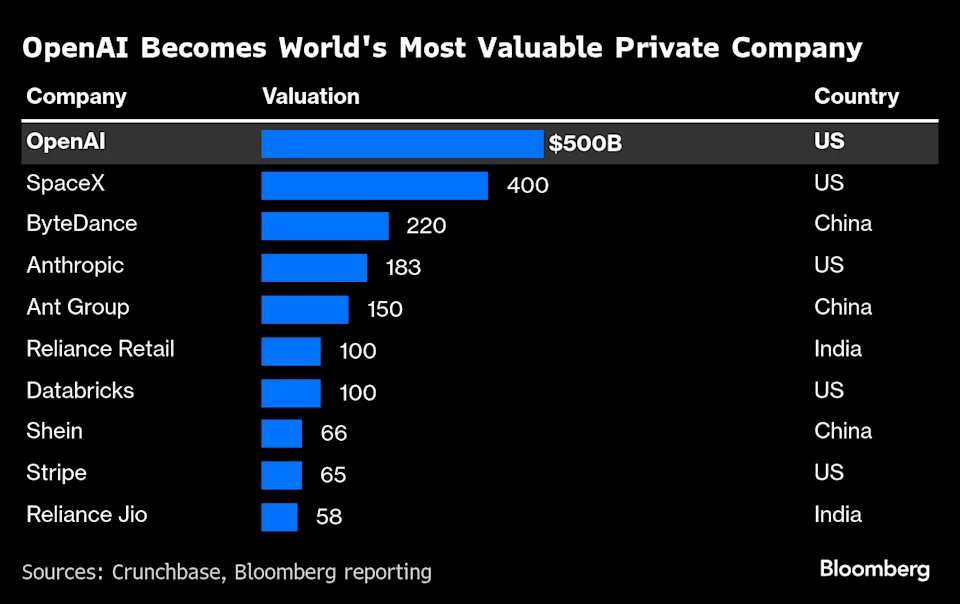

OpenAI has hit a new milestone, securing a $500 billion valuation through a secondary share sale, making it the world’s most valuable startup and surpassing Elon Musk’s SpaceX.

In the deal, current and former employees sold about $6.6 billion worth of stock to big-name investors including Thrive Capital, SoftBank, Dragoneer, Abu Dhabi’s MGX, and T. Rowe Price. The valuation marks a sharp jump from the $300 billion level reached earlier this year, underscoring the intense investor appetite for AI leaders.

The growth comes despite OpenAI not yet turning a profit. The company has signed mega-deals with partners like Oracle and SK Hynix and continues to drive a global boom in AI infrastructure, which could cost trillions.

The move also places OpenAI ahead of SpaceX’s $400 billion valuation, at a time when CEO Sam Altman is pushing to convert OpenAI into a for-profit public benefit corporation. Musk, who co-founded OpenAI but left its board in 2018, has sued to block the shift, accusing the firm of abandoning its nonprofit mission after taking billions from Microsoft.

Competition in AI talent is intensifying, with Meta and others luring researchers with massive pay packages. This secondary sale helps OpenAI provide liquidity and incentives for employees to stay.

Still, challenges loom. Rivals like Google and Anthropic are racing ahead with their own breakthroughs, while OpenAI recently rolled out GPT-5 and new open-source reasoning models to maintain its edge.

OpenAI’s valuation leap cements its status as the leader of the AI boom — but the battle with Musk, regulatory scrutiny, and a war for talent will define whether it can sustain that lead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.