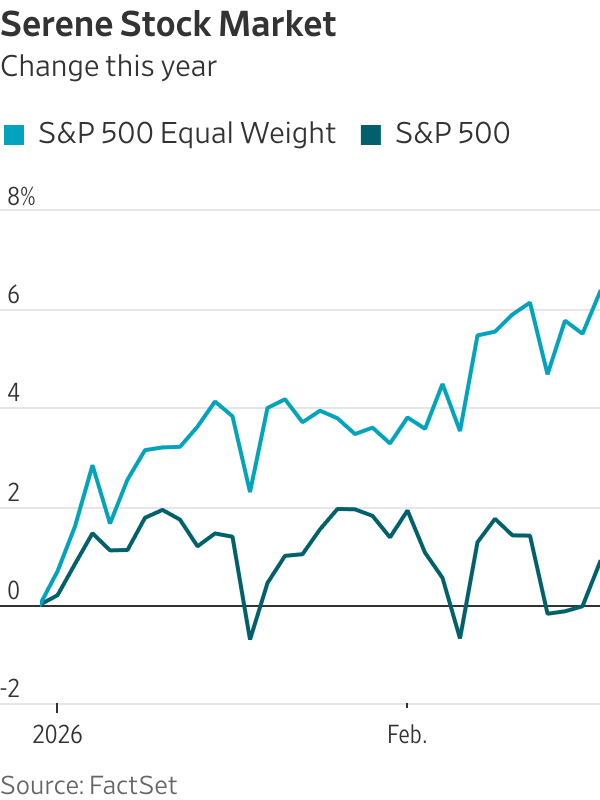

It isn’t just you. The market is strange right now. Stocks are swinging as if something has broken, yet the main index is sitting close to record highs.

The S&P 500 is only about 2% below its peak and is basically flat for the year. But that calm headline hides dramatic movement underneath.

A Rare Split Beneath the Surface

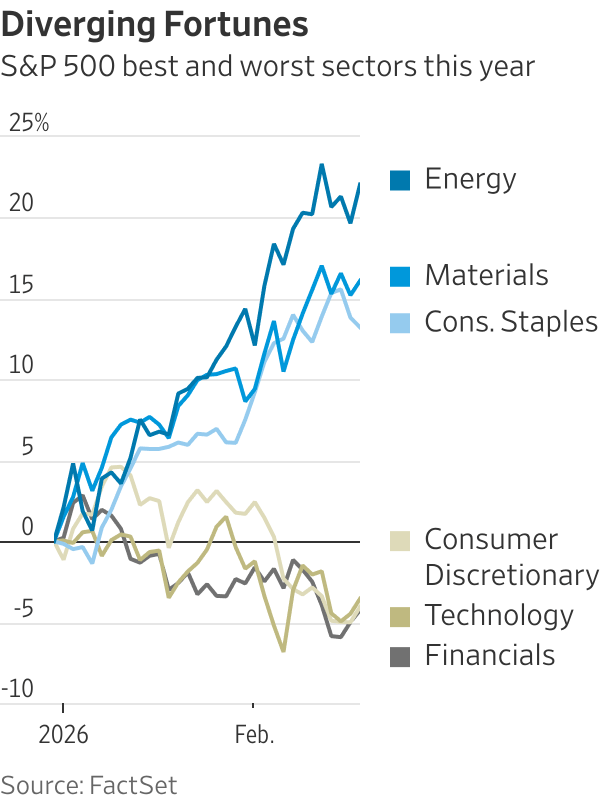

One of the clearest signs is sector divergence. The gap between the three best-performing sectors and the three worst over the past six weeks is among the widest seen since the mid-1990s. Historically, that kind of spread tends to appear during major stress events.

The last time moves were this extreme was just before the collapse of Silicon Valley Bank, which triggered a global banking scare. Earlier examples include the rebound after pandemic lockdowns and the violent rotations during the 2008 financial crisis and the dot com era.

What makes the current situation unusual is simple. Those past episodes came with obvious shocks. This one has not.

Calm Index, Chaotic Stocks

Investors who only track the index might not notice anything strange. The average stock is still hovering near record levels. Yet performance differences across sectors tell a very different story:

- Energy sector up about 22 percent

- Consumer staples up about 13 percent

- Financials down about 4 percent

At the company level, the swings are even sharper. Many software firms have dropped more than 30 percent this year. Meanwhile, companies tied to data centre infrastructure are surging. Storage firm Seagate Technology, for example, has jumped more than 50 percent.

Options markets confirm the pattern. Analysts say expected stock dispersion, meaning how differently individual shares are predicted to move from one another, is extremely high while overall volatility remains low. That combination is rare and signals an unusually fragmented market.

Why Investors Are Split

A recent survey from Bank of America shows many fund managers think large technology companies may be overspending on artificial intelligence. That belief is reshaping trading behavior across sectors.

The companies building massive AI systems have mostly struggled this year, while the firms selling them components are soaring. Investors seem cautious about whether huge AI investments will generate profits soon, yet they are confident that suppliers will benefit immediately.

This divide shows up across multiple industries:

- Software services firms are among the weakest performers as traders question whether AI could disrupt their business models.

- Transportation stocks have swung sharply on speculation that new AI logistics platforms could bypass traditional intermediaries.

- Hardware and infrastructure suppliers are booming because demand for chips, storage, and testing equipment keeps rising.

Faced with these crosscurrents, investors are responding in different ways.

Some ignore the turbulence and stay invested in index funds, since winners and losers mostly cancel out.

Some actively trade the rotations, trying to profit from which sectors gain and which fall.

Others cut risk exposure (panic), worried that extreme internal swings could eventually spill into the broader market.

History Offers No Clear Guide

Past periods of large sector divergence have led to very different outcomes. After similar rotations in 2023, stocks were lower six weeks later. After the pandemic shock, markets surged thanks to stimulus. During the financial crisis and the dot-com cycle, big sector shifts sometimes preceded gains and sometimes losses.

What has not happened before is what is happening now. The overall market has barely moved.

The market looks calm from a distance but unsettled up close. That contrast is what makes this moment so confusing for investors. Nothing is clearly broken, yet nothing feels completely normal either.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US Stocks are losing the global race. Should Investors Be Worried?

Why risk-loving options traders are turning to prediction markets