For years, betting on America felt like the safest trade in the world. Big Tech dominated. The dollar was strong. The S&P 500 consistently outperformed.

But 2026 has opened with a very different tone.

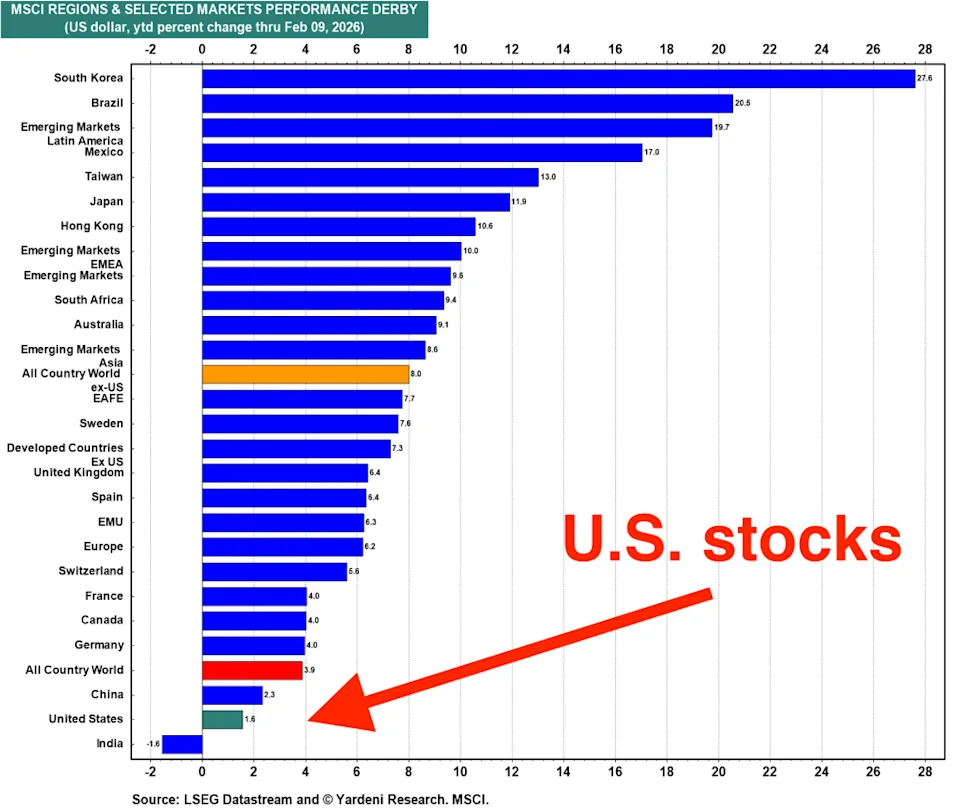

The S&P 500 is up just 1.4% year to date, and at times has even slipped into negative territory. Meanwhile, global markets are surging. The MSCI ACWI ex U.S. Index is up nearly 8–9%, marking the worst relative start for US stocks versus global markets since 1995, according to Goldman Sachs.

So what’s going on? Is this the end of American exceptionalism, or just a rotation?

The Numbers Tell a Clear Story

Let’s look at performance snapshots:

- S&P 500: roughly flat to slightly negative early in 2026

- MSCI EAFE: up ~8%

- MSCI ACWI ex-US: up ~8.5%

- South Korea’s KOSPI: up an eye-catching 24% year to date

- Japan’s Nikkei 225: up 2.3% in recent trading

- UK FTSE 100: modest gains

- Emerging Markets: Goldman now sees 12–14% USD returns for 2026

Even Bitcoin is hovering around $66–67K, while the US Dollar Index (DXY) has weakened about 1% year to date and nearly 9–10% over the past year.

When global investors compare 1% growth in US stocks to markets rising 8–24%, the temptation to rotate capital becomes obvious.

Is This a “Sell America” Trade?

Not quite.

