The US stock market is taking on a new look in 2025 — and it’s not all about the Magnificent 7 anymore.

After two straight years of mega-cap tech dominance, the 2025 rally is being fueled by broader sector strength and diverse stock winners, signaling improving health in the wider economy.

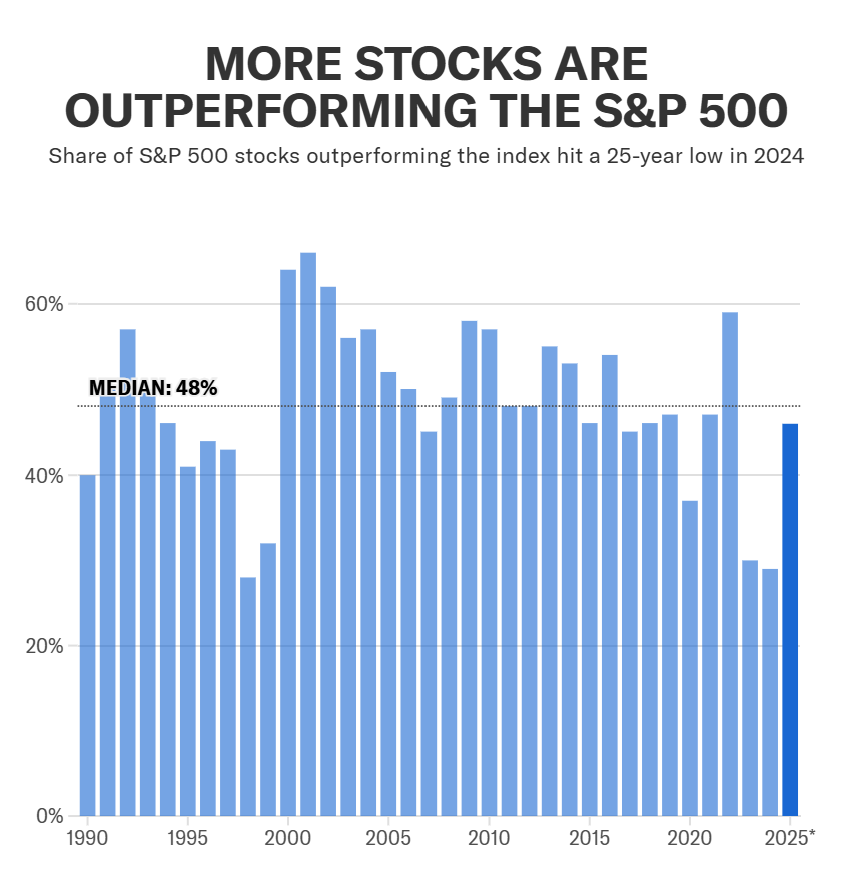

According to data through June 11, 46% of S&P 500 companies have outpaced the benchmark’s modest +2.6% gain. That’s a significant change from 2023 and 2024, where only a handful of tech giants drove most of the index’s returns.

“All investors should hope the broadening continues,” said Richard Bernstein, CEO of Richard Bernstein Advisors. “It means the health of the broader economy is improving.”

Sector Performance:

- Industrials (XLI): +9.3%

- Utilities (XLU): +7%

- 7 of 11 S&P sectors are outperforming the index

The Twist? – While the Magnificent 7 (Apple, Amazon, Meta, Microsoft, Nvidia, Tesla, Alphabet) helped markets rebound in the last month, they are down 2.5% YTD as a group — compared to a +5.3% gain by the other 493 S&P companies.

This shift marks a key transition away from a narrow market and toward a stock picker’s environment, with less correlation and more company-specific catalysts — especially as tariff noise from Trump’s policy shifts has cooled down.

2025’s Standout Performers:

- Palantir (PLTR): +80% YTD – leading the S&P 500

- NRG Energy (NRG) and Newmont Gold (NEM) — both benefiting from energy and gold demand

- Dollar General (DG) — proving retail resilience

- GE Vernova (GEV) and CVS Health (CVS) — less flashy, but strongly rebounding

“I have a very tough time understanding why people think it’s great that seven stocks dominate the world,” Bernstein added. “That’s a horrifically bearish forecast for future profits and growth.”

With AI still hot, but no longer the only game in town, 2025 is shaping up to be the year of diversification — and that may be exactly what the market needs.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Says Israel Attack ‘Great for Market’ as Stocks Plunge, Oil Soars After Iran Retaliation

10 Reasons China Is Leading the Robot Race

Trump Unloads on EV Mandates, Talks Musk, Tariffs, and National Guard: Here’s What He Said

Why gold beat Euro to become world’s second-largest reserve asset

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift