Gold’s historic surge past $5,000 an ounce may only be the beginning.

After hitting a record above $5,090 on Monday, analysts say the precious metal still has significant upside as geopolitics, central-bank buying, and investor demand continue to fuel one of the strongest rallies in decades.

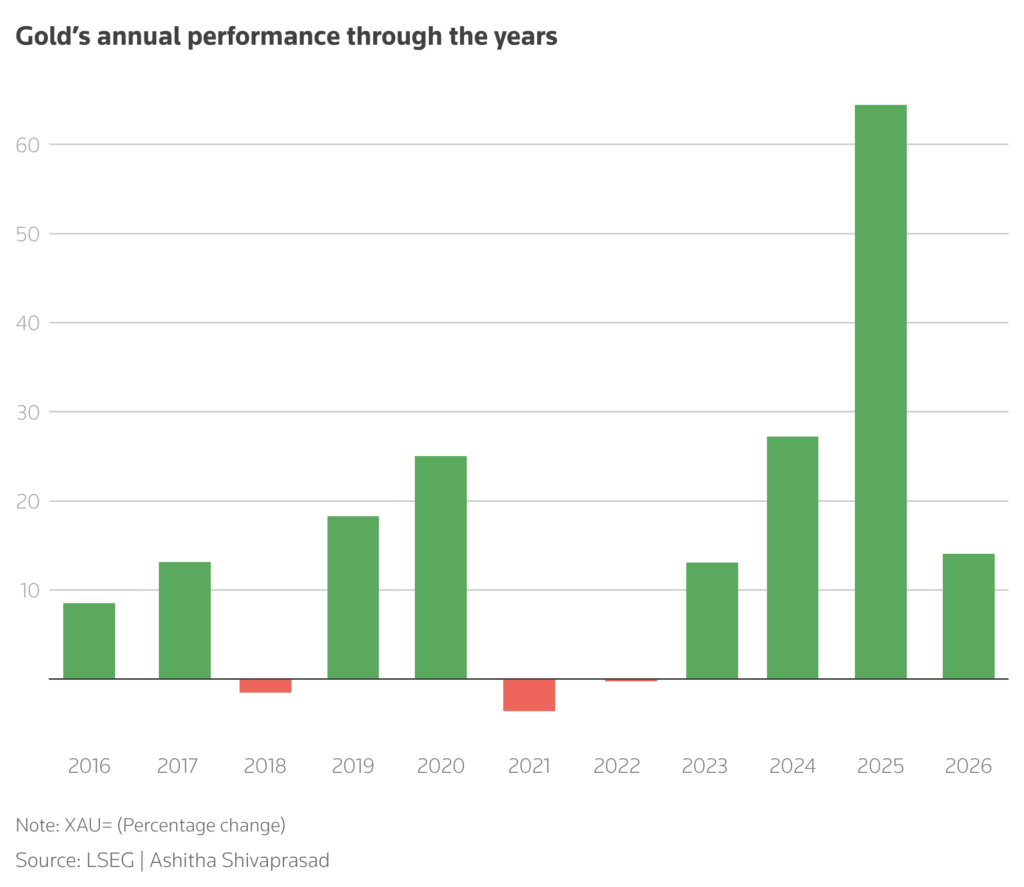

Gold is already up more than 17% in 2026, after soaring 64% last year, its best annual performance since 1979. Several major banks now see prices climbing toward $6,000 or higher before the year ends.

Why Gold Is Surging

The rally is being driven by a rare mix of political risk, financial uncertainty, and powerful institutional buying.

Recent tensions between the US and its allies over Greenland, new tariff threats from President Donald Trump, and growing doubts about the independence of the Federal Reserve have pushed investors toward safe-haven assets.

“The only certainty right now is uncertainty, and that plays directly into gold’s hands,” said independent analyst Ross Norman.

Markets are also bracing for the US midterm elections later this year and for potential volatility in overstretched equity markets. Analysts say both factors are encouraging investors to diversify into gold.

Central Banks Are a Major Force

One of the strongest drivers is central-bank demand.

Emerging-market central banks are continuing to diversify away from the US dollar and into gold. Goldman Sachs expects purchases to average 60 metric tons per month this year.

