Robinhood’s third-quarter results delivered a powerful headline: revenue doubled, profits soared, and crypto trading exploded by more than 300%.

The retail-trading giant beat Wall Street expectations on both revenue and earnings, proving that its push beyond simple stock trading — into crypto, prediction markets, and new digital products — is starting to pay off.

Yet, beneath the euphoria, the numbers also tell a more nuanced story: rapid growth comes with rising exposure, heavy reliance on trading volumes, and higher risk sensitivity.

Earnings Recap: A Beat That Reinforces Momentum

Finblog’s earlier preview (Robinhood Q3 2025 Earnings Preview and Prediction: What to Expect) forecasted a revenue surge and crypto-led upside, and the quarter largely lived up to that call.

The results showed stronger-than-expected profitability and diversification, even as transaction-based revenue narrowly missed the Street’s top estimate.

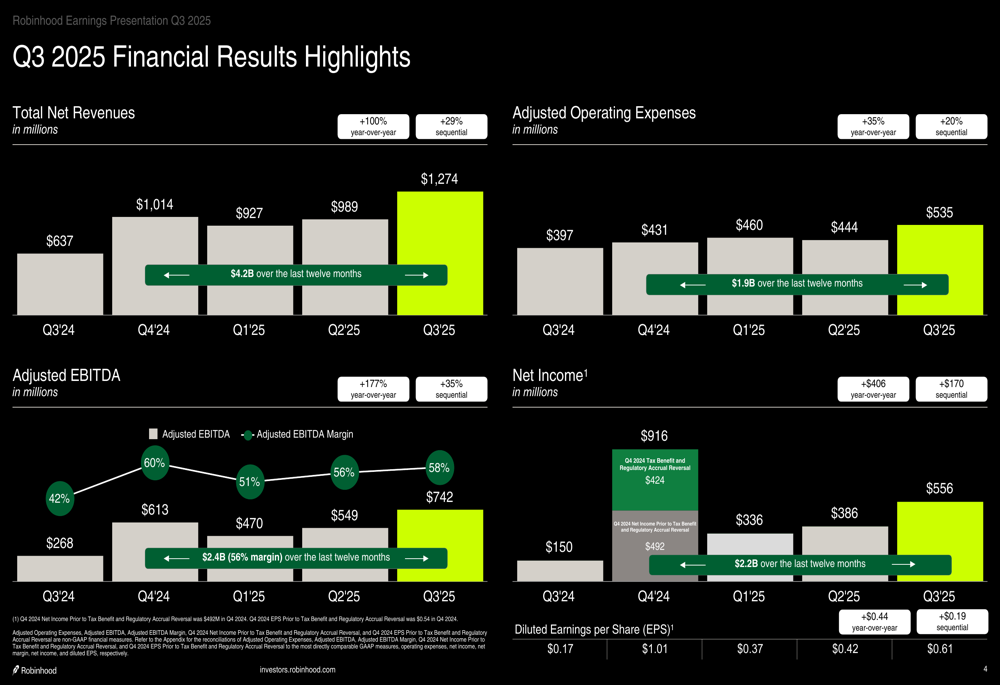

| Metric | Actual (Q3 2025) | Consensus | YoY Change | Finblog Forecast Accuracy |

|---|---|---|---|---|

| Revenue | $1.27 B | $1.19 B | +100% | ✅ Beat predicted |

| EPS (adj.) | $0.61 | $0.53 | +259% | ✅ Profit surprise |

| Crypto Revenue | $268 M | — | +339% | ✅ Crypto surge forecast |

| Transaction-Based Rev. | $730 M | $739 M est. | +129% | ⚠️ Slight miss |

| Net Income | $556 M | — | +270% | ✅ Beat confirmed |

| Forecast Accuracy | — | — | — | A (≈ 91%) |

CFO Jason Warnick summed it up clearly:

“Q3 was another strong quarter of profitable growth, and we continued to diversify our business, adding two more business lines — Prediction Markets and Bitstamp — that are generating over $100 million each in annualized revenue.”

Robinhood is no longer just a retail trading app.

