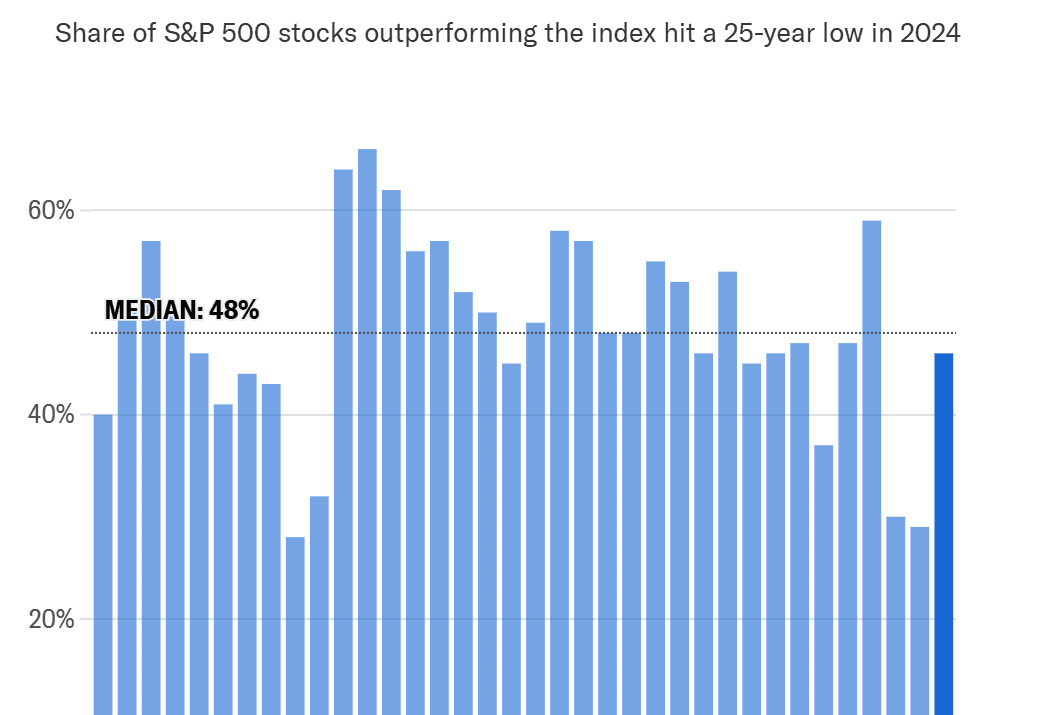

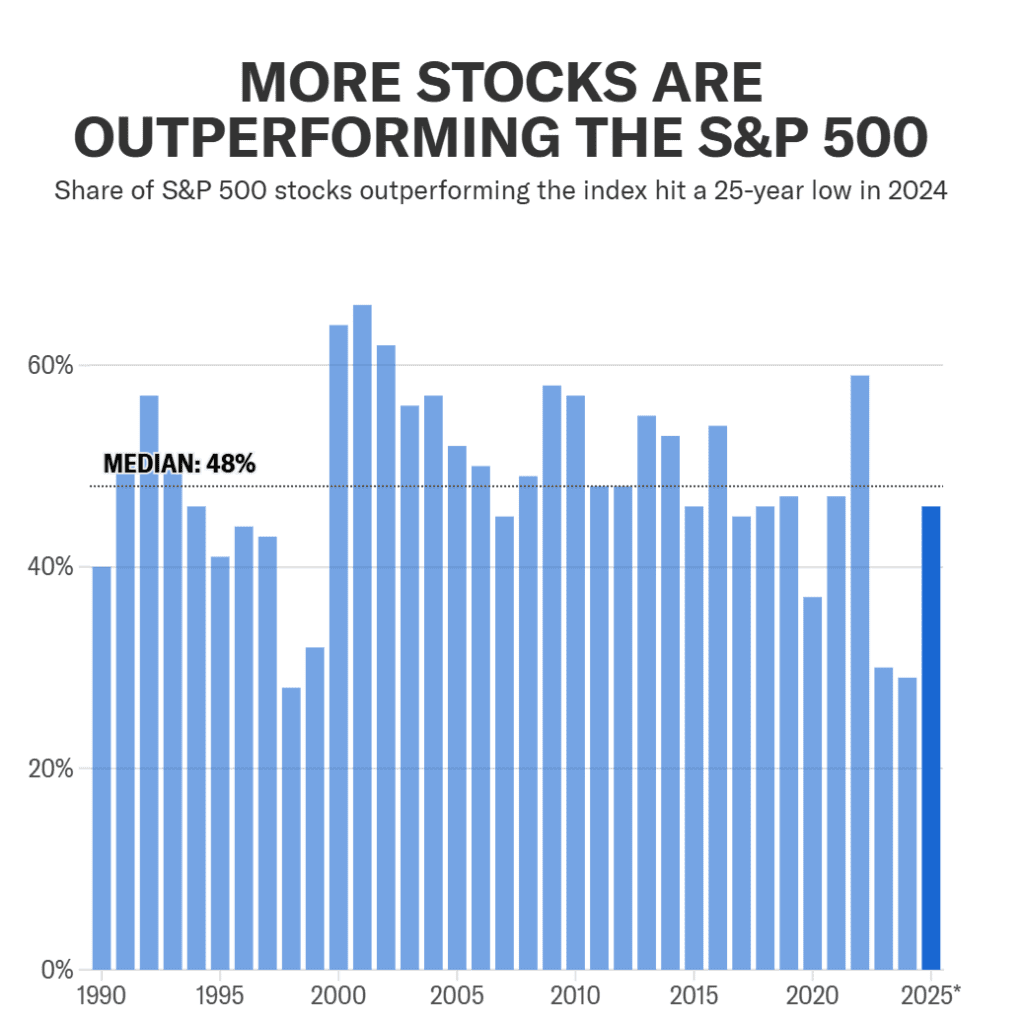

The S&P 500 (^GSPC) is showing a broad rally to start the year in the stock market, with 46% of its companies outperforming the index itself—a significant shift from the last two years, when only 30% of stocks managed to beat the market.

For the past two years, large-cap tech stocks dominated market returns, leaving investors struggling to find winners outside of the Magnificent Seven. But in 2025, sector rotation and company-specific factors are driving a wider range of outperformers, offering new opportunities for stock pickers regarding Yahoo.Finance

Market Trends: A Shift Away from Big Tech

🔹 Only Two Magnificent Seven Stocks Are Beating the Index

- Meta ($META) is up 23% and Nvidia ($NVDA) has gained nearly 6%, both outpacing the S&P 500’s ~4% return so far in 2025.

- Other tech giants like Apple ($AAPL) and Microsoft ($MSFT) are underperforming the market after leading the bull run in recent years.

🔹 AI Boom Creates New Winners & Losers

- The recent sell-off triggered by Chinese AI firm DeepSeek led to Nvidia ($NVDA) falling 17%, while Meta ($META) and Salesforce ($CRM) surged, signaling a more selective AI trade.

- Investors are now focusing on AI software rather than just semiconductor stocks.

🔹 Sector Rotation—Financials, Energy & Materials Outperform

- Unlike 2023 and 2024, where tech dominated, sectors like Financials ($XLF), Energy ($XLE), and Materials ($XLB) are now leading gains.

- Information Technology, which houses many Magnificent Seven stocks, is one of just three sectors lagging the S&P 500.

What’s Driving the Market Shift?

📊 Goldman Sachs: A More “Micro-Driven” Market

- Stock moves are now influenced by company fundamentals, rather than broad macroeconomic themes.

- Stock picking is becoming more important, as individual companies are reacting to specific earnings, AI adoption, and sector trends.

📉 Investor Risk Appetite Remains Strong

