The FED is poised to lower interest rates by 0.25% at its final meeting of 2025 on Wednesday, marking its third cut this year and setting the stage for a contentious 2026 outlook that could define monetary policy amid political pressure and leadership uncertainty. A few minutes later, at 2:00 p.m. ET, the FOMC meeting will begin with the official policy announcement, followed by Chair Jerome Powell’s press conference at 2:30 p.m. ET.

A “Hawkish Cut” Expected

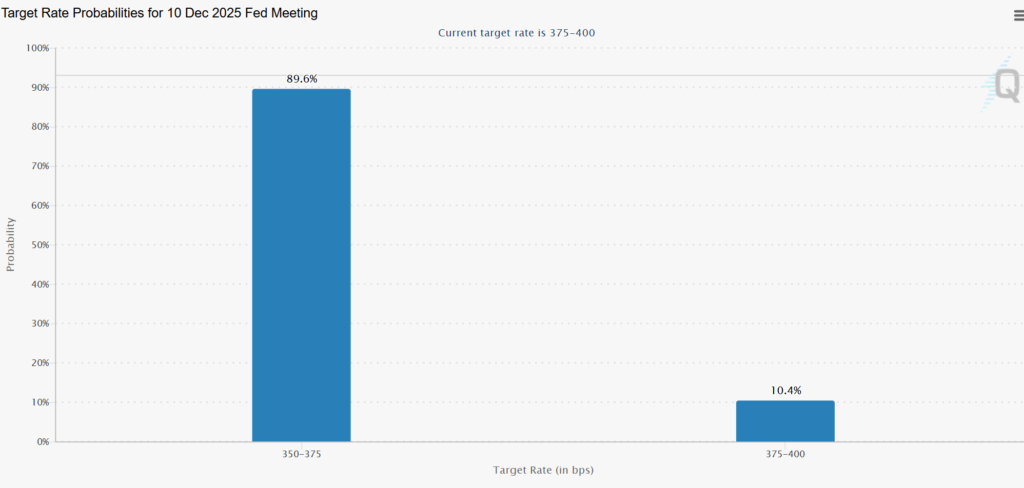

Markets have priced in an 89% probability of a quarter-point reduction, according to the CME FedWatch tool, which would bring the federal funds rate to 3.50% to 3.75%, down from a peak of 5.5% earlier this cycle. The decision, however, is expected to feature multiple dissents, possibly the highest number since 1983, reflecting the Fed’s internal divide over whether inflation has cooled enough to justify continued easing.

Analysts widely anticipate what’s being called a hawkish cut, a move that eases borrowing costs but signals a pause ahead. Deutsche Bank’s Matt Luzzetti said the outcome “will not be unanimous and is likely to feature dissents in both a hawkish and dovish direction.”

At least four officials, including Boston Fed’s Susan Collins, Kansas City’s Jeff Schmid, Chicago’s Austan Goolsbee, and St. Louis’s Alberto Musalem, have warned that more cuts could reignite inflation. Meanwhile, Fed Governor Stephen Miran, a Trump ally, has pushed for a larger 50 basis point cut, arguing that tariffs have not fueled price growth.

2026 Forecasts in Focus

Alongside the policy decision, the Fed will release its Summary of Economic Projections (SEP) including the highly anticipated dot plot showing policymakers’ rate expectations for 2026 and beyond.

In September, the median forecast showed just one rate cut next year after three in 2025, but analysts expect Wednesday’s update to reflect softer growth and persistent inflation risks. The core PCE price index, the Fed’s preferred inflation gauge, rose 2.8% in September, slightly above target but within a cooling trend.

“The dots aren’t a great forecaster,” Chair Jerome Powell once said, but traders will nonetheless scour the projections for signals about how quickly the Fed could move toward a neutral stance in 2026.

Markets Brace for Powell’s Tone

Stocks were steady ahead of the decision, with the S&P 500 just shy of record highs after inflation data reinforced hopes for easier policy. Yet some strategists warn that Powell’s tone will determine whether the rally continues.

“A 25 basis point cut is important for investor sentiment, not necessarily for corporate fundamentals,” said Mark Malek, CIO at Siebert Financial. “The market wants reassurance that the Fed is mindful of the labor market and won’t tighten prematurely.”

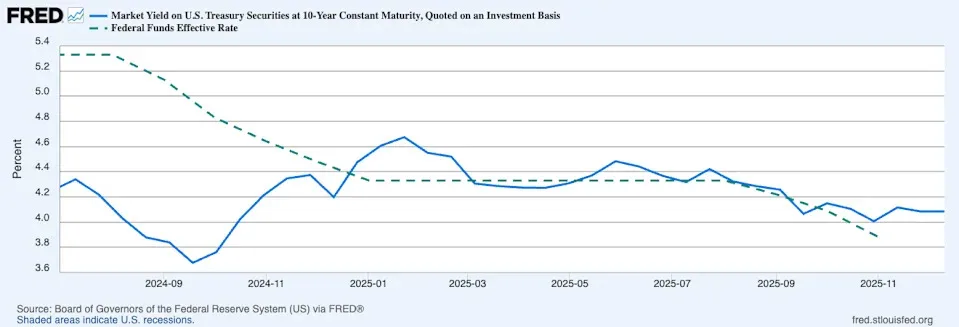

Others caution that rate cuts may not translate directly into lower borrowing costs. As Yahoo Finance’s Hamza Shaban noted, “bond yields remain stubbornly high due to fiscal deficits and policy uncertainty,” with the 10-year Treasury yield hovering near 4.14%.

Trump’s Shadow Over the Fed

Adding political weight to Wednesday’s meeting, President Donald Trump has begun interviewing candidates to replace Powell when his term expires in May 2026. The shortlist includes National Economic Council Director Kevin Hassett, considered the frontrunner, along with former Fed Governor Kevin Warsh, current Governors Chris Waller and Michelle Bowman, and BlackRock’s Rick Rieder.

Trump told reporters aboard Air Force One that he has “a pretty good idea” of his choice, hinting that a willingness to cut rates quickly would be a “litmus test” for the next chair. Hassett has publicly urged the Fed to “cut right now,” saying the central bank should react faster to changing economic data.

Global Yields Rise Ahead of Decision

Globally, bond markets are signaling caution. A Bloomberg gauge of long-dated government bonds hit its highest level since 2009, with traders betting that major central banks including the ECB and Bank of Japan may soon end their rate-cutting cycles.

In the US, the 30-year Treasury yield has climbed back toward multi-month highs as investors weigh fiscal risks and concerns about Fed independence under a new administration.

The Fed’s expected move on Wednesday caps an extraordinary year in monetary policy, one that saw inflation cool but remain above target, growth stay resilient, and political scrutiny intensify.

If Powell signals that further cuts will depend on a “material deterioration” in the labor market, as JPMorgan’s Michael Feroli predicts, the Fed could be signaling the end of its current easing cycle and the start of a politically charged new era for America’s central bank.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.