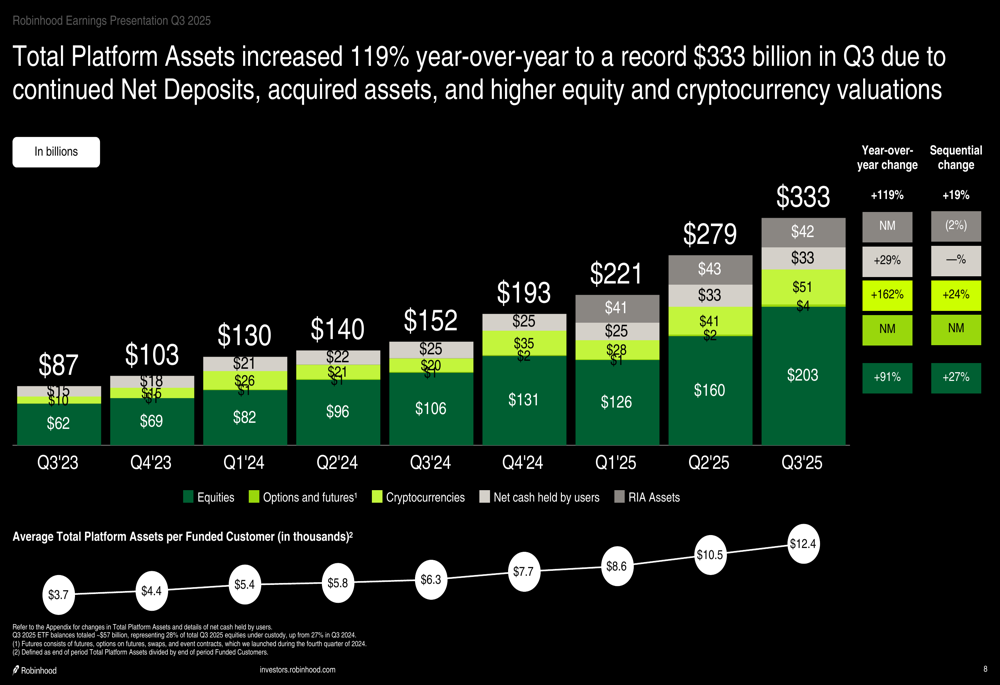

Its product lineup now spans crypto, stock lending, prediction markets, instant withdrawals, and international brokerage — all part of its plan to evolve into a “financial super-app.”

Q3 2025 results underscored that shift:

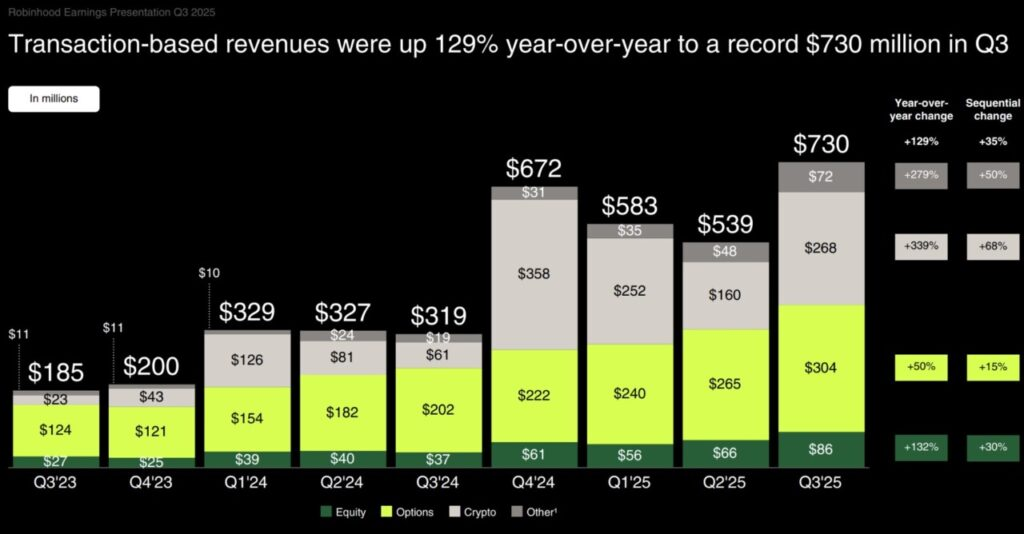

- Crypto trading volumes climbed to $80 billion, more than triple last year.

- Options trading jumped 50% to $304 million, while equities revenue grew 132%.

- New segments like Prediction Markets and Bitstamp each crossed the $100 million annualized run-rate threshold.

CEO Vlad Tenev called it “a quarter of relentless product velocity.”

Crypto & Prediction Markets: The Core Growth Engine

Crypto remains Robinhood’s most explosive growth driver. Digital-asset revenue surged 339% to $268 million, and crypto now makes up roughly one-fifth of total company revenue.

Meanwhile, Prediction Markets — launched less than a year ago — reached a $300 million annualized run rate based on October volumes.

Tenev said during the call:

“Prediction markets could become one of the largest asset classes because you can price risk in almost anything.”

This business already spans sports, politics, economics, and cultural events, positioning Robinhood early in what could become a mainstream financial vertical.

Profitability & Expansion

Operating leverage remains a bright spot: despite higher bonus accruals and expansion costs, Robinhood maintained strong margins.

Management guided that incremental adjusted EBITDA margin remains around 75% on new revenue — a rare level in fintech.

Geographically, Tenev set bold long-term goals:

“Ten years from now, over half of our revenue should come from outside the US — and over half from non-retail, institutional segments.”

Analyst Reaction: Growth Praised, Quality Questioned

Wall Street’s take was mixed. Analysts praised the performance but raised flags on sustainability.

| Firm | Rating | Comment |

|---|---|---|

| JPMorgan | Neutral (PT ↑ to $130) | “Strong quarter but tax benefits inflated results; crypto volumes fell short of expectations.” |

| Bernstein | Buy (PT ↑ to $160) | “Prediction markets and tokenization strategy could redefine retail finance.” |

| Goldman Sachs | Hold | “Solid numbers, but quality of earnings remains mixed; heavy reliance on crypto cycles.” |

| DL News & DeFi Planet | Positive | “Robinhood’s expansion into Web3 and real-asset tokenization could cement its fintech leadership.” |

Post-earnings, Robinhood shares fell ~11%, reflecting profit-taking and investor caution after the stock’s major run-up earlier in 2025.

