The big question in tech right now is simple: is AI a bubble or a long term boom? In the last few weeks, leaders like Jensen Huang, Sundar Pichai, Jeff Bezos and Mark Zuckerberg have all tried to answer it.

Related: How Big Tech Created the 2025 AI Boom on Debt

Pichai compared AI to the early internet. There was too much money and hype, but the technology itself was real and changed the world. He says AI looks similar today. There is both logic and madness at the same time.

Worries are growing because investment is running far ahead of revenue. JPMorgan estimates that big tech companies could spend around 5 trillion dollars on AI data centers by 2030. To justify that, annual revenues would need to reach around 650 billion dollars. Right now they are closer to 50 billion dollars. OpenAI alone has signed almost 1.4 trillion dollars of long term infrastructure deals, while expected revenue for 2025 is only about 20 billion dollars.

At the same time, debt is rising fast. Data center debt has jumped more than 18 times since 2022. Some investors, like Michael Burry, say AI infrastructure is being overbuilt and valuations are too high. Others, like Tom Leighton of Akamai, say it feels a bit like the late 1990s internet boom, with real innovation but also inflated prices that will later correct.

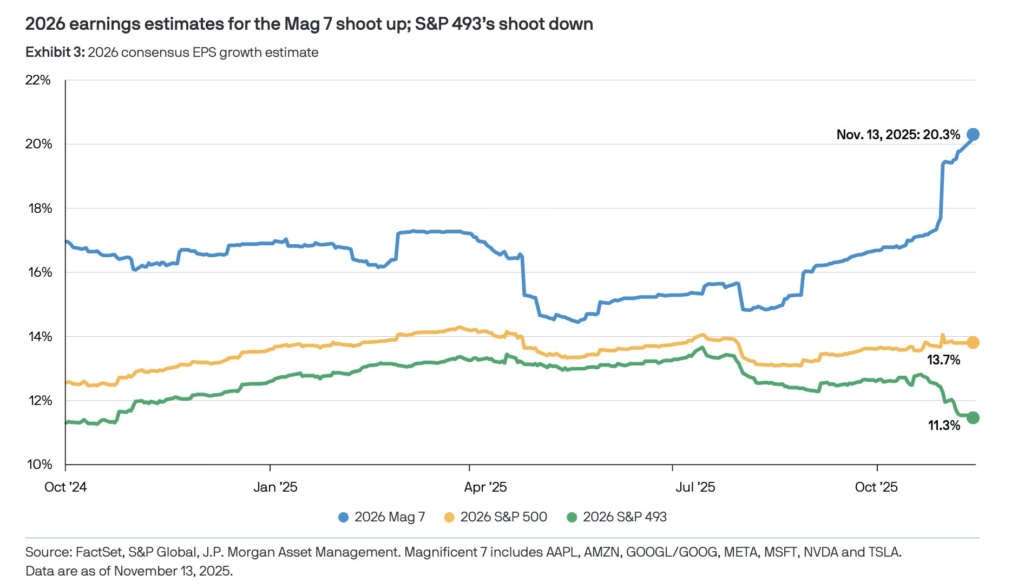

JPMorgan is more positive. The bank points out that this time most AI spending is coming from profitable, cash rich companies, not from weak, loss making startups. Tech free cash flow margins are near 20 percent, more than double the dot com era. AI spending is also already turning into real demand for chips, cloud services and software.

In short, many experts think this is not a fake story that will vanish. AI may still have a painful correction in prices and weak players, but the money going into chips, data and models is likely building the base of a new digital economy. The risk for investors is not only that AI is a bubble, but also that they pick the wrong companies in a very big, very real shift.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

AI boom brings fresh risks to US markets, and more money to M&A

BofA’s Hartnett Says Gold and China Stocks Are the Best Hedges Against the AI Boom

Is the AI Boom a Revolution — or the Next Big Bubble? Here’s What the World’s Top CEOs Are Saying