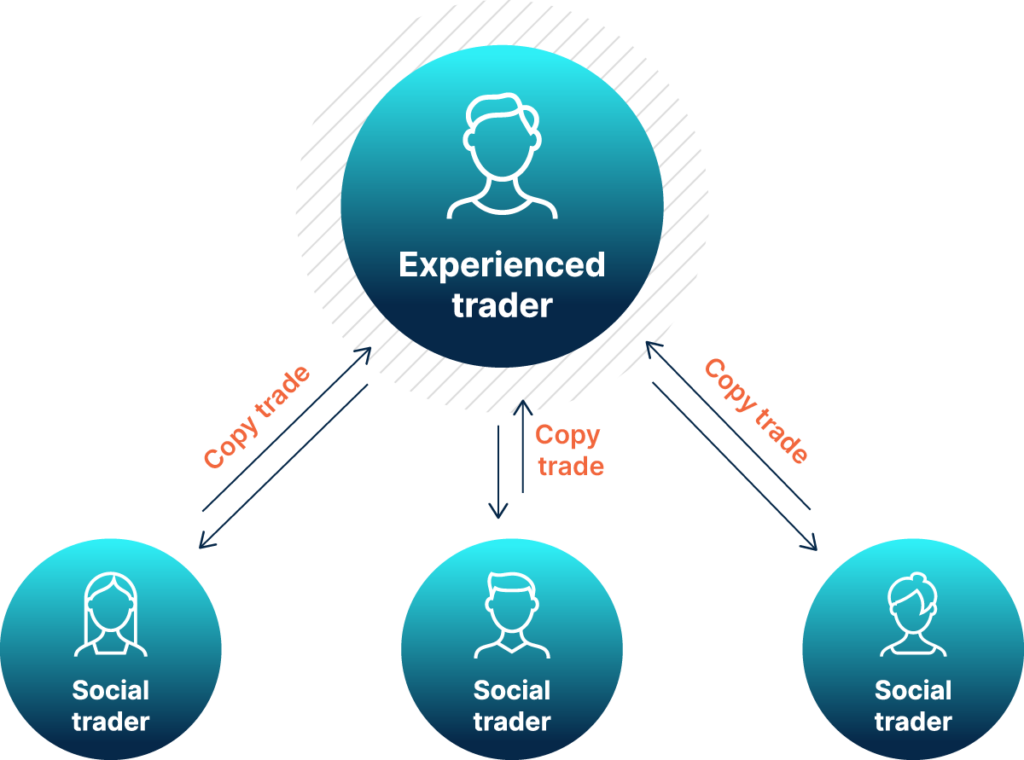

Copy Trading is an innovative investment strategy that allows users to replicate the trades of experienced investors automatically. Popularized in the last decade, it serves as an accessible gateway to trading for beginners and time-constrained investors. By leveraging the expertise of seasoned traders, users can diversify their portfolios without having to master the complexities of financial markets.

| Feature | Description |

|---|---|

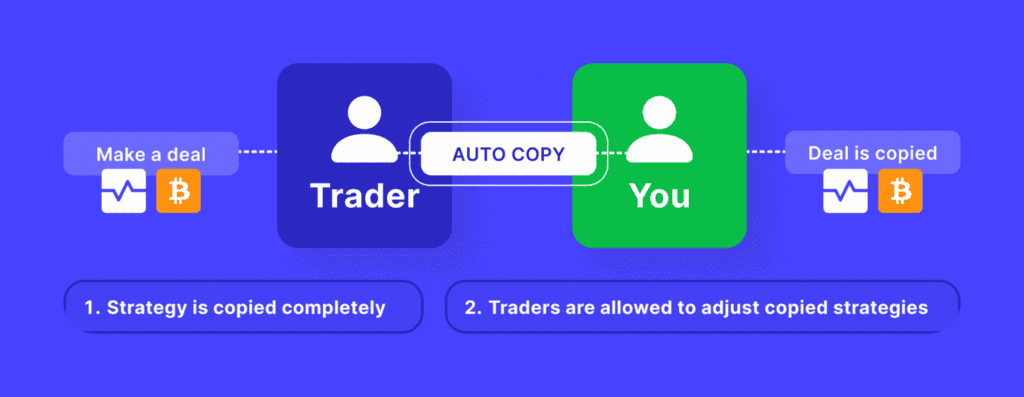

| Automation | Trades are automatically copied, requiring minimal manual intervention. |

| Diverse Assets | Works across various markets, including stocks, forex, cryptocurrencies, and commodities. |

| Accessibility | Open to beginners who lack time or expertise to develop their strategies. |

How Does Copy Trading Work?

