Emerging market (EM) economies have long been touted as the engines of global growth. With their young populations, expanding middle classes, and vast natural resources, they represent some of the most promising investment opportunities. Yet, in 2025, these markets face significant headwinds—from rising debt burdens to inflationary pressures—that are reshaping their economic landscapes.

For investors, understanding these dynamics is crucial to balancing risk and reward. Here’s a comprehensive look at where emerging markets stand today, the challenges they face, and the opportunities that lie ahead.

Rising Debt Pressures Weigh on Emerging Economies

Over the past few years, EM countries have taken on significant debt, driven by pandemic-related spending, external borrowing, and currency depreciation. According to the Institute of International Finance (IIF), emerging markets’ total debt reached $105 trillion in 2024, an all-time high, with external debt denominated in U.S. dollars posing a serious challenge.

As the U.S. dollar strengthens and global interest rates remain elevated, nations like Argentina, Turkey, and Nigeria are particularly vulnerable. These countries face ballooning debt servicing costs, which strain government budgets and limit fiscal flexibility. Already, Zambia and Ghana have undergone debt restructuring, and analysts warn others could follow if borrowing costs stay high.

Meanwhile, countries with manageable debt profiles and stronger currencies, such as India, Indonesia, and Vietnam, are better positioned to weather the storm.

Inflation Remains Sticky Despite Central Bank Action

Inflation has been a persistent challenge for many emerging markets. Argentina and Pakistan are grappling with inflation rates above 40%, while Turkey recently reported annual inflation at 65%, according to Reuters.

Central banks in Brazil, Mexico, and South Africa were among the first globally to tighten monetary policy. Brazil’s central bank, for instance, hiked its benchmark Selic rate to 13.75% by late 2024. These preemptive moves have helped stabilize inflation expectations but have also cooled economic growth.

Looking ahead, if inflation pressures ease, EM central banks may shift toward monetary easing. India, Indonesia, and Brazil are among those where potential policy pivots could unlock growth opportunities, driving renewed investor interest.

