Global markets faced headwinds as U.S. stocks fell and Treasury yields rose, reflecting investor concerns over economic data influencing Federal Reserve policy. According to Yahoo Finance, disappointing market performance underscores lingering uncertainty over monetary tightening in 2025.

1. U.S. Stocks Decline

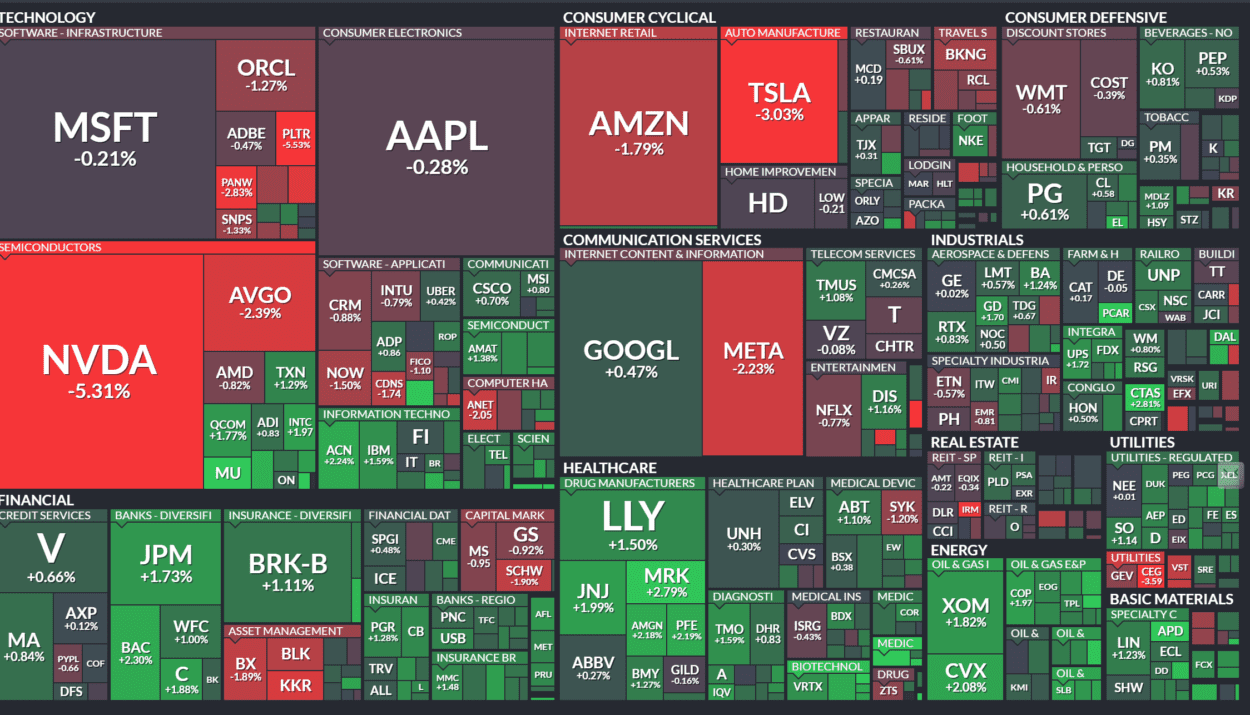

- S&P 500: Dropped 0.6% as technology and energy sectors led the losses.

- Dow Jones Industrial Average: Fell 0.5%, weighed down by industrial and financial stocks.

- Nasdaq Composite: Declined 0.9%, driven by weakness in semiconductor and AI-focused companies.

2. Treasury Yields Rise

- 10-Year Yield: Increased to 4.35%, signaling investor expectations for a prolonged period of higher interest rates.

- Impact: Rising yields have put pressure on equities, particularly growth stocks, as borrowing costs climb.

3. Economic Data’s Role

- Labor Market Strength: Strong employment data has fueled expectations that the Fed could maintain its restrictive monetary stance.

- Inflation Signals: Mixed inflation indicators have added to market uncertainty, with investors seeking clarity on the Fed’s next steps.

Global Market Impact

| Region | Performance | Key Drivers |

|---|---|---|

| Asia | Mixed performance | Strong dollar weighs on exports; rate fears linger. |

| Europe | Broad declines | Rising U.S. yields influence European markets. |

| Emerging Markets | Under pressure | Dollar strength adds to concerns. |

Key Sector Performance

Technology: Growth-sensitive tech stocks faced declines due to rising yields, which reduce the present value of future earnings.

Energy: Energy stocks fell as crude oil prices declined amid concerns over weakening global demand.

Financials: Banks and financial institutions saw modest losses as rising rates dampened loan growth prospects.

Dollar and Currency Markets

- The U.S. dollar index fell by 0.3%, providing some reprieve to Asian and European exporters.

- Emerging market currencies remained under pressure, reflecting concerns about capital outflows amid rising U.S. yields.

Outlook for Investors

Near-Term Trends

- Fed Policy Watch: Markets will closely monitor upcoming economic data, including wage growth and inflation reports, for insights into the Federal Reserve’s rate trajectory.

- Earnings Season: Corporate earnings in tech and consumer sectors will provide critical clues about economic resilience.

Long-Term View: Analysts suggest diversification into defensive sectors like healthcare and utilities as volatility persists.

As Yahoo Finance highlights, falling stocks and rising Treasury yields reflect investor apprehension about the Federal Reserve’s policy direction. Economic data will remain pivotal in shaping market sentiment, with volatility likely to persist in the short term.

Related article: Asian Shares Fall Amid Rate Concerns and Wall Street Losses