- Bank of America’s February Fund Manager Survey shows cash allocations at a 15-year low (3.5%), signaling bullish sentiment despite uncertainty over tariffs and interest rates.

- Investors are diversifying away from the Magnificent Seven, spreading risk across multiple sectors.

Will This Trend Continue?

✅ Bullish Case:

- AI expansion is broadening beyond just chipmakers like Nvidia, creating new winners in AI software and services.

- Sector rotation into Financials, Energy, and Materials could continue to drive outperformance.

- A strong U.S. economy and resilient earnings growth support continued market expansion.

❌ Bearish Risks:

- Tariff uncertainty under the Trump administration could disrupt supply chains and corporate margins.

- The Federal Reserve’s interest rate policy remains unclear—delayed rate cuts could slow momentum.

- If tech earnings disappoint, it could drag down the broader market.

The Magnificent Seven’s reign over markets appears to be fading, and 2025 is shaping up to be a more diversified stock-picking environment. With stronger performance from financials, materials, and energy stocks, investors may have more opportunities beyond Big Tech this year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Elon Musk plans to send a Tesla Bot with Grok AI to Mars by late 2026

Elon Musk Unveils “World’s Smartest AI”—Trained on 100K NVIDIA GPUs

Another CEO is speaking out against naked short selling

Key Events to Watch in This Week & Their Market Impact

Earnings Calendar for This Week: Stocks to Watch and Forecast

Trump’s Auto Tariffs: Will Auto Stocks Crash or Rally?

Car Tariffs May Start on April 2, What It Means for Stock Market

Trump’s Auto Tariffs: What It Means for Tesla Stock

The stock market just won’t crack. Bulls say it’s time for a breakout to new highs

Schwab reports GME stock price above $40,000 in latest glitch: Naked short-selling manipulation?

Javier Milei just DESTROYED market: Are meme coins officially DEAD?

What changes to the CHIPS act could mean for AI growth and consumers