Key Developments After Earnings

- CFO Transition: Jason Warnick to be succeeded by Shiv Verma in 2026, signaling a generational shift in financial leadership.

- Bitcoin Treasury Plan: Tenev confirmed the company is “actively considering” adding Bitcoin to its balance sheet, citing alignment with crypto adoption trends.

- Global Expansion: The company continues to scale in Europe and Asia through Bitstamp integration, targeting cross-border trading and tokenized-stock offerings.

- RWA Focus: Robinhood and Coinbase are both betting on tokenized stocks and real-world-asset trading — part of a broader shift toward 24/7, blockchain-based markets.

The Valuation Picture

| Metric | Value / Estimate | Interpretation |

|---|---|---|

| Price Target (avg.) | $145 – $160 | ~15–20% upside if execution holds |

| Crypto Revenue Mix | ~21% of total | High growth, high volatility |

| EPS (annualized) | $2.44 | Tripled YoY |

| Operating Margin (est.) | ~32% | Strong leverage despite expansion |

| Valuation Multiple (Forward P/E) | ~24× | Fair given growth vs risk |

Analysts agree that Robinhood’s valuation reflects confidence, not comfort — it assumes the company can continue expanding outside retail and sustain its high-margin digital revenue mix.

Why the Narrative Is Shifting

- Revenue quality under the microscope, while crypto and trading drive upside, institutional investors want steadier income streams.

- Diversification is working, eleven business lines now generate $100 million+ each in annualized revenue.

- International scale, Bitstamp integration opens regulated global channels.

- New asset classes emerging, Prediction Markets and tokenized stocks put Robinhood at the frontier of fintech evolution.

Robinhood’s Q3 2025 was a statement of strength — a reminder that its trading ecosystem still thrives, even amid market uncertainty.

But the next chapter is about proof of stability, not just growth.

If management can convert momentum into durable, diversified revenue — from tokenized assets, prediction markets, and global operations — the stock could re-rate higher.

Until then, the market’s message is clear: impressive, but keep proving it.

The S&P 500 fell 0.19% and the Nasdaq Composite lost 0.45%, snapping Monday’s rebound that followed Senate approval of a deal to reopen the federal government after 41 days — the longest shutdown in US history. The Dow Jones edged up 0.16%, helped by gains in McDonald’s (MCD) and Goldman Sachs (GS).

US bond markets were closed for Veterans Day, but equity traders focused on two themes: lingering AI valuation stress and the likely release of delayed economic data once the shutdown officially ends.

AI Angst Returns

Nvidia (NVDA) shares dropped 2.3% after Japan’s SoftBank Group sold its remaining $5.8 billion stake in the chipmaker, triggering profit-taking across the AI sector.

CoreWeave (CRWV), backed by Nvidia, plunged nearly 11% after trimming its 2025 revenue forecast to $5.05–$5.15 billion from $5.35 billion, citing delays from one of its data center developers. Analysts flagged its growing reliance on debt and heavy exposure to Microsoft (MSFT) as a key customer.

Bank of America cut its price target on CoreWeave to $140 from $168, while DA Davidson warned that the company’s “circular financing model” — borrowing against Nvidia chips to buy more Nvidia chips — poses long-term risk.

The selloff hit the broader AI complex:

- Tesla (TSLA) fell over 2%

- Meta (META) and Broadcom (AVGO) dropped more than 1%

- Nvidia remains up 40% YTD despite this week’s slide.

Economic Data & Shutdown Outlook

Private payroll data from ADP showed US employers shedding roughly 11,250 jobs per week in October, reinforcing signs of a slowing labor market. Goldman Sachs estimates the shutdown could cause a 50,000-job decline in October’s official payroll count once data resumes.

Markets expect the shutdown to end this week after the Senate passed a bipartisan deal late Monday. The bill now heads to the House of Representatives and then President Trump’s desk. Betting markets fully price in government reopening by Thursday.

Once federal agencies resume operations, traders anticipate a “data catch-up rally” as delayed reports like CPI, retail sales, and nonfarm payrolls are published.

Stock Highlights

- Paramount Skydance (PSKY) surged 8.7% after announcing more cost cuts and a $1.5B investment into streaming and studios.

- Rocket Lab (RKLB) rose 4.7% on record quarterly revenue.

- Occidental Petroleum (OXY) gained 3.6% after beating profit estimates.

Markets are caught between relief over Washington’s progress and renewed anxiety about AI valuations. With SoftBank’s Nvidia exit and CoreWeave’s guidance cut, investors are reassessing how sustainable the AI rally really is — even as the long-awaited government reopening promises a short-term boost in sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.