The recent presidential debate has boosted Donald Trump’s lead over Joe Biden, sparking intense speculation about which stocks stand to gain the most from a Trump victory. Economists and traders widely anticipate that a Trump administration would prioritize deregulation, tax cuts, bolstered domestic energy production, and a tougher stance on trade, potentially leaning towards protectionism.

Industries Expected to Thrive:

- Oil Companies: Reduced regulatory burdens and favourable trade conditions could boost oil companies.

- Healthcare Firms: Deregulation and tax cuts might benefit healthcare firms.

- Automakers: Favorable trade policies and reduced regulations could benefit the auto industry.

- Crypto Sector: Trump’s pro-cryptocurrency stance contrasts sharply with Biden’s regulatory approach, potentially benefiting stocks like Coinbase (NASDAQ).

- Trump Media: Trump’s own company, Trump Media (NASDAQ), could see gains due to increased investment from entities looking to curry favour.

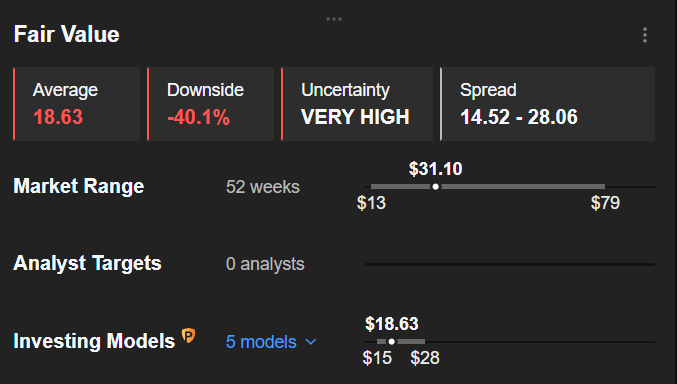

1. Trump Media & Technology Group Trump Media & Technology Group, which runs Trump’s social network Truth Social, could be one of the biggest beneficiaries of a Trump victory. This stock falls into the category of theme stocks, whose value depends on speculation and FOMO more than financial logic. Despite its value having more than halved from its record high at the end of March, it could see significant investment if Trump wins the presidency.

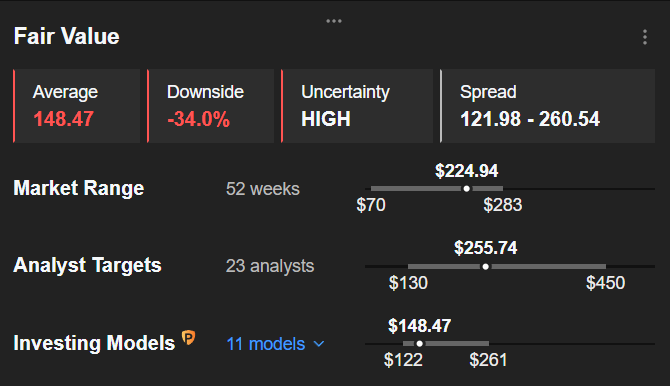

2. Coinbase Global Donald Trump has made numerous pro-cryptocurrency statements during his campaign, even claiming at a private gala that he wants to become the “President of Cryptocurrencies.” Therefore, shares of Coinbase could benefit greatly from a Trump victory, with the expectation of regulations that are more favourable to the industry’s development. Analysts estimate that the stock could rise by a further 14%.

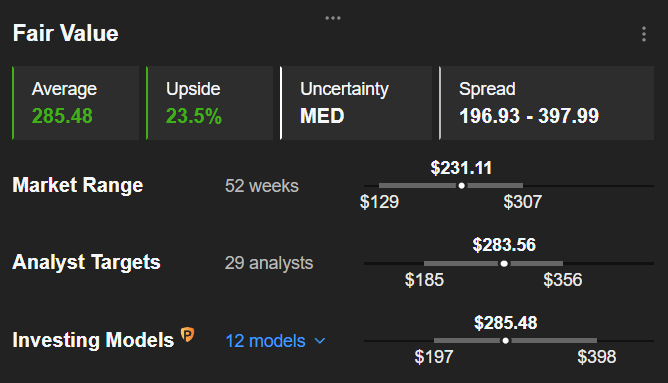

3. First Solar While Trump is known as a supporter of the oil industry, First Solar, which suffers from Chinese competition, could benefit from a rise in protectionism, making Chinese products less competitive. The stock posted a powerful rebound of 6.64% on Wednesday and has an upside potential of 23.5% according to InvestingPro’s Fair Value.