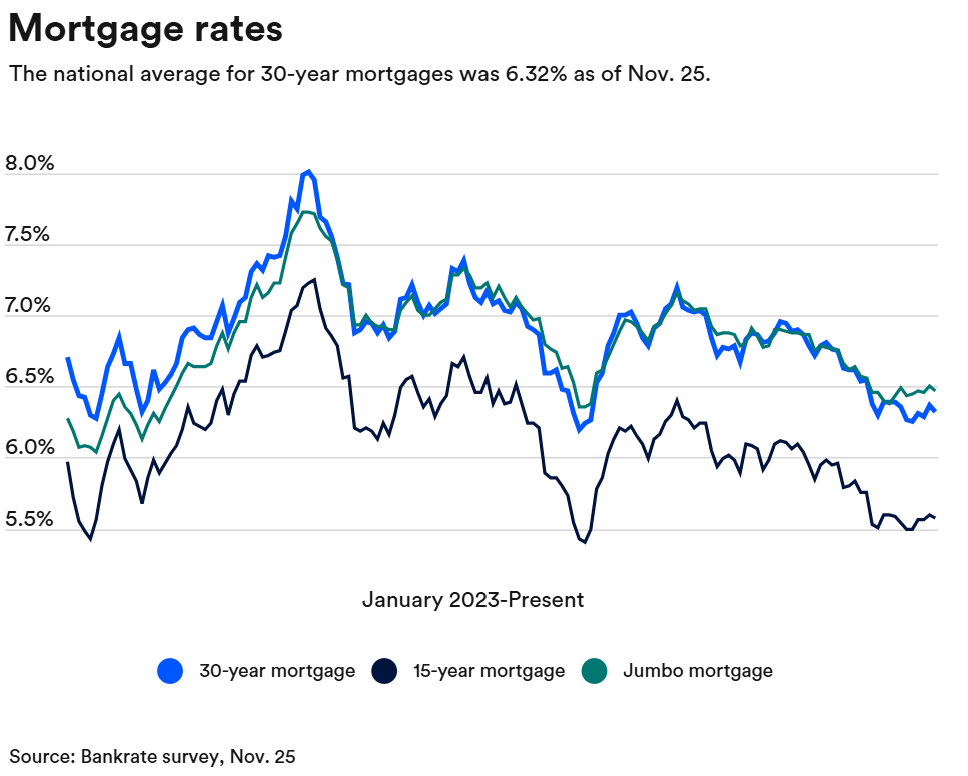

Mortgage rates edged lower for the second consecutive week, according to Bankrate’s national lender survey, which showed the 30-year fixed rate averaging 6.32%, down from 6.37% a week earlier. The 15-year fixed averaged 5.57%, while jumbo loans came in at 6.47%.

Each 30-year loan in the survey carried an average 0.32 points in combined discount and origination fees.

Affordability Still Tight but Improving

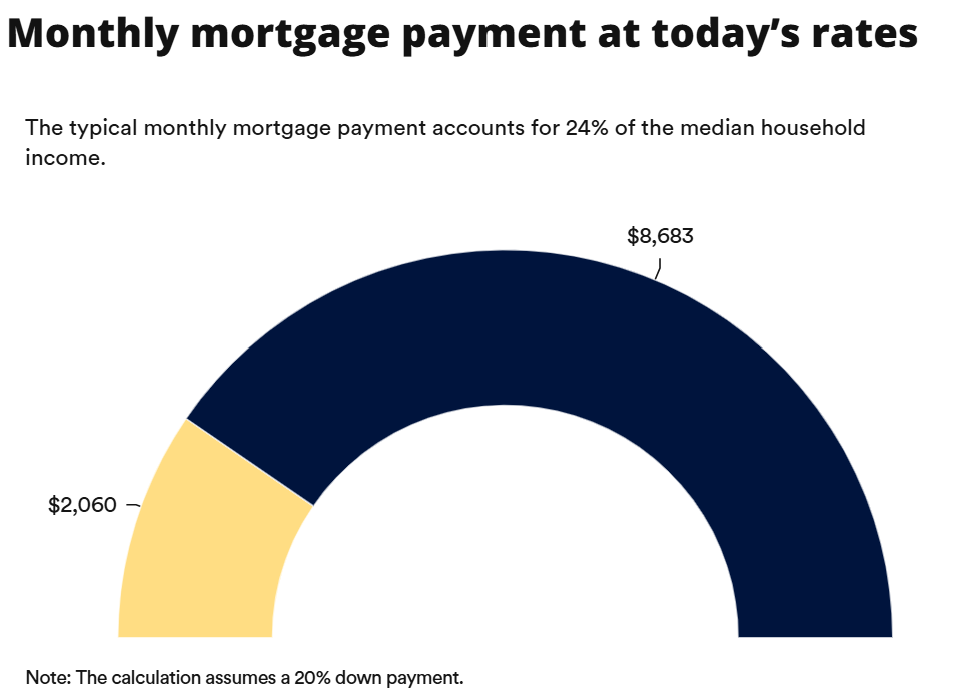

Based on the national median family income of $104,200 and a median home price of $415,200, a typical monthly mortgage payment now stands around $2,060 with a 20% down payment. That figure represents roughly 24% of the average household income, a slight improvement from midyear levels when affordability reached decade highs.

“With more housing inventory coming online and prices starting to level off, this remains a promising environment for those looking to buy or refinance,” said Samir Dedhia, CEO of One Real Mortgage. “Heading into the final Fed meeting of the year, we may see continued volatility, but for now, opportunity still exists.”

Fed Pause and Economic Uncertainty

The Federal Reserve has cut its benchmark rate twice this year, most recently in October, aiming to support an economy that appears to be slowing. Mortgage rates are still near their lowest levels of 2025, down from peaks seen earlier in the year.

Though mortgage rates are not directly tied to the Fed’s policy rate, they often track 10-year Treasury yields, which fell to 4.0% this week from 4.11% a week ago as investors sought safer assets amid signs of cooling growth.

Inflation remains above target, with prices up 3% in September, partly attributed to President Donald Trump’s tariff measures, which have pushed up import costs. The job market has also shown early signs of weakness, adding to market caution.

Outlook for the Rest of 2025

Analysts expect rates to fluctuate near current levels heading into December’s Fed meeting. If bond yields continue to retreat, mortgage rates could dip closer to 6.2%, providing further breathing room for buyers and homeowners looking to refinance.

“Mortgage rates have stabilized, but the next few months will depend on how inflation and the labor market evolve,” said Dedhia.

For now, buyers are cautiously optimistic, enjoying a slightly more affordable entry point into an otherwise challenging housing market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: What to expect in mortgage rates, car loans and savings accounts in 2025