Copy trading operates through a straightforward process that includes the following steps:

- Choosing a Platform

Platforms like eToro, ZuluTrade, and CopyMe offer comprehensive tools for beginners and advanced users. - Selecting a Trader

Users can browse and evaluate professional traders based on key metrics like historical performance, risk level, and trading strategy. - Allocating Funds

Investors decide the percentage of their portfolio to allocate for mirroring a trader’s moves. Proportional allocation ensures scalability. - Automated Execution

Once set up, all trades executed by the chosen trader are automatically mirrored in the user’s account in real-time. - Performance Monitoring

Users can track portfolio performance and make adjustments, such as stopping replication or diversifying their strategy.

Popular Platforms for Copy Trading

1. eToro

eToro offers a user-friendly interface designed for both beginners and experienced traders. Its CopyTrader tool allows users to replicate strategies from top-performing traders. The platform supports a wide range of asset classes, including stocks, forex, cryptocurrencies, and ETFs.

Pros: Low minimum investment requirements, making it accessible to most users. Social trading features promote community engagement and knowledge sharing.

Cons: Withdrawal fees and currency conversion charges can reduce profitability.

2. ZuluTrade

ZuluTrade provides advanced analytics to compare traders’ performance, along with robust risk management tools like stop-loss limits and ROI-based rankings. It supports a variety of markets, including forex, crypto, and other financial instruments.

Pros: Offers diverse account options to cater to varying trader needs. Allows a combination of copy trading and manual interventions for greater flexibility.

Cons: Higher initial deposit requirements may deter some users.

3. CopyMe

CopyMe focuses on cryptocurrency markets, offering customizable copy settings and risk management tools. The platform is mobile-friendly, enabling users to trade conveniently while on the move.

Pros: Excellent platform for crypto enthusiasts with transparent performance metrics. Customizable tools ensure better risk management.

Cons: Limited to cryptocurrencies, with no support for stocks or forex markets.

4. AvaTrade

AvaTrade integrates seamlessly with forex and CFD trading platforms, offering market analysis tools and multiple account types to suit traders of all expertise levels.

Pros: Competitive spreads and advanced risk management features. Compatibility with MT4 and MT5 platforms offers flexibility for advanced traders.

Cons: Can be overwhelming for beginners, especially those unfamiliar with CFD trading.

5. NAGA

NAGA is a social trading platform that includes in-app messaging for enhanced community support. It allows both copy trading and independent investing across various asset classes like crypto, forex, and stocks.

Pros: Comprehensive educational resources for traders at all levels. Strong customer service ensures a better user experience.

Cons: Fees on trades and withdrawals can add up over time, affecting returns.

Benefits and Risks of Copy Trading

| Aspect | Benefits | Risks |

|---|---|---|

| Accessibility | Easy entry for beginners without requiring extensive market knowledge. | Dependence on another trader’s expertise; lack of personal skill development. |

| Diversification | Ability to spread investments across multiple traders and markets. | Over-diversification may dilute potential returns and complicate portfolio tracking. |

| Time Efficiency | Automated systems save time by eliminating the need for constant market monitoring. | Blind reliance on automation can lead to missed opportunities or unchecked losses. |

| Learning Opportunity | Learn from observing professional trading strategies and market movements. | Following unsuccessful traders may result in financial losses. |

| Risk Management Tools | Many platforms offer built-in tools to set stop-loss limits and cap potential losses. | Poorly understood or misconfigured tools can lead to significant risks. |

| Profit Potential | Opportunity to earn returns by leveraging the expertise of successful traders. | High fees or commissions can erode profits significantly. |

Advanced Tips for Copy Trading Success

- Vet Traders Thoroughly

Examine their historical performance, trading strategy, and risk profile. Favour those with consistent returns over a long period. - Diversify Your Choices

Avoid putting all your funds into copying one trader. Distribute allocations across different strategies and markets. - Monitor Trades Regularly

Stay informed about ongoing trades and market conditions to make necessary adjustments. - Limit Allocation

Allocate a small portion of your overall portfolio to copy trading to mitigate risks.

Related articles:

- What is Crypto Analysis: Types and Strategies – Part 1

- What is Crypto Analysis: Techniques and Indicators – Part 2

- What are some benefits of using cryptocurrency as a method of payment?

- What is cryptocurrency mining? A Beginner’s Guide to Getting Started

- What is Cryptocurrency Solana (SOL) and How Does It Work?

- How to Buy Solana Meme Coins and Create Your Own on Solana

- How to Sell Bitcoin: A Step-by-Step Guide for Beginners

- How to Pay with Cryptocurrency: A Guide to Digital Payments

- What Are Meme Coins & How Do They Work?

- How to Buy Meme Coins: A Beginner’s Guide

- How to Trade in Crypto: Risks and Rewards

- Which are Best FREE Crypto Exchanges & Apps in 2024

- How to Invest in DeFi: A Step-by-Step Guide

- Cryptocurrency Trading: What it is and How to Trade?

- Cryptocurrency vs. Stock Market: Where to Invest for 2025

- Top DeFi Projects and Where to Trade Them in 2025

- Top Crypto Wallets and How to Use in 2025

Sources: