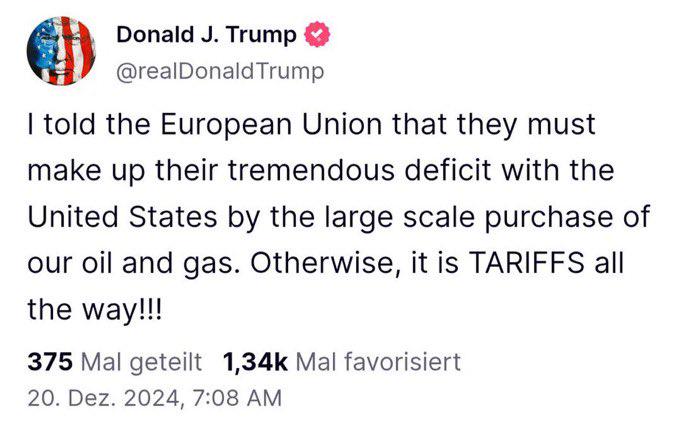

President-elect Donald Trump has threatened to impose tariffs on the European Union unless it significantly increases its American oil and gas purchases. While the move is aimed at narrowing the U.S.-EU trade gap, it has sparked economic concerns and market uncertainty.

- Energy Push: Trump urges the EU to buy more U.S. fossil fuels despite America already being Europe’s largest LNG supplier.

- Tariff Threats: Broad tariffs could be imposed, following similar threats to Canada and Mexico over trade and border enforcement.

- Market Impact: European stocks dropped sharply, while U.S. markets showed early declines, with fears of renewed global inflation.

Implications

- Economic Risks: Tariffs could reignite inflation and provoke EU retaliation, impacting U.S. exporters.

- Strained Relations: Demands could challenge Western unity as Europe pivots from Russian energy to U.S. LNG.

- Policy Outlook: The EU may negotiate exemptions or retaliate, while businesses brace for potential disruptions.

Trump’s trade strategy could boost U.S. energy exports but risks damaging transatlantic relations and escalating economic volatility. Markets and policymakers will closely monitor the EU’s next move.