Global trade is heading into 2026 with momentum on the surface but growing stress underneath. After weathering a turbulent 2025, marked by tariffs, rerouted supply chains, and fragile trade deals, businesses and governments now face a year where the consequences of policy shifts start to fully hit.

Shipping data suggests trade volumes are still expanding, yet the balance is changing fast and not evenly.

Trade held up in 2025, but cracks are forming

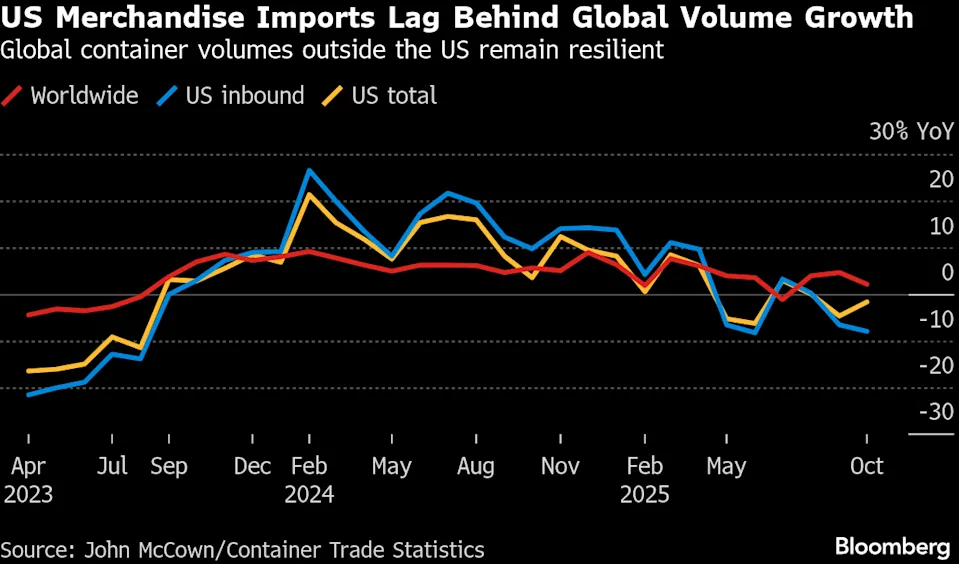

Global container trade grew 2.1% year over year in October, showing resilience despite rising barriers. But the regional picture tells a different story.

- US inbound volumes fell 8%

- Imports surged across Africa, the Middle East, Latin America, and India

- Supply chains are already reconfiguring away from the US

Industry analysts say 2025 was the year tariffs were imposed, while 2026 will be the year businesses feel their full impact.

Trump’s trade reset reshapes global flows

Since returning to office, Donald Trump has pushed aggressive trade measures that are accelerating long term shifts in global commerce.

US importers, after a strong 15.2% surge in container volumes in 2024, are now pulling back sharply. Trade routes are being rewired as companies seek alternatives to avoid rising costs and policy uncertainty.

The result is a world trading system that is less centralized, more fragmented, and harder to predict.

USMCA review could trigger fresh tensions

One of the biggest flashpoints in 2026 will be the upcoming review of the USMCA between the US, Canada, and Mexico.

US Trade Representative Jamieson Greer says stakeholders broadly support the agreement but almost all want changes.

That creates a problem.

Any improvement for one country likely comes at the expense of another, setting up difficult negotiations just as industries in Canada and Mexico struggle with US import taxes. Relations are already strained, especially with Canada, after trade talks were abruptly cut off in late 2025.

Shipping faces two potential shocks

For global shipping, 2026 could bring disruption from two very different directions.

First, a possible return to Red Sea routes. Attacks in the region have eased, prompting carriers like CMA CGM and A.P. Moller-Maersk to cautiously resume transit. But analysts warn that a full reopening could flood the market with capacity, triggering severe congestion at European ports.

Second, stronger US economic growth could fuel a wave of inventory restocking. If demand rebounds quickly, shipping networks may struggle to cope, echoing the bottlenecks seen during the pandemic years.

Fragile trade deals raise new risks

The White House has promoted several trade agreements as major wins, but many lack the structure of traditional trade deals.

- Most include short term truces, not binding commitments

- The US and China remain linked only by a one year truce

- Smaller economies face pressure from both Washington and Beijing

Recent frictions highlight the risks. China has already warned countries like Malaysia and Cambodia against trade arrangements that undermine its interests, while Indonesia has pushed back against US demands it sees as limiting its independence.

Even close partners like the UK and EU are not immune, with the US threatening retaliation over digital regulation and tech policy.

Supreme Court ruling adds major uncertainty

Another major wildcard for 2026 is a pending decision by the US Supreme Court on the legality of Trump’s reciprocal tariffs.

If the court rules against the administration, questions loom over whether importers would be refunded for tariffs already paid. Betting markets currently assign around a 75% chance that the tariffs will be struck down.

Even so, officials signal that alternative legal tools could be used to reimpose tariffs through other means, keeping trade uncertainty alive.

What this means for 2026

For global businesses, 2026 is shaping up as a year of consequences, not just policy headlines.

- Trade growth may continue, but routes and partners will keep shifting

- Tariff risks remain high, even if legal challenges succeed

- Supply chains face renewed congestion and cost volatility

- Trade diplomacy looks more fragile, not more stable

In short, the global trading system is entering another year of instability, where resilience will depend less on volume growth and more on adaptability, diversification, and risk management.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: The geopolitical risks that could reshape global business in 2026