This is absolutely insane: On February 20th, JP Morgan CEO Jamie Dimon sold $234 million worth of $JPM stock. On February 22nd, Warren Buffett announced a record $334 BILLION cash balance. 12 days later, the Nasdaq 100 crashed – 11%.

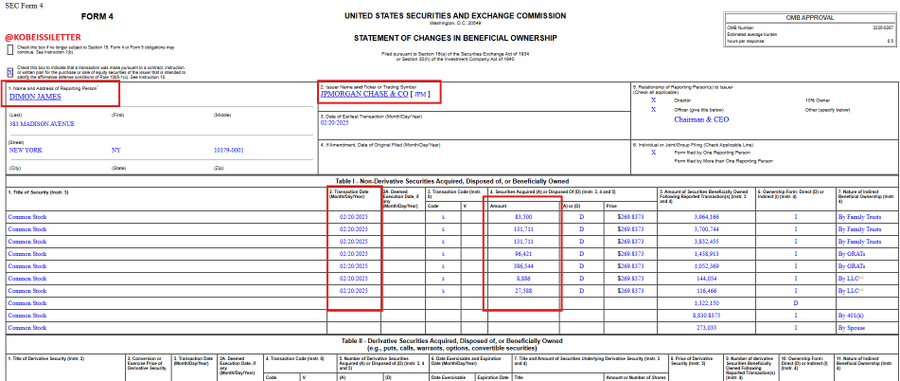

Amid all of the headlines and market noise, Jamie Dimon made a large sale on February 20th. He sold approximately 866,361 shares of $JPM at a price of ~$269.83/share, totaling $234M. These shares were sold through various entities, including family trusts and LLCs.

Jamie Dimon’s purchases and sales of $JPM have been widely watched over the years. They are also generally regarded as a “leading indicator” for the broader market. Since Dimon sold these shares, $JPM has fallen over -13% in a matter of days. It has only been 2 weeks so far.

This brings us back to the “Dimon Bottom” during the pandemic in May 2020. As panic spread, Jamie Dimon joined CNBC on May 20th, 2020 and said $JPM was “very valuable” amid the crash. Within 3 weeks of the bottom, $JPM has traded a whopping +41% higher. This was historic.

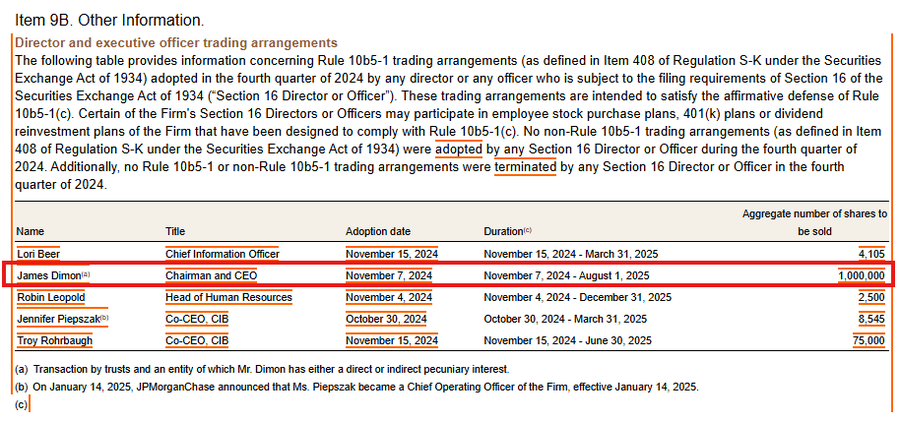

Jamie Dimon is not done selling yet. As per the below SEC filing, Jamie Dimon will be selling a total of 1 million shares of $JPM by August 1st. This comes EXACTLY 1 year after his first ever sale of the stock since taking over the company 19 years ago. And, there’s more.

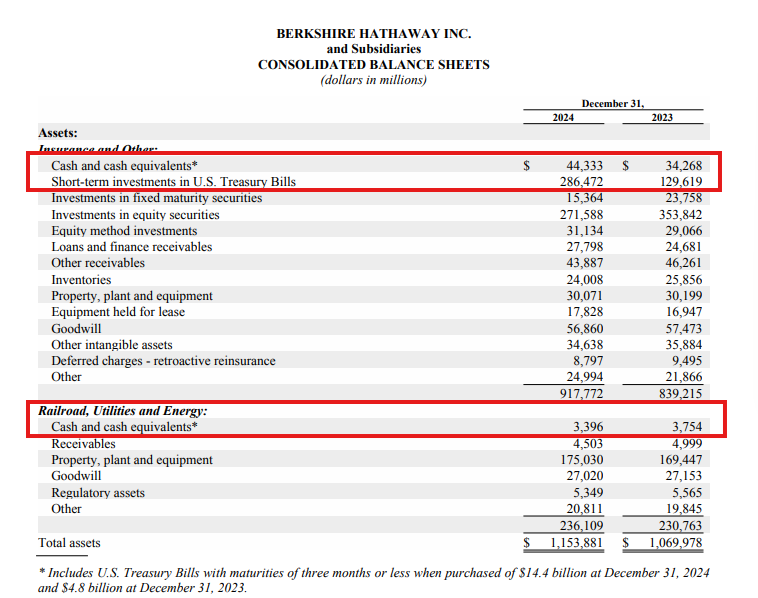

2 days later, Warren Buffett’s Berkshire Hathaway announced they hold a record $334 BILLION in cash. Between Q1 2024 and Q4 2024, their cash balance rose a massive $145.2 BILLION. This is one of the largest cash balances held by a public company ever recorded.

