China’s State Administration for Market Regulation has launched a probe into Nvidia over potential antimonopoly law violations related to its 2020 acquisition of Mellanox, an Israeli networking solutions company.

Nvidia shares dropped over 2%, reflecting investor concern amid rising regulatory scrutiny.

- U.S.-China Trade Tensions:

- The Biden administration recently imposed chipmaking restrictions targeting semiconductor tools, escalating trade tensions.

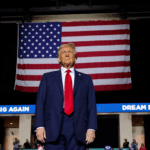

- President-elect Donald Trump has vowed to increase tariffs on foreign goods, potentially exacerbating these tensions.

- AI Chip Restrictions:

- The U.S. has restricted Nvidia and other chipmakers from selling advanced AI chips to China, citing national security concerns over military use.

- Nvidia has responded by developing alternative products tailored to comply with U.S. regulations.

- Regulatory Focus:

- Chinese regulators appear to be scrutinizing agreements made during Nvidia’s Mellanox acquisition, possibly in retaliation for U.S. chip restrictions.

- This move may also signal China’s intent to assert greater control over the tech industry amid U.S. efforts to curb its semiconductor ambitions.

Impact on Nvidia:

- Stock Performance: Despite this setback, Nvidia shares have surged 188% year-to-date, driven by investor confidence in the AI sector.

- Broader Implications: This regulatory probe introduces uncertainty, potentially affecting Nvidia’s operations in China, a crucial market for its products.

What’s Next:

- Nvidia’s Response: The company has yet to comment on the investigation, leaving questions about its strategy in China.

- Market Watch: Investors will monitor the outcome of the probe and how it aligns with broader U.S.-China trade dynamics.

- Sector Implications: As tensions rise, other U.S. semiconductor companies operating in China could face similar scrutiny, further disrupting the global chip industry.