As the final month of 2025 gains momentum, investors enter a defining week for markets, one that could determine whether December’s rally holds or falters. With the Federal Reserve’s final policy meeting of the year, major earnings from Broadcom, Oracle, Adobe, and Costco, and delayed labour and inflation data all hitting the calendar, markets are bracing for a packed lineup of catalysts.

Fed Week: All Eyes on Powell

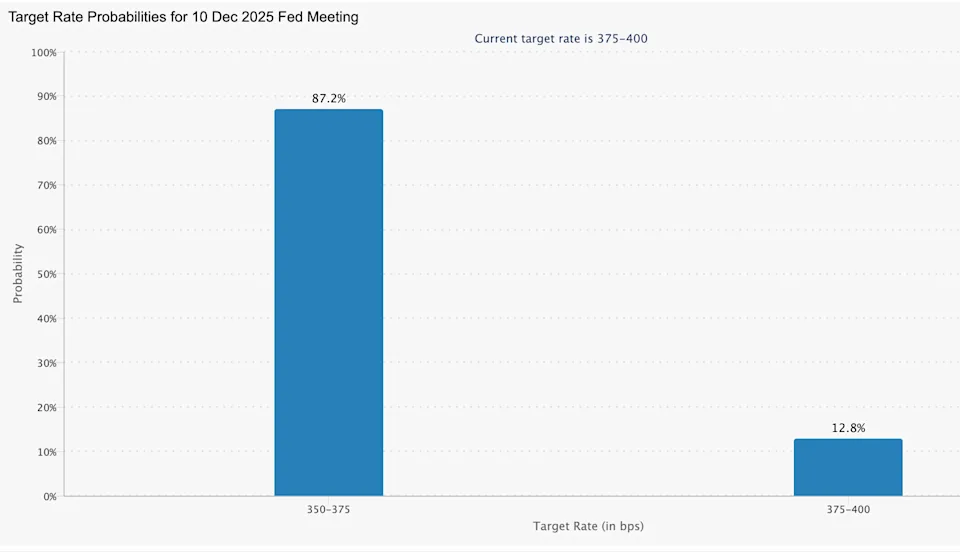

The centrepiece of the week will be the Federal Reserve’s two-day policy meeting, concluding on Wednesday with Chair Jerome Powell’s final press conference of 2025. Markets overwhelmingly expect a 25 basis point rate cut, bringing the federal funds range down to 3.50%-3.75%, marking the Fed’s third cut since September.

Friday’s PCE inflation data, showing continued moderation in price growth, solidified expectations for easing. However, the real focus will be Powell’s tone and forward guidance, especially as speculation intensifies around his replacement. President Donald Trump said last week he will announce the next Fed chair nominee early in 2026, with Kevin Hassett, his top economic adviser, widely seen as the frontrunner.

Traders will also scrutinize the Fed’s Summary of Economic Projections, the “dot plot,” revealing policymakers’ outlook for growth, inflation, and rates into 2026. The meeting also marks the final vote for the current lineup of Fed presidents before a new rotation begins in January, bringing in the heads of the Cleveland, Minneapolis, Dallas, and Philadelphia Feds.

Despite near certainty around this week’s cut, the market remains uncertain about 2026. With inflation still hovering near 3%, and a mixed labor picture, the question is whether the Fed will continue to lower rates or pause amid persistent price pressures.

Stocks Hover Near Record Highs

The S&P 500 closed last week just below 6,900, while the Nasdaq and Dow Jones both sit within striking distance of all-time highs. The market’s powerful run has been fueled by optimism around rate cuts and resilient corporate earnings, but analysts warn that euphoria may be masking fragility.

Bank of America strategist Michael Hartnett cautioned that a dovish cut could backfire if investors perceive it as a sign of economic weakness, potentially pushing bond yields higher and pressuring equities. The 10-year Treasury yield ended the week around 4.14%, up more than 10 basis points, reflecting lingering inflation concerns.

Still, optimism about a “Santa Claus rally” remains strong. A soft landing, cooling inflation, and the Fed’s first synchronized rate-cut cycle since 2020 are fueling hopes of ending the year on a high note.

Key Earnings Ahead: Oracle, Adobe, Broadcom, Costco

Corporate earnings will provide the second major storyline this week, with tech and retail giants set to report.

- Oracle (ORCL) reports Wednesday amid a sharp 30% decline from its highs, as investors weigh the company’s $300 billion partnership with OpenAI and its massive capital expenditure push to expand AI cloud infrastructure. Analysts expect earnings of $1.64 per share and 15% revenue growth to $16.2 billion. Wall Street will watch whether Oracle can reassure investors about its financing and long-term AI monetization strategy.

- Adobe (ADBE) also reports Wednesday and is expected to post solid results amid growing demand for AI-driven creative tools. Its Firefly AI platform and new enterprise cloud subscriptions will be key focus points for analysts.

- Broadcom (AVGO) headlines Thursday’s reports. Analysts expect 31% EPS growth and a 24% rise in revenue, driven by surging AI networking demand and integration of VMware assets. UBS recently raised its price target to $472, reflecting expectations of continued growth linked to Google’s Gemini Premium and new TPUv7 chip deployment.

- Costco (COST) rounds out Thursday with its quarterly report. Investors are watching whether the retail giant’s membership renewals and inflation-resistant consumer demand can sustain its earnings momentum.

Other notable names reporting this week include Chewy, Lululemon, Toll Brothers, AutoZone, and Ciena, with the latter expected to post strong gains from telecom AI infrastructure orders.

Economic Data: Jobs, Inflation, and Spending

The economic calendar is packed with delayed and critical releases following the lengthy government shutdown.

- Tuesday: The JOLTS report for September and October will finally reveal trends in job openings, layoffs, and quits. The data will be key to gauging labor market resilience after recent private payroll weakness.

- Wednesday: The Fed’s rate decision at 2:00 PM ET, followed by Powell’s press conference at 2:30 PM ET, will dominate headlines.

- Thursday: Initial jobless claims and wholesale inventories will give insight into consumer and business health.

- Friday: A quiet day, with markets digesting the Fed’s decision and setting up for next week’s November jobs report on Dec. 16, the first full employment release post-shutdown.

Bitcoin and Commodities Watch

While stocks flirt with records, Bitcoin (BTC-USD) remains volatile near $91,000, climbing more than 2% Friday. The world’s largest cryptocurrency is still down for the year, diverging from equities for the first time since 2014. Analysts note that it continues to behave as a risk-on asset, closely tied to tech sentiment.

Meanwhile, gold remains near record highs after gaining nearly 60% year-to-date, as investors hedge against long-term inflation and geopolitical uncertainty.

It’s a defining week for markets: the Fed’s final rate decision of 2025, a wave of high-profile earnings, and key economic data releases will set the tone for the rest of December.

If Powell’s message reassures investors and inflation continues to cool, the Santa Claus rally could extend into year-end. But if the Fed’s tone turns cautious, or if next week’s jobs data surprises to the downside, the final act of 2025’s bull run may end with volatility instead of victory.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.