Despite a choppy December and renewed concerns around AI spending and valuations, major Wall Street players remain confident that a Santa rally can still materialise before year’s end.

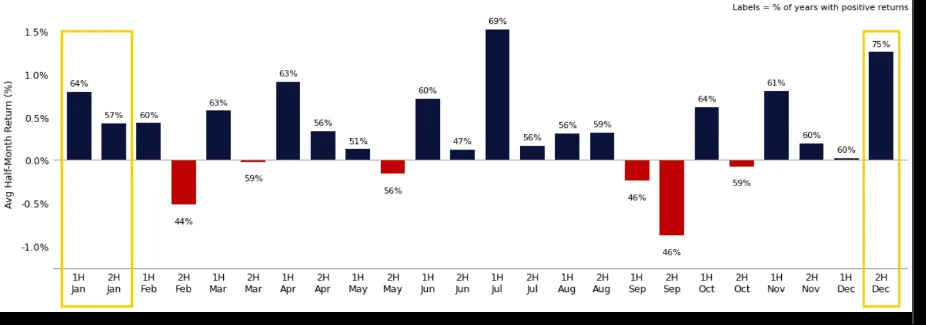

The S&P 500 rebounded 0.8% this week, snapping a four day losing streak, while the Nasdaq 100 and big tech stocks led gains after softer inflation data improved expectations for future rate cuts. Historically, markets tend to perform well at this time. Since 1928, the S&P 500 has risen 75% of the time in the final two weeks of December, with an average gain of about 1.3%, according to Citadel Securities data.

At Goldman Sachs, traders say seasonal trends, easing volatility, and cleaner positioning favor upside into year end, even if gains are modest. They argue that without a major shock, it is difficult to fight the positive year end setup.

Options markets support that view. Investors have been buying call spreads on Nvidia, Micron, Broadcom, and tech ETFs, while selling downside protection on mega cap stocks. Citadel Securities notes that retail investors have been net buyers of call options for 32 of the past 33 weeks, reflecting sustained confidence.

Broader flows also remain supportive. About $100 billion has flowed into US equities over the past nine weeks, and investor sentiment tracked by Goldman is at its most bullish level since April. Institutional investors have also increased exposure, branching beyond Big Tech into industrials, real estate, and other cyclical sectors.

While skepticism around AI returns and the Fed’s 2026 rate path persists, many strategists believe cooling inflation, lower volatility, and strong seasonal patterns still provide a credible foundation for a Santa rally, even after an uneven start to December.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.