Retail investors are piling back into technology shares after last week’s sharp software-led selloff, signalling renewed confidence among individual traders even as institutional investors remain cautious.

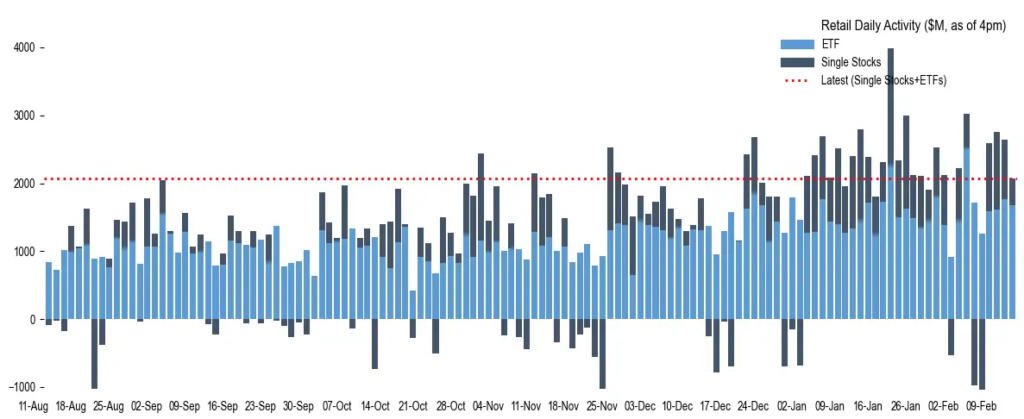

According to analysts at JPMorgan, retail flows rebounded sharply between February 6 and February 11, rising above the daily average for 2026 after briefly dropping to a year-to-date low during the downturn. The rebound was driven largely by ETF purchases rather than individual stocks, highlighting a preference for diversified exposure during volatile conditions.

Dip Buyers Target AI Leaders

Data shows retail traders focused heavily on large-cap tech and artificial intelligence names that had recently declined. Among the most actively bought stocks was Microsoft, which JPMorgan categorised as an “AI-resilient” software pick.

Other popular purchases included Palantir and AppLovin, both of which attracted strong retail inflows after falling during the software slump.

At the same time, retail traders were net sellers of several established software firms, including Salesforce, Roper Technologies, and Intuit, suggesting a rotation toward perceived growth or momentum names rather than traditional enterprise software plays.

Post-Earnings Dips Seen as Opportunities

Retail traders also treated earnings-driven declines among Big Tech giants as buying opportunities. JPMorgan noted that investors stepped in to purchase shares of Amazon and Alphabet after post-earnings weakness, while largely sitting out the rally in Meta.

Sentiment appeared mixed across online communities such as Reddit, where discussions reflected both optimism about AI’s long-term potential and concern about near-term spending levels.

ETF Dominance Shows Defensive Positioning

Trading data indicates ETFs have dominated retail activity since mid-2025, a trend reinforced during the latest dip-buying wave. Analysts say this pattern suggests retail investors want exposure to market rebounds while limiting single-stock risk.

The January Charles Schwab Trading Activity Index similarly showed individuals buying declines in major tech names, reinforcing the view that retail traders see pullbacks as tactical entry points rather than warning signs.

Meanwhile, market-making firm Citadel Securities reported record pace retail dip buying in software stocks, underscoring how aggressively individuals have moved to exploit recent volatility.

Retail vs. Hedge Funds: A Growing Split

JPMorgan flagged several stocks where heavy retail buying collided with significant hedge-fund short interest. Such divergences can create sharp price swings because opposing positioning often amplifies volatility when sentiment shifts.

This dynamic is becoming increasingly important as retail traders regain influence in short-term price movements, particularly in sectors tied to AI and high growth expectations.

Not Everyone Is Buying the Dip

Despite the surge in retail activity, some institutional investors remain hesitant. A report cited by Financial Times noted that concerns about AI-related spending and debt levels have made parts of the market more cautious about aggressively buying declines.

Market Takeaway

The latest data highlights a growing divide in market psychology:

- Retail traders: eager, opportunistic, momentum-driven

- Institutions: selective, hedged, valuation-focused

For now, individual investors appear convinced that last week’s tech drop was a buying opportunity rather than the start of a deeper correction. Whether that confidence proves prescient or premature may depend on earnings trends, interest rates, and whether AI spending ultimately delivers the profits investors expect.

Related: US Stocks are losing the global race. Should Investors Be Worried?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.