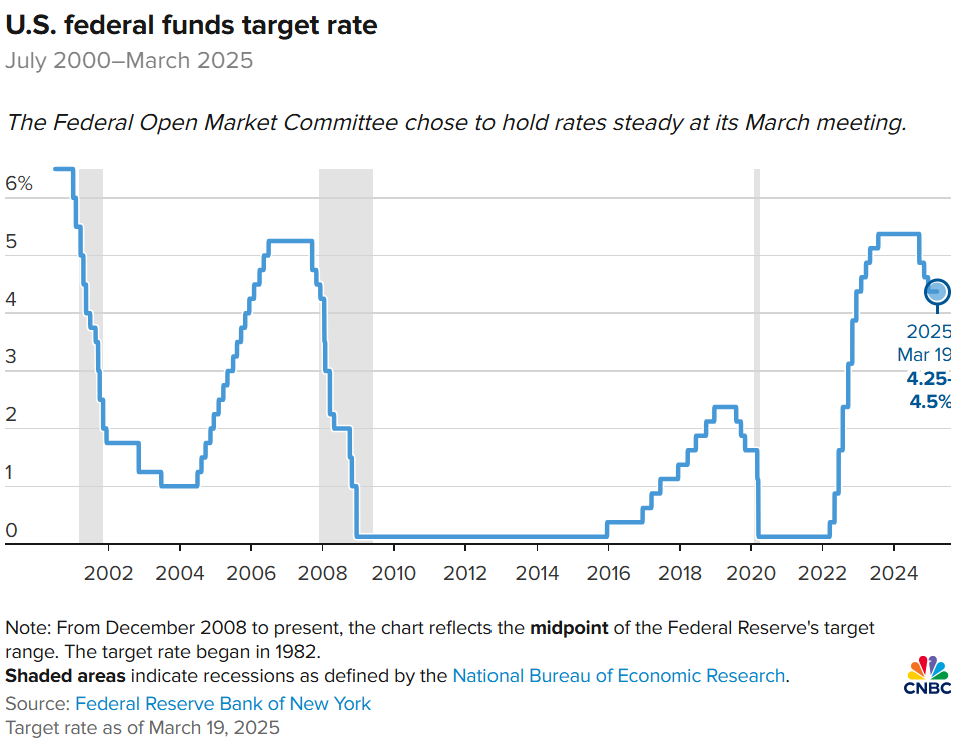

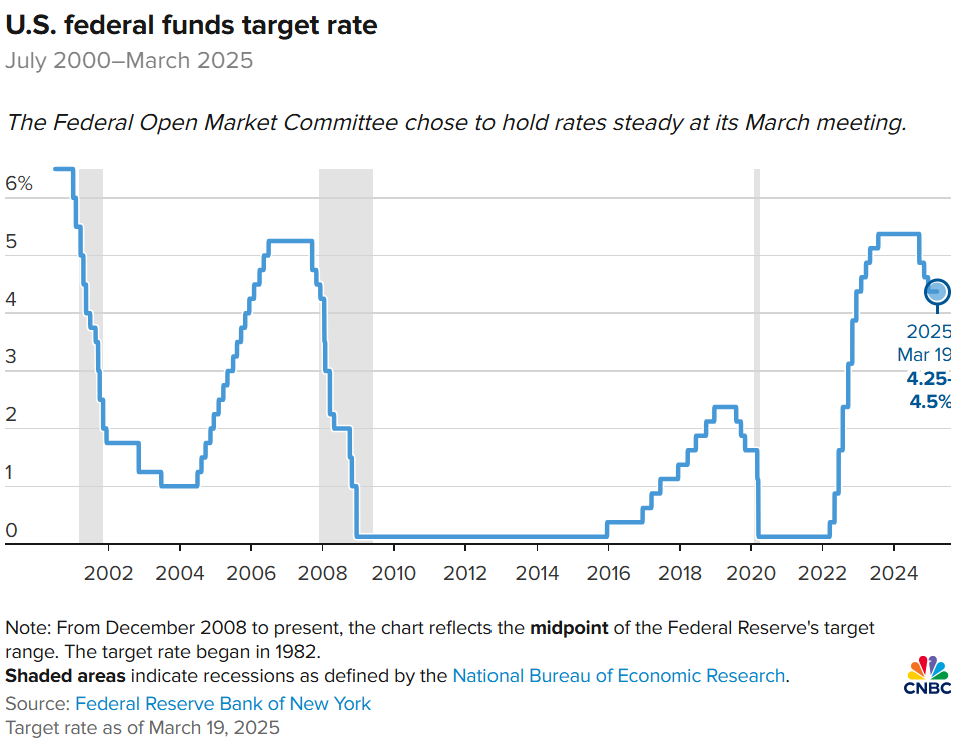

The Federal Reserve opted to hold interest rates steady in its closely watched decision on Wednesday, keeping its benchmark rate in the range of 4.25% to 4.5%. Despite mounting economic uncertainty, the Fed signaled that two rate cuts are still likely later this year, even as it downgraded growth projections and acknowledged rising inflation risks.

Why the Fed Hit Pause

With President Donald Trump’s aggressive tariff policies rattling markets and clouding the economic outlook, policymakers chose caution. Fed Chair Jerome Powell and the Federal Open Market Committee (FOMC) emphasized heightened risks from trade tensions and deregulation efforts, contributing to increased market volatility.

“The Committee is attentive to the risks to both sides of its dual mandate,” the FOMC said in its post-meeting statement, citing “increased uncertainty” about the economy’s future.

Economic Projections: Slower Growth, Higher Inflation

The Fed cut its GDP growth forecast for 2025 to 1.7%, down from 2.1% in December. Meanwhile, core inflation is now expected to run at 2.8%, up from 2.5%.

The Fed’s “dot plot” showed a more hawkish tone, with four officials now expecting no rate cuts this year—up from just one in December.

Still, the consensus points to two quarter-point cuts in 2025 and further easing into 2026 and 2027.

Scaling Back Quantitative Tightening

In addition to interest rates, the Fed announced it would reduce the pace of its quantitative tightening program. It will now allow only $5 billion in Treasurys to roll off its balance sheet monthly, down from $25 billion. However, the $35 billion cap on mortgage-backed securities remains unchanged.

Fed Governor Christopher Waller dissented, preferring to keep the balance sheet runoff unchanged.

The Trump Factor

Markets have been on edge as Trump’s tariffs on steel, aluminum, and other goods stoke fears of higher inflation and slower growth. More aggressive tariffs could be announced following an April 2 review.

These policies have already dented consumer confidence, with inflation expectations rising. Retail sales grew in February but missed expectations.

Labor Market and Consumer Spending

While unemployment remains relatively low at 4.1%, February’s jobs report showed signs of weakness, with payrolls missing forecasts and broader unemployment hitting its highest point since October 2021.

Still, some optimism remains. Bank of America CEO Brian Moynihan said on Wednesday that consumer spending is holding up well. BofA’s economists project 2% GDP growth this year.

The Fed’s wait-and-see approach reflects a delicate balancing act between managing slowing growth and persistent inflation, all against a backdrop of political and policy uncertainty.