Intel ($INTC) is in the middle of its biggest shake-up in years. Over the past week, rumors of a company breakup, asset sales, and restructuring efforts have dominated headlines, leaving investors wondering: Is this the start of Intel’s turnaround, or is the tech giant falling apart?

Here’s a deep dive into everything that’s happened this week, why it matters, and what it means for Intel’s stock in 2025.

💥 Intel’s Wild Week—What Happened?

🔹 Intel’s Foundry Business Could Be Spun Off – Analysts are increasingly pushing for Intel to separate its struggling foundry unit, which has been bleeding cash. Some believe this move could unlock over $200 billion in shareholder value.

🔹 TSMC’s Interest Sparks Political Controversy – Reports indicate Taiwan Semiconductor Manufacturing Co. ($TSM) has explored a stake in Intel’s foundries. However, the U.S. government is against it, with Trump’s administration keen on keeping Intel’s chipmaking capabilities domestic. ( Related: Can Broadcom Save Intel? What Investors Should Know About the Latest Deal Rumors)

🔹 Intel Looking to Sell Altera Unit – Intel is reportedly in talks with private equity firm Silver Lake to offload its Altera FPGA business in a multi-billion-dollar deal. This signals a major shift in Intel’s strategic priorities.

🔹 Apple Ditches Intel Modems for Good – Apple has officially launched its C1 modem, cutting all remaining ties with Intel’s legacy modem technology. This marks another long-term revenue hit for Intel as Apple moves toward self-reliance.

🔹 Granite Rapids AI Chips Take Center Stage – Intel unveiled its next-gen Xeon 6700P “Granite Rapids” AI chips, highlighting its push into AI and high-performance computing to remain competitive in the evolving semiconductor landscape.

🔍 Why is Intel Facing Breakup Pressure?

For decades, Intel was the undisputed leader in semiconductors. But in recent years, TSMC, Nvidia ($NVDA), and AMD ($AMD) have overtaken it in innovation, efficiency, and market share.

Here’s why Intel’s future is being questioned:

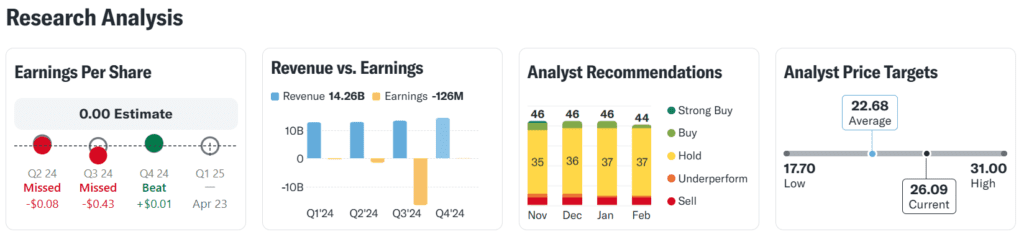

📉 Financial Struggles – Intel reported a $19.2 billion net loss for 2024, with declining revenues across key divisions.

💸 Underperforming Foundry Business – Despite CHIPS Act funding, Intel’s foundry unit is still unprofitable, raising concerns about whether it should be spun off or sold.

🏭 TSMC’s Interest Raises Security Fears – A potential TSMC investment in Intel’s foundries is causing political backlash in Washington. The U.S. government does not want a foreign company controlling a strategic semiconductor asset.

🔄 Structural Inefficiencies – Intel has struggled with execution, falling behind in advanced chipmaking. Delays in its 10nm process allowed TSMC and Samsung to dominate the space, leaving Intel playing catch-up.

📌 Analysts argue that breaking up Intel could unlock billions in value, but the company’s importance to U.S. national security complicates any deal.

🔮 What’s Next for Intel?

With so many factors at play, here are three key scenarios for Intel’s future:

✅ Bullish Case – Intel’s Comeback Plan Works:

- Intel successfully restructures, offloads non-core assets (like Altera), and refocuses on AI and data center chips.

- New Granite Rapids AI chips gain traction, making Intel a bigger player in high-performance computing.

- Stock rallies as investors see Intel as a leaner, more focused company.

❌ Bearish Case – Intel’s Breakup Talks Collapse:

- Breakup rumors stall, leaving Intel struggling with its unprofitable foundry unit.

- TSMC’s potential involvement is blocked, preventing a much-needed capital injection.

- Intel continues losing market share to Nvidia and AMD, keeping the stock under pressure.

⚠ Wildcard – U.S. Government Intervention:

- Trump’s administration could push for Intel to remain fully domestic, blocking foreign partnerships.

- Further CHIPS Act funding could be directed toward Intel, influencing its strategic direction.

Intel is facing its most uncertain period in years—and investors will be watching closely to see whether the company can turn things around or if it’s heading for a major restructuring.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Joins Musk In Targeting Fort Knox Gold—What We Know About Its $400 Billion Supply

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge

Bullish Momentum vs. Financial Reality in Palantir

Is Palantir Proving to be the Dark Horse AI Stock?

China’s Quantum Computing Breakthrough Raises Concerns—Is This Why Quantum Stocks Are Dropping?

The 2025 stock market rally isn’t just about the Magnificent 7

Elon Musk plans to send a Tesla Bot with Grok AI to Mars by late 2026

Elon Musk Unveils “World’s Smartest AI”—Trained on 100K NVIDIA GPUs

Another CEO is speaking out against naked short selling

Key Events to Watch in This Week & Their Market Impact

Earnings Calendar for This Week: Stocks to Watch and Forecast