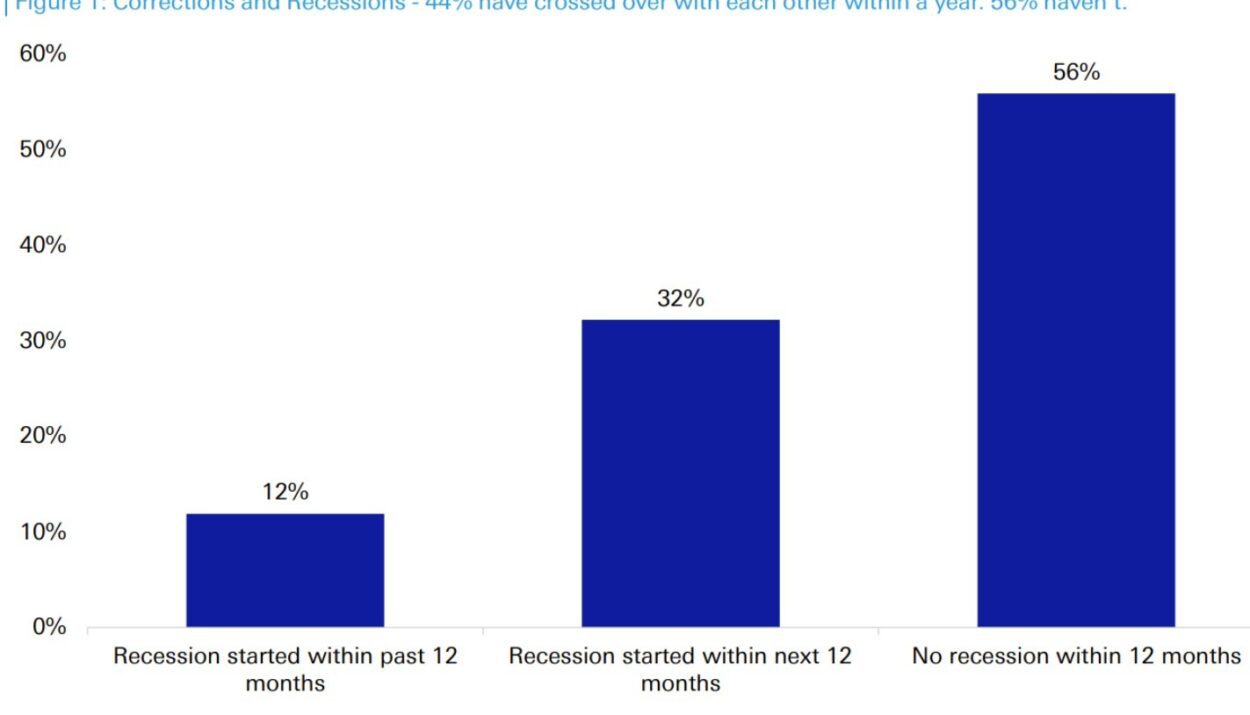

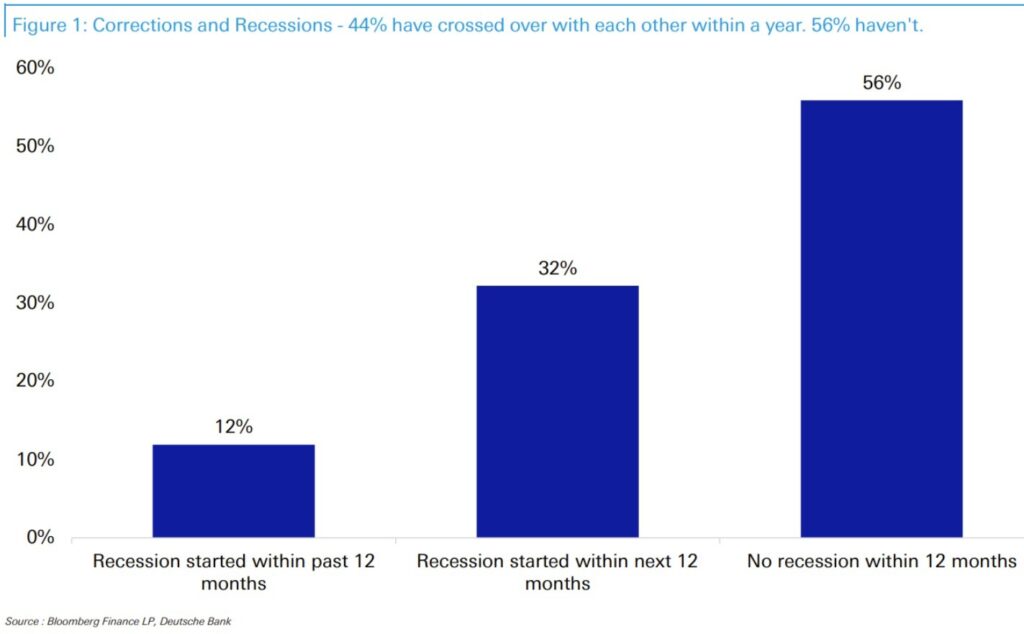

Deutsche Bank analyzed the impact of a 10% US equity market correction. Historically, there have been 60 such events. In 12% of cases, a recession was already underway. Another 32% were followed by a recession within a year. However, 56% of corrections never led to a recession, highlighting that market pullbacks often don’t predict economic downturns.

- Recession Link: 44% correlation between corrections and recessions.

- No Recession: In the majority of cases (56%), markets stabilized.

- Watchlist: Yields, liquidity, valuations, inflation, and Powell’s policy stance are critical indicators.

📉 Yields & Earnings Pressure: Rising yields are compressing valuations, particularly for growth stocks. If earnings guidance holds steady, markets may find relief. If not, expect prolonged volatility.

Corrections can offer opportunities but come with risks. Deutsche Bank emphasizes evaluating forward-looking indicators over reacting solely to price movements.

Source: Deutsche Bank Analysis

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Investing Strategies from the Best Investors

Google Bought Wiz for $32 Billion: What to expect

‘Some Kind of Mental Illness’: Elon Musk Slams Violent Attacks on Tesla