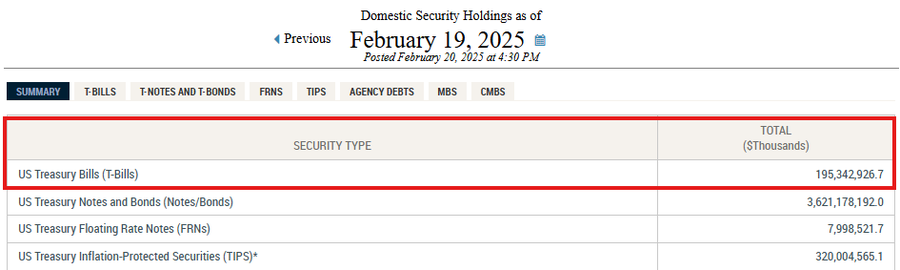

They held $286.5 BILLION of US Treasury Bills. Meanwhile, the US Federal Reserve held $195.3 billion in US Treasury Bills at the time of this announcement. This means that Berkshire Hathaway held ~$91.2 billion MORE of T-bills than the Fed. Once again, unprecedented.

Warren Buffet was asked about why he decided to build such a large cash balance. “Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” he said. Buffett was basically saying that *most* stocks appeared to be overvalued.

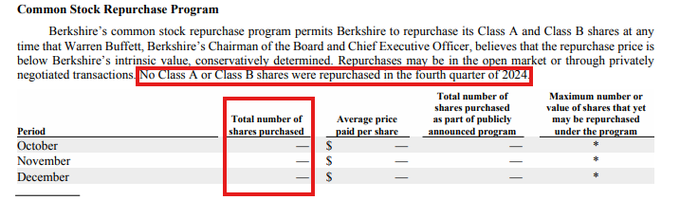

In fact, Buffet didn’t even buy his own stock. Berkshire Hathaway repurchased $0 of stock in Q4 2024. This is the 2nd straight quarter without buybacks. In Q3, Berkshire said buybacks will resume when Buffett “believes that the repurchase price is below intrinsic value.”

Since the Dimon’s sales and Buffett’s cash balance surging to a record $334 billion, ALL risky assets have dropped. Also, in the week following these announcements, crypto lost a whopping -$700 billion. The market has moved into risk-off mode as the trade war ramps up.

Additionally, in a matter of weeks after these announcements, the Atlanta Fed made multiple downward revisions in GDP estimates. Their GDPNow tool went from +3.9% growth in Q1 2025, to -2.8% contraction, then finally -2.4% last week. Recession odds have surged as well.

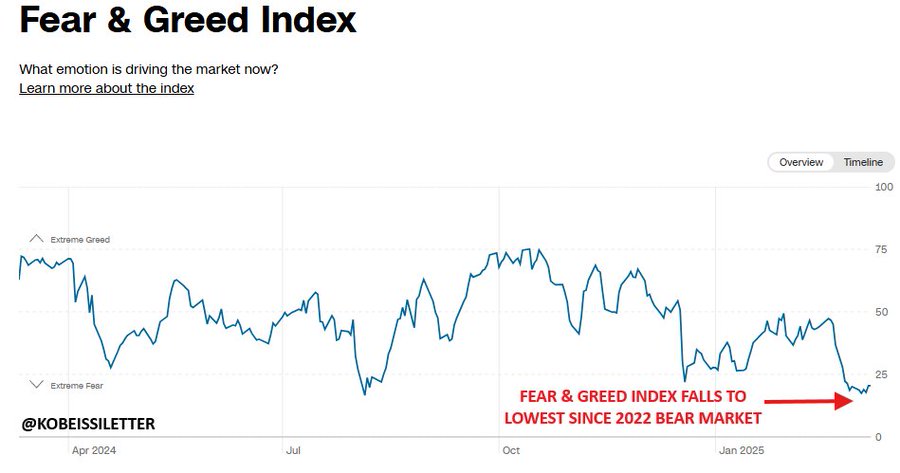

So, how did they know? The exact timing of these announcements and the market’s top aligning with them could be a coincidence. However, prior to these sales, we had seen greed levels in risky assets rise to unsustainable levels. Positioning simply became too polarized.

Also, since the recent market correction began, the Fear & Greed Index has fallen sharply. Last week, the index hit its lowest level since the 2022 bear market. The market has become increasingly emotional with sudden shifts in risk appetite. For traders, this is great.

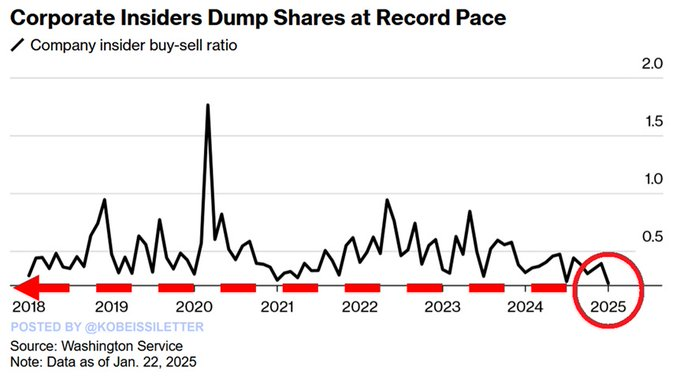

Lastly, it wasn’t just Buffett and Dimon selling stock. Heading into February, the ratio of insider buyers to sellers dropped to 0.22, the lowest since 1988 when data began. Can retail dip buyers hold on here?

Source: TKL

Related:

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?