Investing in penny stocks can be a thrilling, high-risk journey with the potential for significant rewards. For one Reddit user, _chai_satire_, it turned into an eye-opening experience as he shared his story on the subreddit r/pennystocks. After making and losing $20,000, the user reflected on the hard lessons learned about timing, risk management, and the unpredictable nature of the market.

“Beginner’s Luck is a real thing. I think that is the reason why all my investments generated crazy money when I started trading penny stocks a month ago. I am someone who usually does not take huge risks. If I take a risk, I go with the mindset that I will lose it all. But boy, it was all different with penny stocks. I have never been so royally humbled in my life. And the worst part is that trading penny stocks somehow wired my brain to do stupid things with my regular investing patterns as well.

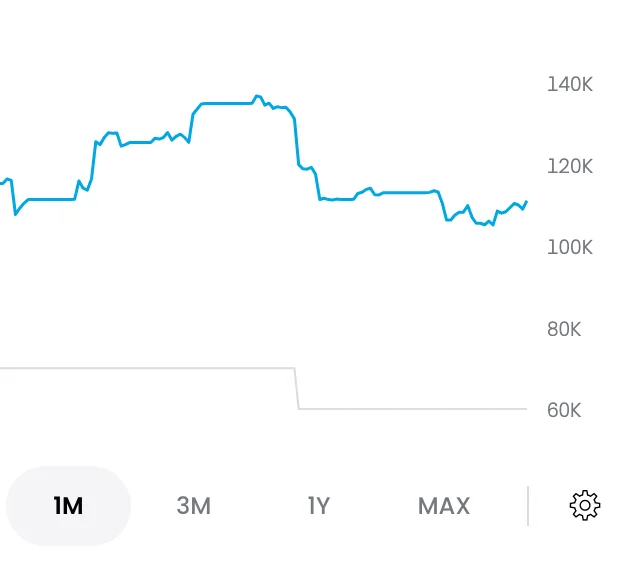

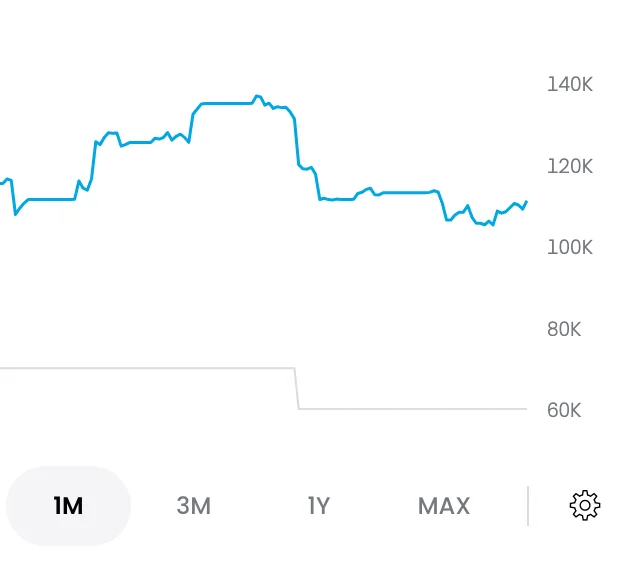

I am writing this post primarily to note down my journey and learnings—and maybe others can learn something from it too. I will also attach a screenshot of my rise and fall. Please know that I am not rich. I am a regular person working my ass off to save money, and my portfolio is made up of my savings from 15 years.

Enough ranting—below are the learnings:

1. Stay away from Chinese stocks.

Many people told me about P&D schemes in Chinese stocks, and I was aware of the risks. I put in some money and was even in the green initially. My biggest mistake was buying into the hype, thinking it would go up even more, and not triggering my stop losses when the Chinese stocks started going down. Well, guess what? Unlike traditional investments, they never came back up. They went down 40%, and I thought they would recover—but they continued to drop and are now down 80%. There’s no sense in selling them now, as I’ll get back only about $400.

Note: This logic applies only to Chinese penny stocks. There are some good Chinese stocks out there that you can always consider.

2. Always take profit.

This was a mistake I made with all the stocks—I didn’t take profits. Instead, I invested even more, thinking the stock price would keep climbing. But sadly, it all went down, and I lost money. Here, I don’t think I took blind bets. I did a good amount of research and still got burned.

I’m talking about stocks like RVSN, CTM, etc., which didn’t go up despite consistently getting great news. I burned a significant amount of money on LODE, and I recommend people stay away from LODE and similar stocks.

3. If you believe in a company, stay with it.

I bought quantum stocks of RGTI after they fell 40%—a company I really believe in. When the stock went down further, I sold it immediately because of my penny stock experience. I could have just held on for a while, as I had opened a medium position of $5K. I sold at a $1,000 loss. The stock is up now.

I made similar mistakes with 2–3 other companies.

4. If you’re going to buy penny stocks, buy when the hype is just getting started.

My observation is that I knew about many penny stocks before their pump. But I chose to wait until they went up. If I had invested $1K in all of them when I first became aware of them, I would have still made a 30% profit, even if I sold before they peaked.

Looking at the current state of the market, though, I’m not sure if this strategy will still work.

5. I still got some diamonds while mining coal.

All this hustle was not a complete waste. I am currently at a 20%-40% loss with these stocks, but I believe that in 1 year, I will have at least a 30%-40% profit from them: LPSN, MVST, OTLK, QSI, MATEF, REKR, AMPX, LTRX, BigBear, NIO, and ARBE.

All these stocks together represent 40% of my portfolio. I am sure not all of them will make money, but combined, they will do great. I do not intend to invest more in any of these stocks—I will take profits when possible and not wait for them to peak.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.