Investors are preparing for a crucial week packed with major economic data releases that could set the tone for global markets, just 10 days Key Economic Events to Watch This Weekbefore President Donald Trump’s reciprocal tariffs are slated to take effect on April 2nd.

With growing concerns over trade tensions and economic slowdown, the spotlight is on data that will offer fresh insights into the health of the U.S. economy and potential policy responses from the Federal Reserve.

Key Events This Week

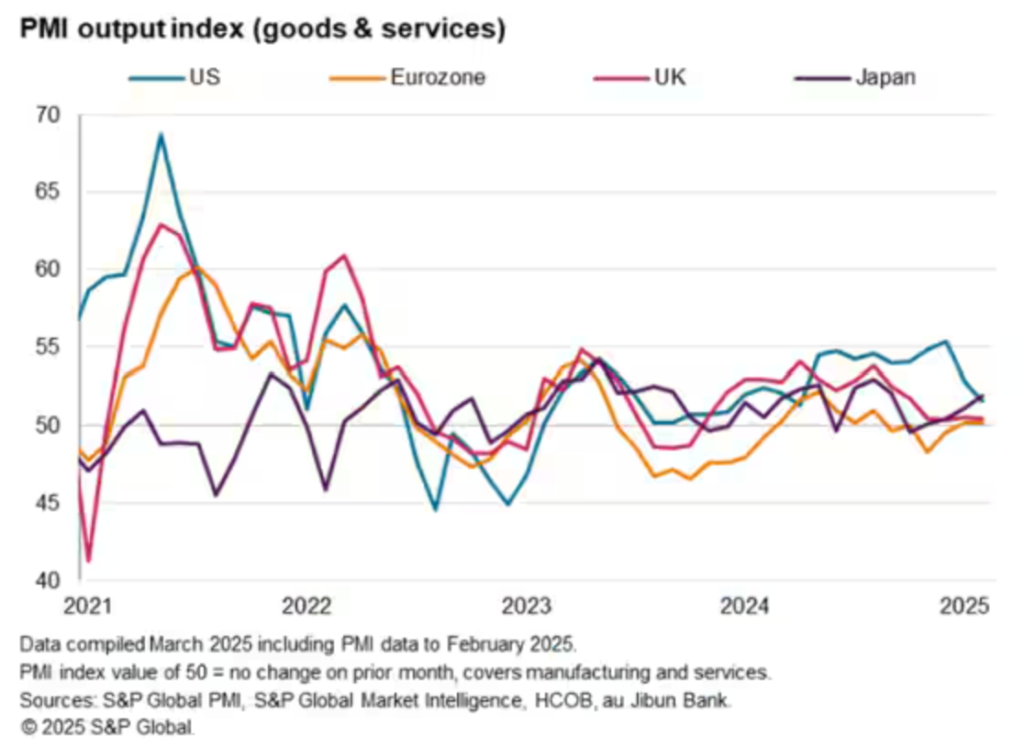

Monday – S&P Global Manufacturing PMI

Markets will be watching for signs of strength—or weakness—in the U.S. manufacturing sector as supply chain disruptions and tariff threats loom.

Tuesday

- CB Consumer Confidence

Consumer sentiment will be a key indicator of spending trends as inflation and trade concerns weigh on household budgets. - February New Home Sales

Housing market data will offer clues on how higher interest rates and affordability issues are impacting demand for new homes.

Wednesday – Atlanta Fed GDPNow Update

This real-time forecast for U.S. economic growth will be closely monitored for potential adjustments ahead of official GDP data.

Thursday – US Q4 2024 GDP Report

The final read on last quarter’s economic growth is expected to shape expectations for the year ahead, especially with Trump’s tariffs set to impact trade and production.

Friday – February PCE Inflation Data

As the Fed’s preferred inflation measure, the PCE report will be pivotal for monetary policy watchers. Elevated inflation could pressure the central bank to stay hawkish.

Countdown to Tariffs

President Trump’s reciprocal tariffs are scheduled to go live on April 2nd, which could escalate trade tensions and trigger volatility in global markets. Investors are bracing for potential fallout as details of the tariff rates and targeted countries emerge.

This week’s data could help determine whether the U.S. economy is resilient enough to withstand upcoming trade shocks. Markets will be closely watching for any signals that could influence the Fed’s next move—and prepare for what’s shaping up to be a volatile start to Q2.

Related:

Drama Over Quantum Computing Future heats Up

Nvidia Death Cross Has Traders on High Alert as Momentum Withers

Musk: Tesla to build 5,000 Optimus robots in 2025, tells staff not to sell shares

Trump Promises ‘Flexibility’ on Reciprocal Tariffs

MicroCloud Hologram Reports Strong 2024 Financial Results, Eyes Global Expansion

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance