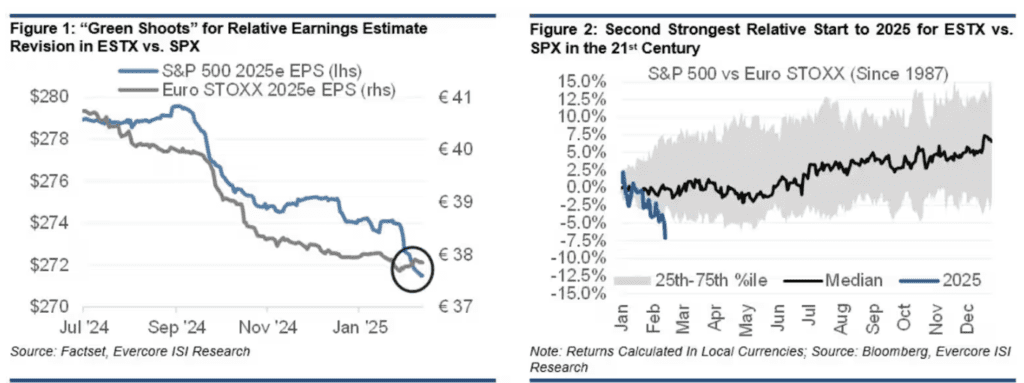

After trailing U.S. markets for much of the past decade, European stocks have outpaced their American counterparts since the start of 2025, marking a significant shift in global equity performance.

The rally has propelled the Euro STOXX 50 index to its first record close in 25 years, according to Dow Jones Market Data.

Why Are European Stocks Outperforming?

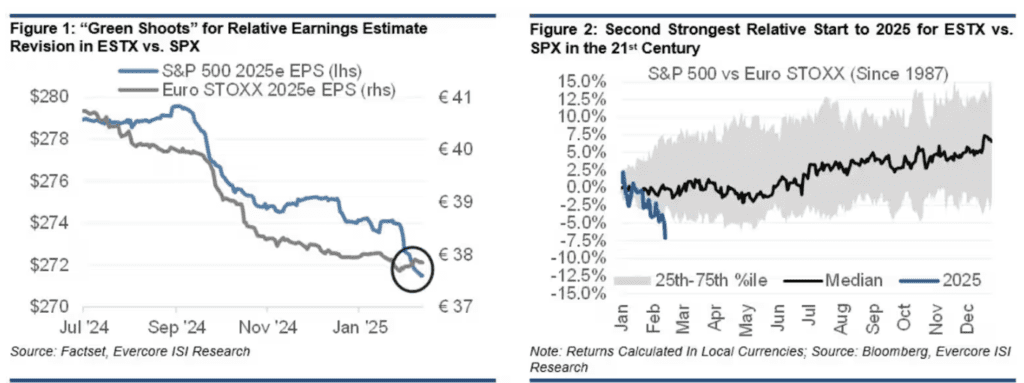

🔹 Earnings Momentum: Unlike Wall Street analysts, who have lowered earnings expectations for S&P 500 companies in 2025, Euro STOXX 50 earnings forecasts have remained strong.

🔹 Valuation Rebound: Many view this surge as a classic reversion to the mean, with European stocks finally catching up after years of underperformance.

🔹 Ukraine Peace Deal Speculation: Reports of a potential resolution to the Russia-Ukraine war have fueled optimism in European markets, outweighing concerns over Trump’s proposed tariffs and sluggish EU economic growth.

How Big Is the European Stock Rally?

📈 Euro STOXX 50 is having its second-best start relative to the S&P 500 in 25 years.

📊 The index could soon break its all-time high set 25 years ago if momentum continues.

Can Europe Keep This Lead Over the U.S.?

✅ Bullish Case:

- Stronger earnings growth expectations compared to the U.S.

- Lower valuations attract investors looking for cheaper opportunities.

- A Ukraine war resolution could further boost sentiment.

❌ Bearish Risks:

- Trump’s trade tariffs could slow European exports and weigh on corporate profits.

- Europe’s economic growth remains sluggish, posing challenges to long-term gains.

For now, European stocks are leading the charge, and investors are watching closely to see if this trend holds or if U.S. markets make a comeback.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.