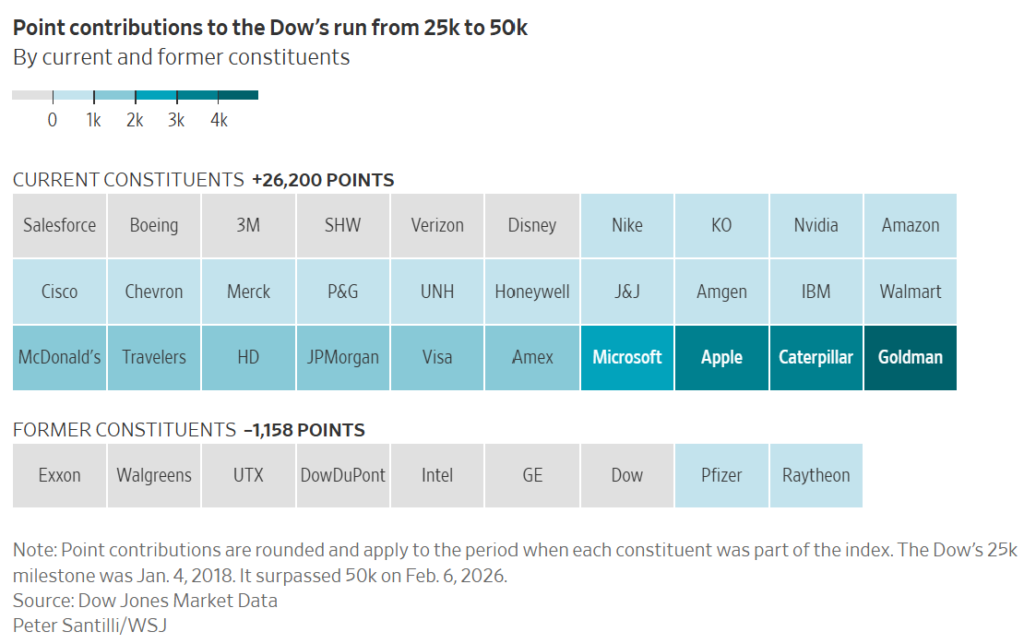

The Dow Jones Industrial Average crossed 50,000 for the first time on Friday, marking a historic milestone in a rally shaped less by headline tech winners and more by a handful of high-priced, old-economy heavyweights.

It took just over eight years for the blue-chip index to climb from 25,000 to 50,000, a sharp contrast to the more than 100 years it took to reach 25,000 in 2018. Because the Dow is price-weighted, stocks with higher share prices have outsized influence on its moves, regardless of market value.

Top contributors

- Goldman Sachs has been the single biggest driver of the move higher. With shares near $929, the bank’s stock carried the most weight as investment banking and markets revenue surged alongside a hot IPO and dealmaking cycle.

- Caterpillar, trading around $726, was next. Demand for power generators from AI data-center developers has boosted results for the machinery giant.

- Apple followed, despite a lower share price near $278. Since late 2017, Apple has delivered a 557% return, regularly competing for the title of the world’s most valuable company.

- Microsoft and American Express round out the top five contributors.

Biggest drags

- Salesforce has been the largest laggard since 25,000. Shares have fallen sharply over the past year amid concerns that AI could disrupt its core business.

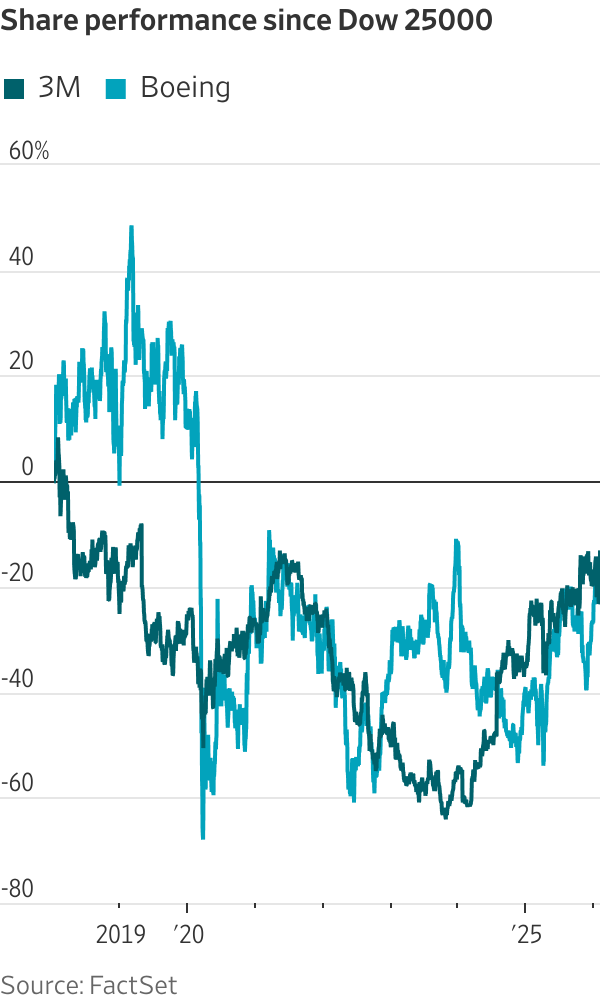

- Boeing also weighed on the index, pressured by engineering issues, slower orders, and mounting losses.

- 3M, along with Sherwin-Williams and Verizon, added to the drag.

Some former Dow stalwarts fell far enough to be removed entirely. Exxon Mobil and Intel are no longer members, with Intel most recently replaced by Nvidia.

Valuations are rising

Strong earnings growth laid the foundation for the rally, but higher valuations are now playing a bigger role. Investors are paying about 22 times trailing earnings for the Dow’s 30 companies, up from roughly 20 times at the 25,000 mark in 2018. Valuations climbed even higher in 2021, when ultralow interest rates left investors with few alternatives to stocks.

As the Dow moves deeper into record territory, its path to 50,000 shows that old-line financials and industrials, not just megacap tech, have been doing much of the heavy lifting.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: What to Watch This Week: Dow 50,000, Jobs Data, Inflation and Big Earnings