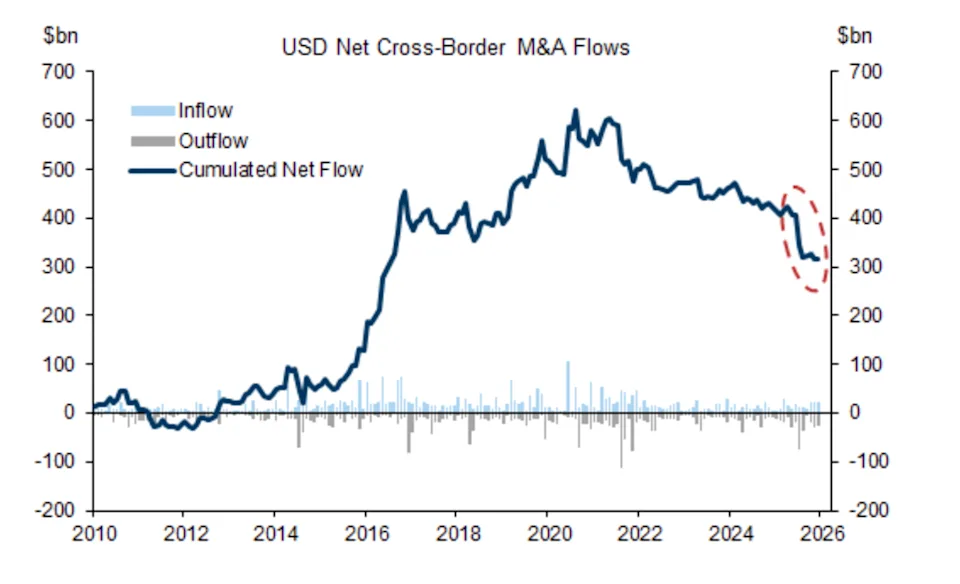

Foreign investors actually poured $1.6 trillion into US assets last year, a record, according to Rockefeller International’s Ruchir Sharma. That hardly signals abandonment.

The issue is more subtle.

With the dollar down nearly 10% year over year, foreign investors face a currency haircut when converting US gains back into local currencies. A 10% currency loss can wipe out equity returns.

So this is less “Sell America” and more: “Use marginal future dollars outside America.”

Investors are hedging currency risk while chasing stronger momentum in Europe and Asia.

Why Are Global Markets Suddenly Winning?

1. Valuations

US stocks are expensive.

Strategists note that US price-to-earnings ratios are roughly 40% higher than international markets. Even excluding the Magnificent Seven, the US trades above 20x earnings.

That premium made sense when US growth clearly outpaced the world. Now that global growth is stabilizing, the gap looks harder to justify.

2. Concentration Risk

The top 10 US companies account for about 40% of the S&P 500.

That means if expectations around AI or tech spending slip, the entire market feels it. In contrast, many international markets entered 2025 with lower valuations and broader sector exposure.

3. Macro and Political Uncertainty

US-specific geopolitical risk has increased. Tariff discussions, trade tensions, pressure on institutions, and unpredictable policy shifts create uncertainty.

Meanwhile, fragmenting global trade patterns may actually benefit parts of Europe and Asia as countries localize supply chains and reduce reliance on US imports.

In other words, volatility at home can create growth abroad.

Is American Exceptionalism Over?

Analyst Ed Yardeni posed the provocative question:

Is American exceptionalism “kaput”?

His answer: No.

The US remains a global innovation engine. Foreign capital is not fleeing. The technology leadership remains real.

But here is the nuance: There are now exceptional companies outside the US attracting capital at cheaper valuations.

For the first time in decades, global investors are meaningfully diversifying away from extreme US concentration.

What This Means for Investors

This may not be a dramatic collapse. It may be something more important.

After a decade where “buy US, ignore the rest” worked consistently, 2026 is testing that assumption. The world is in a global bull market. Capital is flowing. The difference is where it is flowing.

The key question is no longer: “Should I sell America?”

It is: “How much global exposure should I add while the rotation is happening?”

And if history since 1995 is any guide, these early-year shifts can shape performance trends for much longer than investors expect.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: AI bubble fears are creating new derivatives

Russia–US Dollar Return Shock: Did One Headline Reset Global Markets?