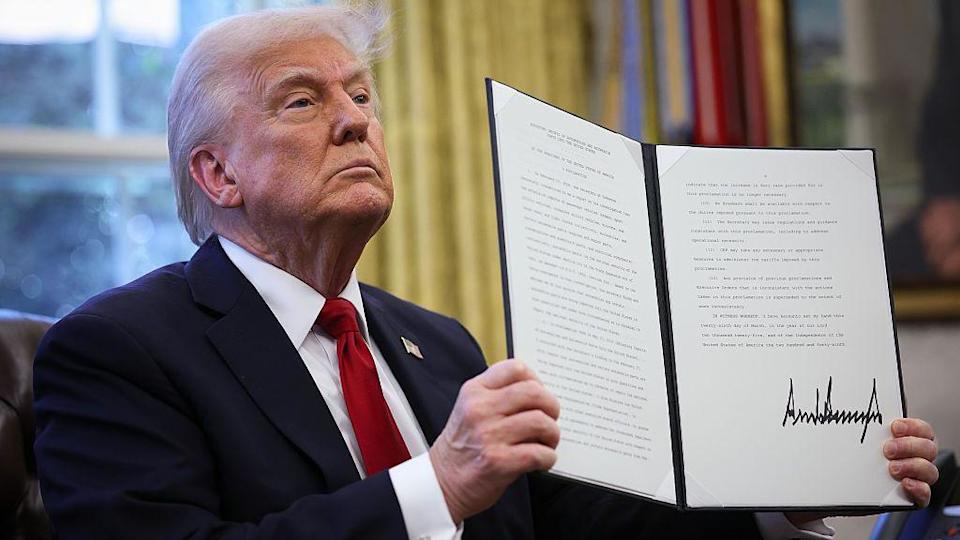

President Donald Trump is facing accusations of market manipulation and possible insider trading after he posted on Truth Social that it was a “great time to buy” — just hours before announcing a dramatic 90-day pause on his widely criticized tariff plan, triggering a massive rally in global markets.

At 9:30 a.m. ET Wednesday, Trump wrote:

“THIS IS A GREAT TIME TO BUY!!! DJT”

Four hours later, he stunned global markets by pausing all “reciprocal tariffs” for 90 days — except for China — reversing a key pillar of his economic offensive that had roiled Wall Street and sparked global recession fears.

The S&P 500 jumped over 9%, the Nasdaq rose more than 12%, and shares of Trump Media & Technology Group (DJT) — the company that controls Truth Social — surged 22%.

Insider Trading Accusations Swirl

Democratic lawmakers were quick to raise the alarm.

- Senator Adam Schiff: “These constant gyrations in policy provide dangerous opportunities for insider trading… The public has a right to know.”

- Senator Chris Murphy: “Trump’s tweet makes it clear he was eager for his people to make money off the private info only he knew.”

- Rep. Alexandria Ocasio-Cortez: “We’re about to learn a few things. It’s time to ban insider trading in Congress.” She called for all members to disclose trades made in the past 24 hours.

The suspicion deepened when reporters asked Trump when he decided on the tariff pause. His answer:

“This morning… Over the last few days, I’ve been thinking about it.”

But White House officials, including Treasury Secretary Scott Bessent, claimed the shift was “part of the strategy all along.”

From Panic to Profit

Markets had been battered for days after Trump’s aggressive “Liberation Day” tariff rollout last week. The reversal immediately flipped investor sentiment:

- Japan’s Nikkei 225 rose 9%

- London’s FTSE 100 climbed as much as 4%

- DJT, Trump’s own media company, surged — despite the broader controversy

Meanwhile, Marjorie Taylor Greene disclosed trades in Amazon and Apple on April 3 and 4 — stocks that popped 12% and 15%, respectively, after Trump’s pause.

Art of the Market?

While Trump’s defenders praised the move as a masterstroke of leverage, critics see something more sinister: a sitting president influencing the market — and personally benefiting from the reaction.

“No one creates leverage for himself like President Trump,” Bessent said Wednesday.

But one market analyst told CNBC: “The only leverage Trump may have created is for himself and anyone holding DJT stock.”

With mounting pressure for transparency, lawmakers on both sides may soon be forced to address the growing overlap between presidential power and personal profit.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts

Trump Raises Tariffs On China To 125% After Beijing’s 84% Move

China vows ‘fight to the end’ after Trump threatens extra 50% tariff

Musk made direct appeals to Trump to reverse sweeping new tariffs

Trump Opens Door to Tariff Talks—But No Pause, No Retreat, Just ‘Tough but Fair’ Deals

Bitcoin: Not so independent from the rest of the market?!…

Tariffs Will Stay in Place for Weeks, Commerce Secretary Howard Lutnick Says