Institutional investors, like hedge funds and investment advisors, often have teams of analysts dedicated to researching stocks. Regular investors can watch what these big players do to get an idea of which stocks might be good investments. Looking at what institutional investors are buying can provide valuable insights into market sentiment and potential long-term value.

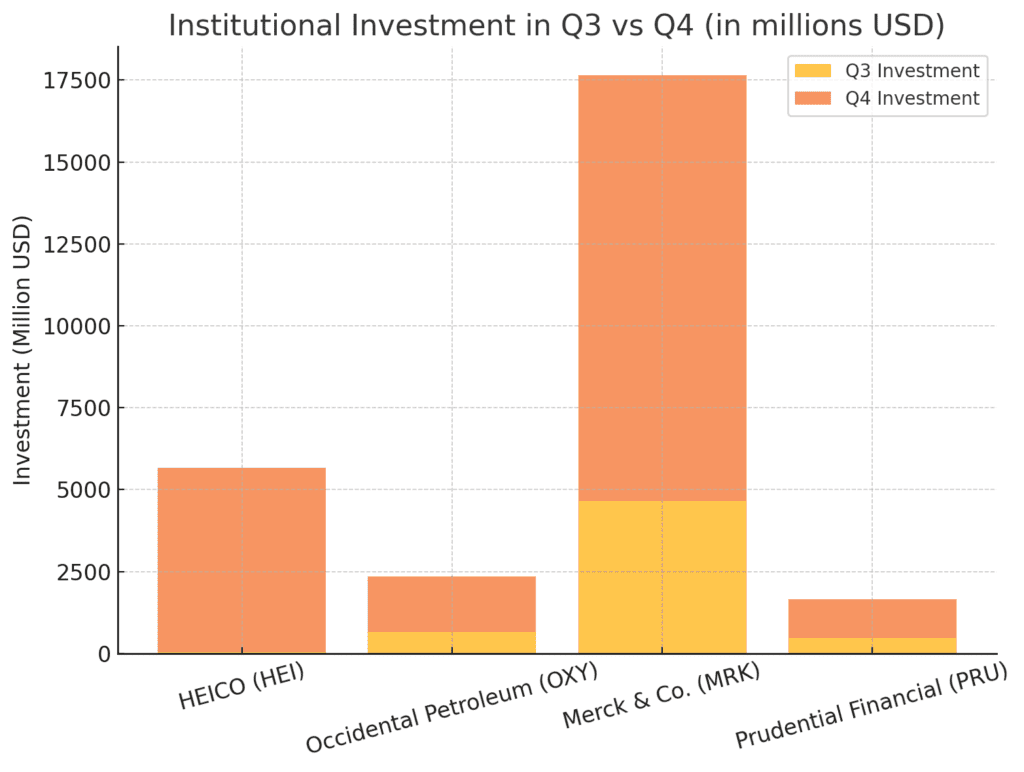

Here’s a look at four companies that saw a lot of institutional buying in the last quarter of 2025, with at least $1 billion invested in each:

HEICO (NYSE: HEI): This company has seen its stock price climb by 13% since the last quarter ended, and institutional buying has jumped from $45 million to a whopping $5.63 billion! This indicates that major investors like Polar Asset Management and Emerald Advisers are increasingly confident about HEICO. The company recently surpassed its earnings expectations by $0.27 per share, which likely explains the heightened interest. Analysts are generally optimistic about HEICO, forecasting a 3.61% growth in the coming year.

Occidental Petroleum (NYSE: OXY): Despite a general downward trend in its stock price (down 26% since last year), Occidental Petroleum experienced increased investment from institutional investors, with purchases rising from $659 million in Q3 to $1.69 billion in Q4. This could suggest that some view the current low price as a buying opportunity. Although analysts currently have a neutral outlook on the stock, they anticipate significant potential for it to rise, predicting over 31% upside. The company also recently exceeded earnings expectations by $0.13 per share.

Merck & Co., Inc. (NYSE: MRK): Even though Merck’s stock price is presently near its 52-week low, institutional investors continue to acquire shares, with purchases increasing from $4.65 billion in Q3 to $13 billion in Q4! Analysts remain positive about the stock’s potential for growth, predicting a 25% price upside. Merck also provides a competitive 3.48% dividend yield and has a history of raising its dividend for the last 14 years, making it appealing to long-term investors.

Prudential Financial (NYSE: PRU): This stock has experienced a recent 12% decline in price, but institutional buying increased from $486 million in Q3 to $1.17 billion in Q4, suggesting some institutional investors see this as a buying opportunity. Prudential Financial also has a low price-to-earnings ratio of 14.71 and a high dividend yield of 4.91%. However, there are some indicators of increased risk, such as a recent failure to meet earnings estimates and rising short interest in the stock (up 6.5% since last month).

Important Note: While monitoring institutional investment can be informative, it’s essential for individual investors to conduct their own research and consider their own risk tolerance before making any investment decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Original source: MarketBeat

Related:

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?