Growth Opportunities Amid Challenges

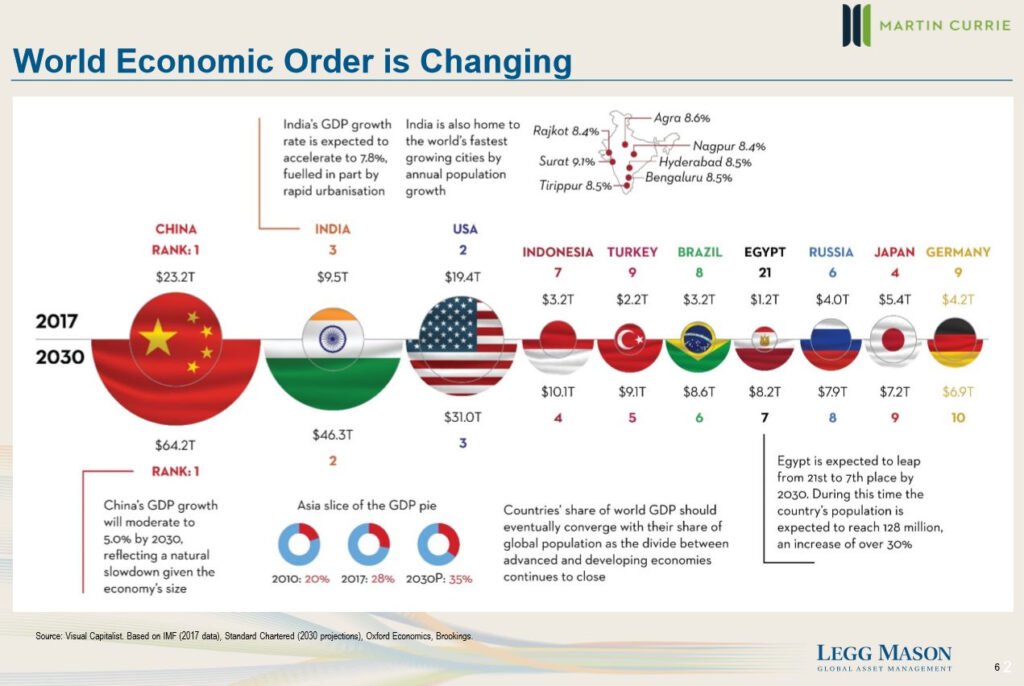

Despite macroeconomic headwinds, emerging markets remain crucial drivers of global GDP growth. The International Monetary Fund (IMF) projects EM growth at 4.2% for 2025, outpacing developed markets.

India

India is on track to become the world’s third-largest economy by 2030, fueled by its burgeoning technology, manufacturing, and infrastructure sectors. According to Goldman Sachs, India’s GDP growth is expected to average 6-7% annually over the next five years.

Vietnam & Southeast Asia

Vietnam and countries like Malaysia and Thailand are benefiting from supply chain diversification as firms reduce reliance on China. Foreign direct investment into Vietnam hit $36 billion in 2024, a record high, according to UNCTAD.

Africa

Parts of Africa, including Nigeria and Kenya, are seeing rapid urbanization, increasing demand for infrastructure, energy, and consumer goods. The African Continental Free Trade Area (AfCFTA) is expected to boost intra-African trade by 52% in the next decade, according to the World Bank.

The Role of Commodities and Trade Dynamics

Commodities remain a double-edged sword for EM economies.

- Commodity exporters like Brazil, Chile, and South Africa benefit from high prices for copper, iron ore, and agricultural products.

- Commodity importers such as India and Turkey struggle with higher import costs, leading to trade deficits and currency depreciation.

Additionally, the global energy transition presents opportunities for countries rich in critical minerals. Chile and Democratic Republic of Congo (DRC), home to vast lithium and cobalt reserves, are well-positioned to benefit from the demand for clean energy technologies.

Risks to Watch in Emerging Markets

While EMs present high-growth potential, risks remain:

🔻 Currency Volatility: Depreciating currencies can amplify inflation and complicate debt repayments.

🔻 Political Instability: Elections in Nigeria, South Africa, and Thailand have already sparked investor uncertainty.

🔻 Global Slowdown: Sluggish growth in China, the U.S., or Europe could dampen demand for EM exports.

🔻 Geopolitical Tensions: The Russia-Ukraine conflict and U.S.-China tensions continue to affect global trade patterns.

Visions of Tomorrow: Key Themes for Investors

🔸 Supply Chain Shifts: India and Vietnam are poised to benefit as companies diversify away from China.

🔸 Commodity Windfalls: Brazil, Chile, and parts of Africa could profit from surging demand for critical resources.

🔸 Policy Pivots: If EM central banks pivot to easing, this could boost equities and bonds.

🔸 Structural Reforms: Improvements in governance and fiscal discipline could attract more foreign investment.

How to Invest in Emerging Markets

- EM Equities: Focus on technology, infrastructure, and consumer sectors.

- Sovereign Bonds: Higher yields in India, Indonesia, and Mexico can offer attractive risk-adjusted returns.

- Commodity Plays: Investments in countries or companies tied to critical minerals and agriculture could outperform.

Embracing Opportunity Amid Volatility

Emerging markets remain volatile, but they offer compelling long-term opportunities. The key for investors is selectivity—focusing on countries with stable governance, manageable debt, and positive demographic trends.

As the global macro environment shifts, emerging markets could be tomorrow’s growth stories—but only for those willing to navigate the complexities.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources:

- Macro Trends in Emerging Markets – Macro Mornings

- Emerging Markets: Opportunities and Risks – Smartling

- Emerging Market Economy Definition – Investopedia

Related:

- Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets

- The world is rearming at a pace not seen the since end of World War II

- What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

- Donald Trump’s Tesla Sales Script Note Is Going Viral

- Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

- Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan