Global equity funds attracted fresh money for a third consecutive week, as investors grew more confident about corporate earnings while also positioning defensively amid uncertainty over US trade policy.

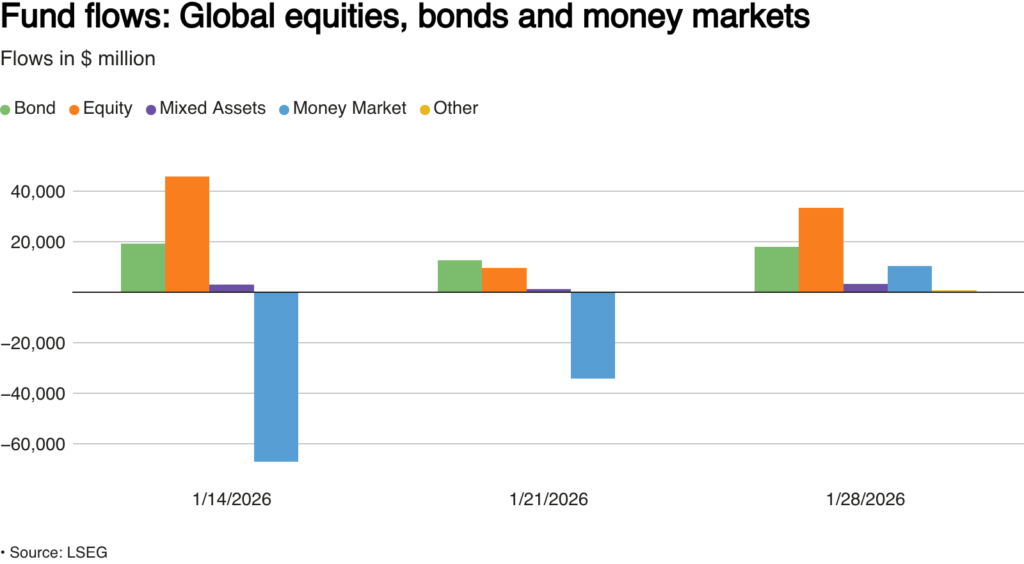

According to data from Reuters, global equity funds recorded $33.39 billion in net inflows in the week ending January 28. That marked a sharp jump from roughly $9.5 billion in inflows the previous week, based on figures from LSEG Lipper.

Europe Leads Equity Inflows

By region, European equity funds topped the list, pulling in $11.03 billion, the strongest weekly inflow in three weeks.

US equity funds followed with $10.73 billion, while Asian equity funds attracted $6.95 billion.

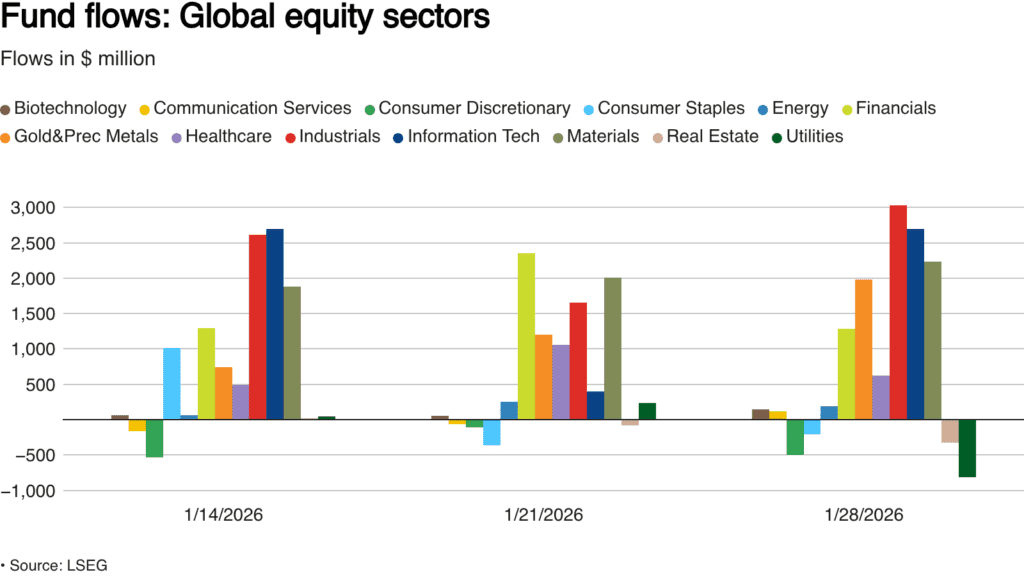

Investor appetite was strongest in cyclical and growth-oriented sectors. Industrial funds saw $3.04 billion in inflows, technology funds added $2.7 billion, and metals and mining funds drew $2.24 billion, reflecting optimism around global growth and commodity demand.

Bond and Money Market Funds Also Gain

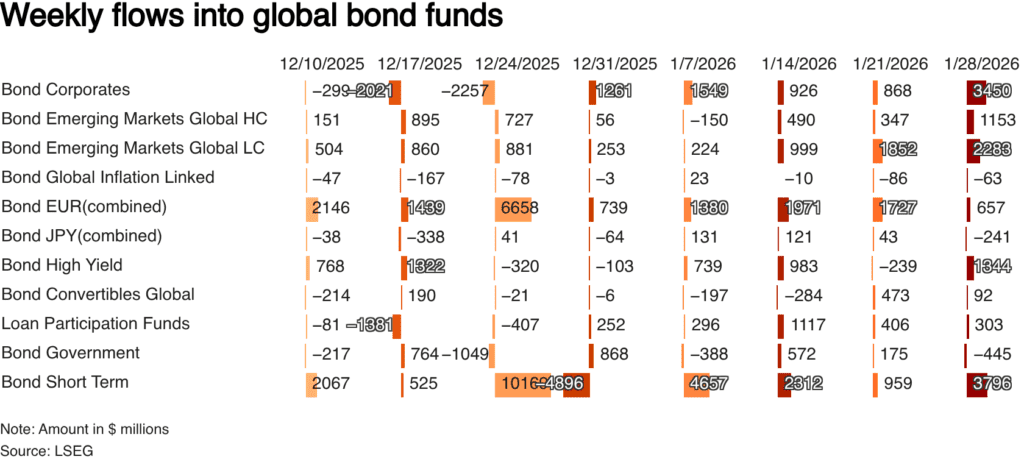

Risk appetite was balanced by continued demand for safer assets. Global bond funds recorded $18.02 billion in net inflows, extending their buying streak to a fourth straight week.

Short-term bond funds were especially popular, attracting $3.8 billion, the largest weekly inflow in three weeks. Corporate bond funds also saw strong demand, with $3.45 billion added.

Money market funds reversed recent outflows, posting $10.31 billion in net inflows after two weeks of net selling.

Gold and Emerging Markets Shine

Amid uncertainty over potential tariff moves under Donald Trump, investors also increased exposure to traditional safe havens. Gold and precious metals funds attracted $2.25 billion, the largest weekly inflow since late December.

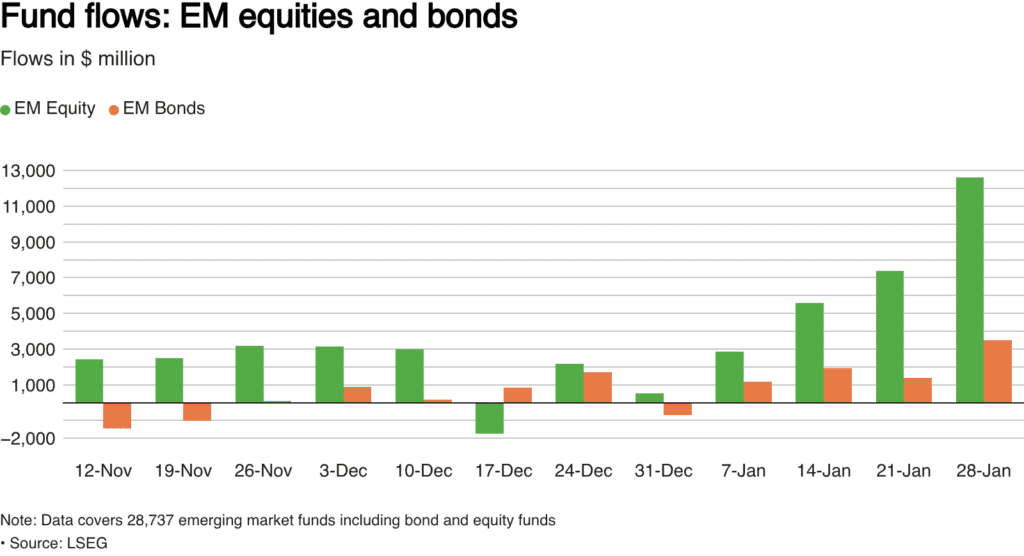

Emerging markets stood out as well. Emerging market equity funds pulled in $12.63 billion, the biggest weekly inflow since at least 2022, supported by cheaper valuations and stronger growth expectations. EM bond funds also saw healthy demand, with $3.51 billion in net inflows.

Big Picture

The latest data suggest investors are not only chasing earnings momentum, but also rebalancing portfolios toward diversification and protection. With trade tensions, tariffs, and geopolitical risks still in focus, flows into equities, bonds, gold, and emerging markets show a market that is cautiously optimistic, but far from complacent.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US equity funds attract inflows ahead of mega-cap earnings