During GameStop’s annual shareholder meeting, which saw the stock (GME) drop by 15%, Chairman and CEO Ryan Cohen emphasized cost reduction and profitability. “With respect to retail operations, we plan to continue reducing costs and focusing on profitability,” Cohen stated, hinting at a “smaller network” of stores.

Despite not revealing detailed strategies, Cohen assured, “We are focused on building shareholder value over the long term. We are not here to make promises or hype things up. We’re here to work.”

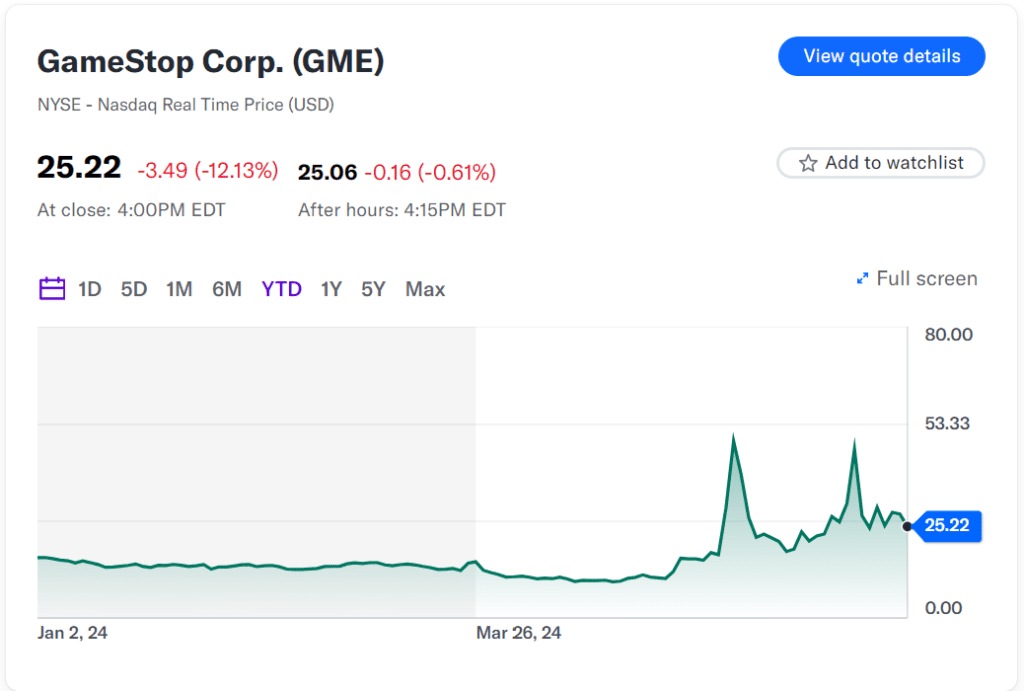

The meeting followed a technical delay last week and comes amid volatile stock movements influenced by retail trader Keith Gill, aka Roaring Kitty. GameStop capitalized on recent rallies by raising over $3 billion from stock offerings.

Cohen highlighted the importance of a robust balance sheet, especially during economic uncertainty. Meanwhile, Gill reaffirmed his support for Cohen’s leadership: “It becomes a bet on the management. In particular, of course, Ryan, f***ng Cohen. Ryan Cohen and his crew. That’s what folks should be focused on,” adding, “I see enough where I believe this guy may be able to do it.”

Gill also confirmed his personal investment in GameStop: “The accounts showing my positions are mine. These are my positions. I’m not working with anybody else. I’m not working with hedge funds,” he declared.