Global markets were shaken this week after President Donald Trump renewed threats over Greenland and trade with Europe, triggering sharp falls in stocks, rising bond yields, and a jump in market volatility. But many Wall Street strategists now say the selloff could be a buying opportunity, not the start of a deeper crash.

On Tuesday, the S&P 500 fell more than 2 percent, its worst day in months, as Trump threatened new tariffs on several European countries and tensions rose over his push to acquire Greenland. At the same time, Japan’s bond market suffered a major selloff, sending shockwaves through global debt markets.

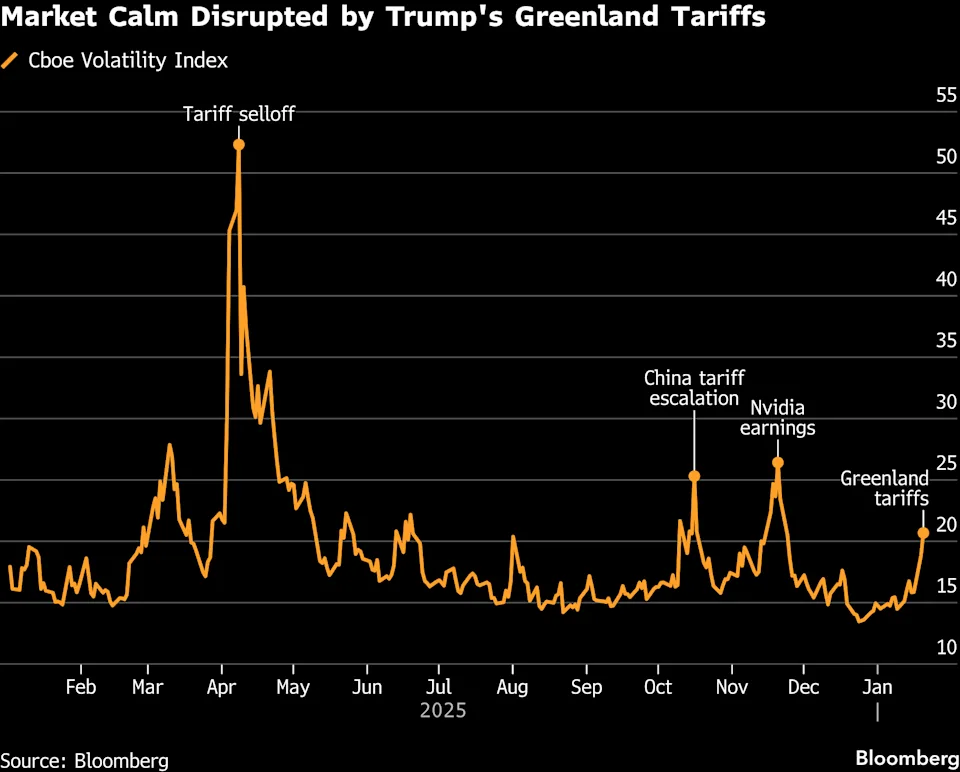

The turbulence pushed the volatility index above 20, gold to record highs, and US Treasury yields to their highest levels in months.

Yet despite the chaos, many investors believe the market’s foundations remain strong.

Why Some Investors Are Still Bullish

Strategists point to several reasons for optimism:

- Corporate earnings are strong. About 73 percent of companies reporting so far have beaten expectations. Profits are expected to grow more than 13 percent in 2025 and rise again in 2026.

- The US economy remains resilient, helped by tax cuts, rising wages, and easing inflation.

- The AI boom continues to support large technology stocks, while gains are spreading to other sectors like healthcare and consumer goods.

HSBC strategist Alastair Pinder noted that in past geopolitical crises, US stocks rose most of the time within three months, unless oil prices spiked sharply.

Technical analysts also say markets do not look like they are near a major peak. Around 70 percent of S&P 500 stocks are still trading above long term trend lines, a sign of underlying strength.

“I’m inclined to buy it,” said Strategas strategist Chris Verrone, who expects any pullback to be limited to about 4 to 5 percent.

The “TACO” Factor

Another reason investors are not panicking is Trump’s past behaviour. On Wall Street, traders often joke about the “TACO trade,” short for “Trump Always Chickens Out.”

Last year, Trump backed down from aggressive tariff threats after markets fell sharply, and stocks later surged nearly 40 percent from their lows.

Many investors believe something similar could happen again, especially with Trump speaking this week at the World Economic Forum in Davos.

“We think it’s too early to abandon US assets,” said JPMorgan strategist Andrew Tyler, advising investors to stay invested but hedge against short term risk.

Risks Still Remain

Not everyone is comfortable. Market sentiment was already very optimistic before the selloff, with fund managers heavily invested in stocks and holding little cash.

There are also real risks:

- A full US EU trade war could hurt growth

- Rising bond yields could pressure stock valuations

- Japan’s bond crisis could spread further (Why Investors Are Worried About Japan’s Bond Market)

Some European and pension investors have already begun reducing exposure to US assets.

Still, most strategists believe this episode looks more like a temporary shock than the start of a major downturn.

“If earnings stay strong, the political noise should fade,” said Solus strategist Dan Greenhaus.

For now, Wall Street is bracing for more volatility, but many see the recent drop as a chance to buy high quality stocks at better prices rather than a reason to flee the market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: European Stocks Fall Again as Greenland Tensions Worry Investors