Japan’s government bond market, once seen as one of the safest and most stable in the world, is now causing serious concern for investors around the globe.

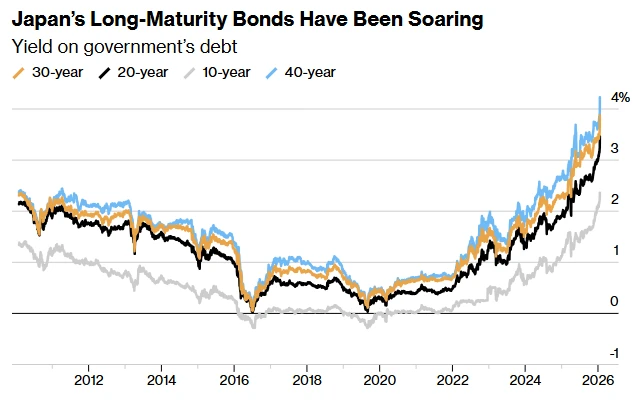

In mid-January, the yield on Japan’s 40-year government bond jumped above 4 percent for the first time in more than 30 years. That move may sound technical, but it matters because Japan has a $7.5 trillion bond market that plays a key role in global finance. When Japan’s bonds become unstable, the shock can spread to the US, Europe, and beyond.

Here is what is happening and why it matters.

More about: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?

What Changed in Japan

For many years, Japan’s central bank kept interest rates extremely low and bought huge amounts of government bonds. This kept borrowing cheap and bond prices stable, even though Japan has one of the highest debt levels in the world.

That system is now changing.

The Bank of Japan has started to reduce its bond purchases and allow market forces to set prices more freely. At the same time, inflation has returned after decades of deflation, which naturally pushes interest rates higher.

Then politics added more pressure.

Prime Minister Sanae Takaichi announced a large stimulus package and promised to suspend the food sales tax for two years. These plans could cost the government around 5 trillion yen per year and may require more borrowing.

Investors now fear that Japan will issue many more bonds in the coming years. When supply rises and buyers are scarce, bond prices fall and yields rise quickly.

Why Demand Is Weak

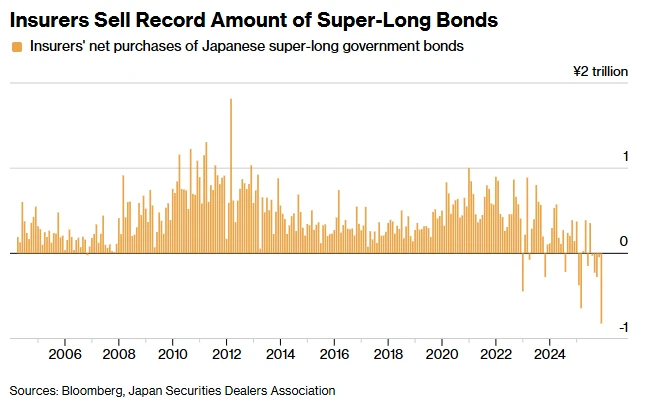

Japan’s central bank used to be the biggest buyer of its own bonds. Now that it is stepping back, there are not enough domestic buyers to replace it.

Local life insurers and pension funds, which traditionally bought long-term bonds, have reduced their buying because prices are swinging too much. Some insurers have already reported large paper losses on their bond holdings.

Foreign investors now dominate trading in Japanese bonds. They are fast to enter and fast to exit. When yields jumped, many cut their positions, making the sell-off even worse.

Why This Affects the Whole World

Japan’s bond market is deeply connected to global markets.

First, when Japanese long-term yields rise sharply, investors sell bonds in other countries to rebalance their portfolios. This week, US, UK, and Canadian bond yields all rose after Japan’s move.

Second, Japan is a major funding currency. Investors often borrow cheap yen to invest in higher-yield assets abroad. When Japanese yields rise, these trades become less attractive and are unwound, hurting stocks and bonds worldwide.

Third, Japan has long been a symbol of stability. When that stability cracks, investors become more cautious everywhere.

Is Japan in Crisis

No, Japan is not close to default. Most of its debt is held domestically, and the government can still borrow.

The real issue is not solvency. It is volatility and credibility.

Markets are learning that Japan is no longer protected by heavy central bank support. Prices can now move freely, and fiscal promises matter much more.

As one economist put it, Japan is not collapsing. It is simply being priced by markets again after many years of artificial calm.

What Comes Next

The Bank of Japan has said it may slow the pace of its withdrawal and step in if markets become disorderly. For now, it is letting yields rise.

Investors will closely watch:

- The upcoming election and new spending promises

- Whether the central bank intervenes

- Whether foreign investors keep selling

The key message for global markets is simple.

Japan is back on investors’ radar, not because it is failing, but because its bond market can now move fast and shake the entire financial system.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Bank of Japan to Begin Selling $534B in ETFs, What It Means for Markets and Crypto