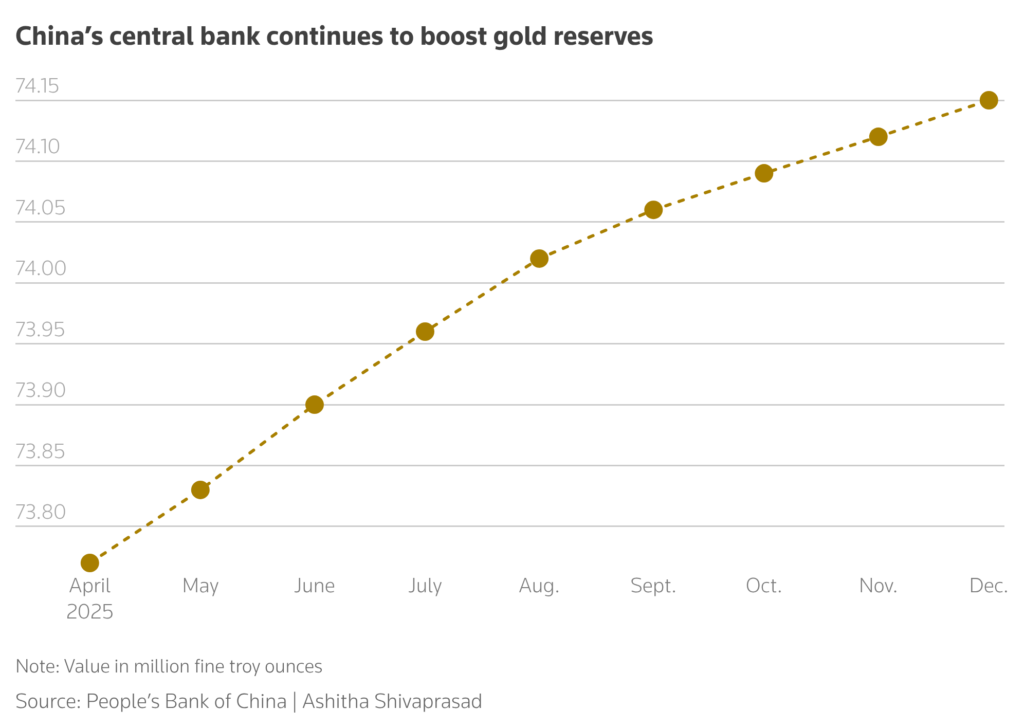

China has now increased its gold reserves for 14 consecutive months, while Poland plans to raise its holdings from 550 tons to 700 tons.

Analysts say this wave of official buying reflects long-term “de-dollarisation” and concern over rising global debt.

“Central banks are looking to reduce reliance on the dollar. There are very few alternatives on this scale other than gold,” Norman said.

ETF Inflows and Retail Buying Add Fuel

Investor demand is also surging.

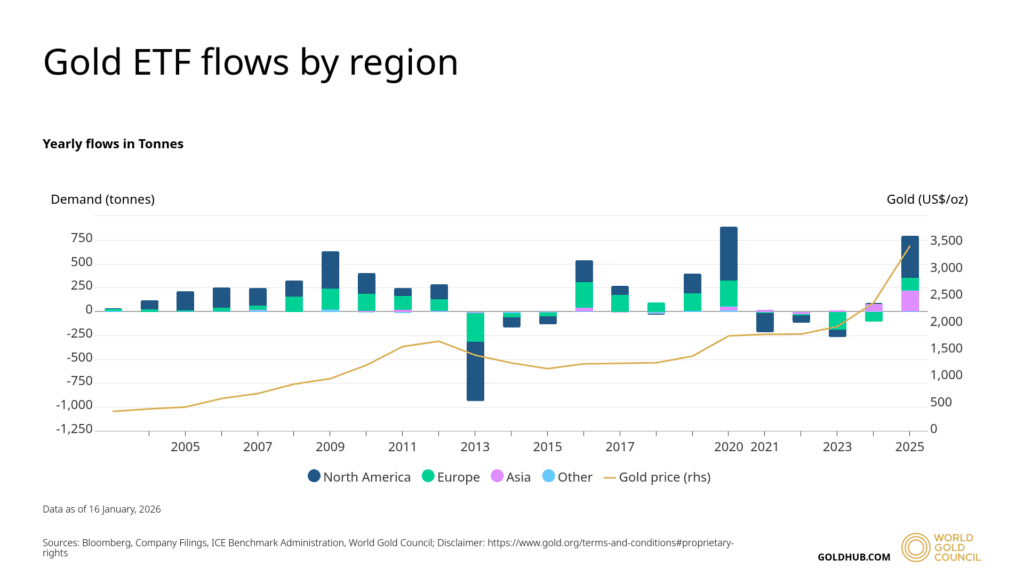

Gold-backed ETFs recorded record inflows of $89 billion in 2025, the highest since 2020. Holdings rose by more than 800 tons, led by North American funds.

As interest rate cuts become more likely later this year, the appeal of non-yielding gold increases.

“When rates fall, the opportunity cost of holding gold drops. That’s very supportive for prices,” said Chris Mancini of the Gabelli Gold Fund.

Retail demand is shifting too. Jewellery sales have weakened due to high prices, but buying of bars and coins is rising sharply in India, China, and Europe as investors seek direct exposure.

How High Can Gold Go?

Forecasts are becoming increasingly bold.

- Goldman Sachs now sees gold at $5,400 by the end of 2026

- Societe Generale expects prices to reach $6,000 this year

- The London Bullion Market Association survey shows projections as high as $7,150

- Ross Norman sees a potential peak near $6,400

Silver, platinum, and palladium are also hitting record highs, reinforcing the idea of a broader precious-metals boom.

What Could Slow the Rally?

Analysts say a correction is possible if US rate-cut expectations fade, equity markets suffer forced selling, or geopolitical tensions ease.

Silver in particular looks stretched, now trading more than 100% above its 200-day moving average, which often signals short-term instability.

Still, most experts believe any pullback will be brief.

“A sustained decline would require a return to a stable geopolitical and economic environment, and that currently looks unlikely,” said Philip Newman of Metals Focus.

Gold’s run to $5,000 has been spectacular, but analysts say the fundamentals still point higher.

With geopolitical risk rising, central banks buying aggressively, and investors flooding into ETFs and physical metal, the safe-haven rally looks far from finished.

For now, the message from the market is clear: Gold is no longer just a hedge. It has become one of the main stories of global finance in 2026.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold and Silver Soar as Bitcoin Falls Behind in 2025