D-Wave Quantum (NYSE: QBTS) remains one of the most intriguing players in the rapidly evolving quantum computing space. While many quantum stocks have already soared past Wall Street’s price targets following recent advancements, D-Wave’s stock still has significant upside, with analysts projecting a potential 45% increase from its current price. Let’s explore the key factors driving its growth prospects.

Google’s Breakthrough Propels Quantum Industry

- In December, Google announced a significant milestone with its Willow quantum chip, which demonstrated the ability to drastically reduce error rates as it scales the number of qubits.

- The chip solved a benchmark computation in 5 minutes, which would take the best classical supercomputer 10 septillion years to complete. While the task was designed as a test, it showcases the potential of quantum computing.

- Google’s innovation has ignited optimism across the quantum computing space, providing a tailwind for other players, including D-Wave.

Why D-Wave Stands Out

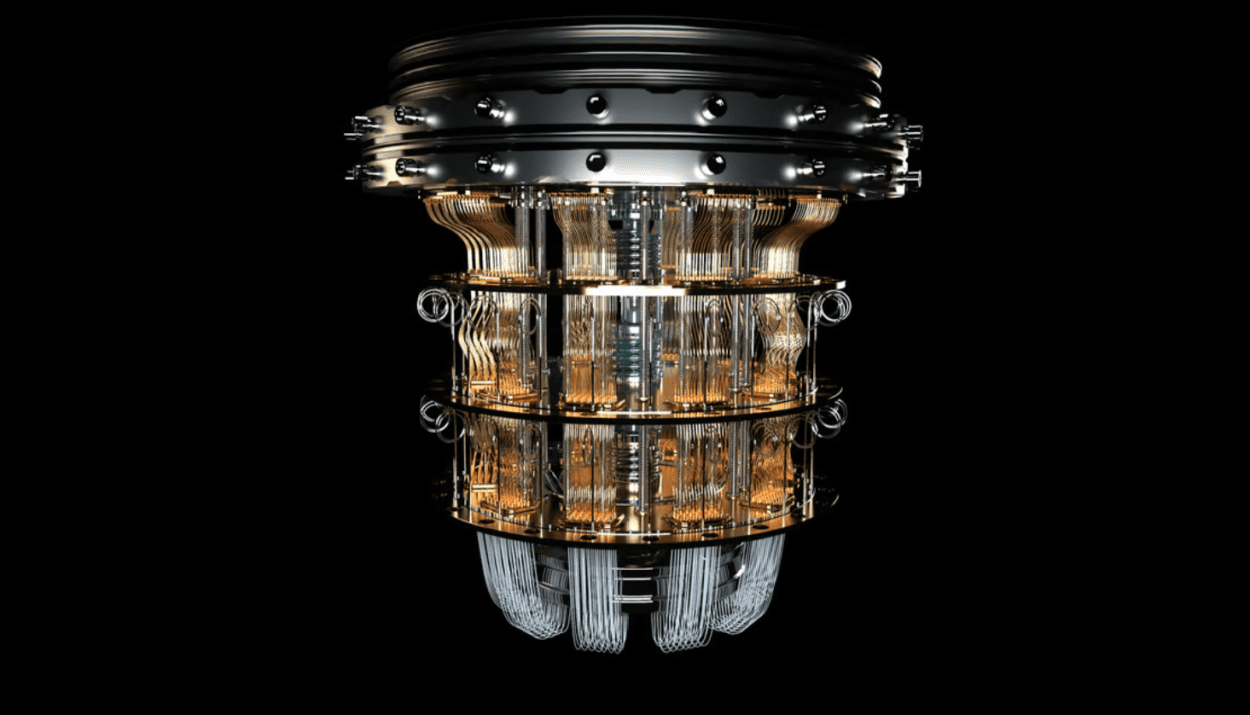

A Unique Approach: Quantum Annealing

Unlike most competitors that use gate-based quantum computing, D-Wave employs a quantum annealing process. This method involves defining a problem as peaks and valleys in a mathematical landscape and allowing quantum particles to find the most efficient solution. Key advantages of quantum annealing include:

- Optimization Strength: Best suited for logistics, financial modeling, and other optimization tasks.

- Lower Error Susceptibility: Annealing-based chips are less prone to errors compared to gate-based chips due to their forgiving probabilistic nature.

- Ready for Use: D-Wave already has dozens of customers across multiple industries using its quantum annealing chips to solve real-world problems.

Early Commercial Viability

D-Wave’s focus on specific tasks allows it to generate meaningful revenue today:

- Management reported a 120% year-over-year increase in bookings for 2024, signaling growing adoption of its technology.

- The company’s chips are already being used in logistics and financial modeling, offering nearly optimal solutions where classical computers fall short.

Strategic Fundraising

In December, D-Wave raised $175 million through a stock sale, capitalizing on its recent stock price surge. This move strengthens its cash position and allows the company to:

- Invest in R&D: Develop more advanced quantum systems to maintain a technological edge.

- Expand Sales and Marketing: Capture additional market share in the growing quantum industry.

Stock Performance and Analyst Projections

- Current Price: $6.22

- 52-Week Range: $0.73 – $11.41

- Market Cap: $1 billion

- Wall Street Projections: Analysts see D-Wave’s stock potentially rising to $9 per share, representing a 45% upside from its current price. Even the median price target of $7.50 reflects a 21% gain.

The Risks and Opportunities

- Competition: D-Wave faces intense competition from tech giants like Alphabet and other quantum computing startups, which continue to invest heavily in gate-based systems.

- Cash Burn: The company currently spends about $60 million annually on research and operations, and it is not yet profitable. However, the recent fundraising extends its cash runway.

- Near-Term Growth Potential: Analysts expect 2025 to be an investment-heavy year, but strong revenue growth during the year could drive stock performance.

A Long-Term Investment in the Future of Computing

D-Wave Quantum, with its focus on quantum annealing, is uniquely positioned in the quantum computing sector. While quantum computing remains a high-risk, high-reward industry, D-Wave’s ability to generate revenue today, coupled with its robust cash position and growing customer base, makes it a compelling choice for investors looking to bet on the future of computing. With a potential 45% upside in its stock price, D-Wave is one to watch closely in 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.