The Federal Reserve delivered its third straight interest rate cut on Wednesday, lowering the federal funds rate by 25 basis points to a range of 3.5%–3.75%, in a widely expected move that still revealed deep divisions within the central bank and a cautious outlook for 2026.

The 9–3 vote on the decision was the most divided since 2019, with Fed Governor Stephen Miran favoring a deeper 50-basis-point cut, while Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid wanted to hold rates steady. The split underscores the tension between policymakers focused on cooling inflation and those more concerned about weakening job growth

A “Hawkish Cut” With a Divided Committee

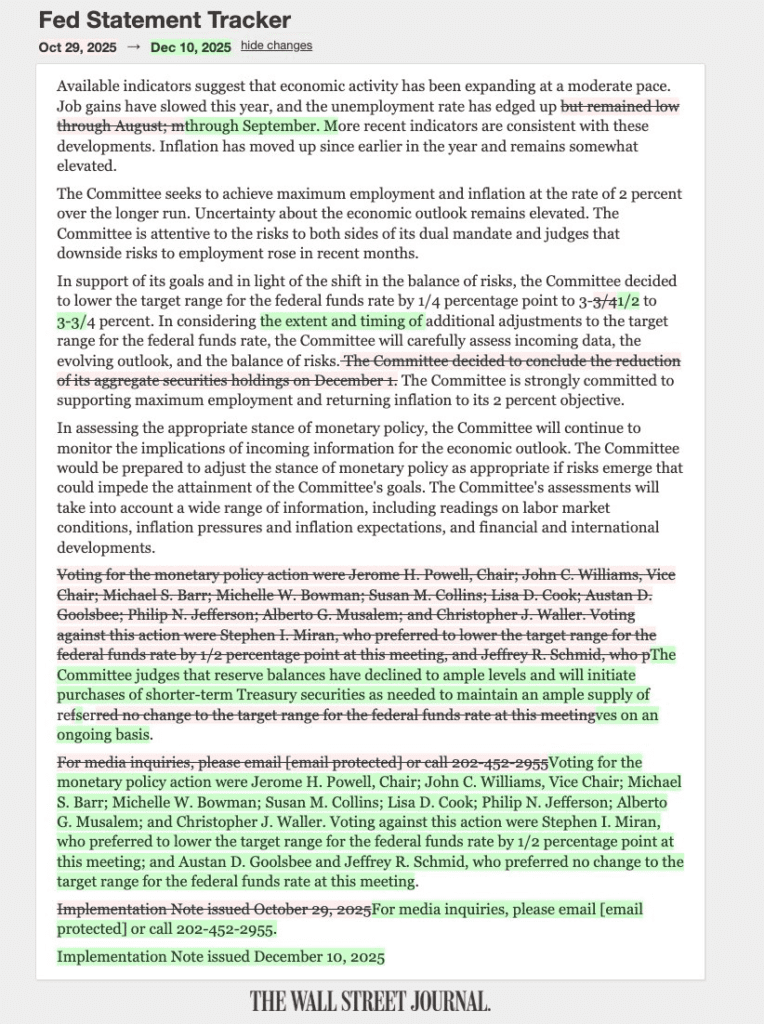

The rate reduction fulfils market expectations for what analysts dubbed a “hawkish cut”, a move to support growth while signalling caution about further easing. The Fed’s statement maintained that the Committee will “carefully assess incoming data, the evolving outlook, and the balance of risks,” echoing language from December 2024, which marked the last time the Fed paused its cutting cycle.

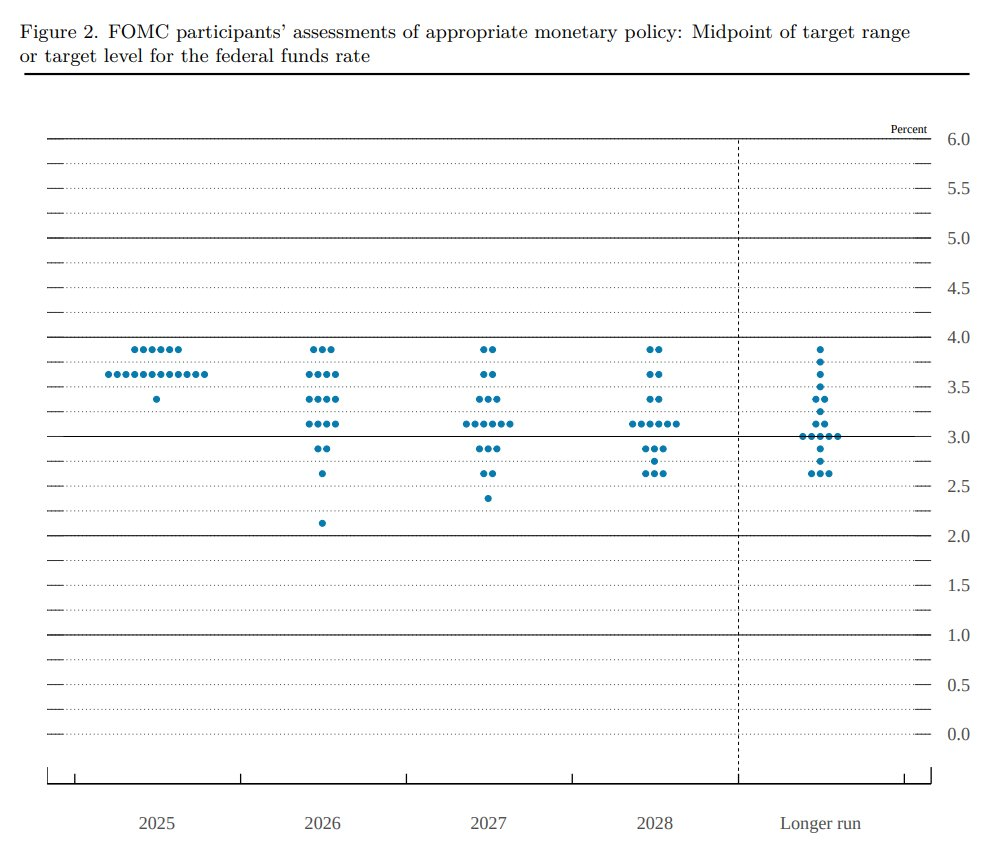

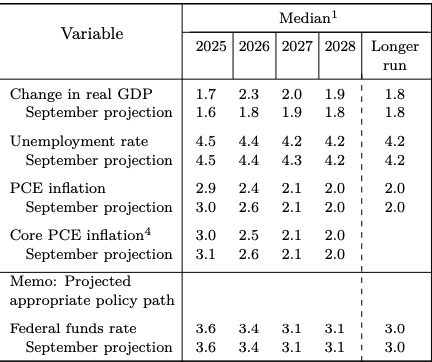

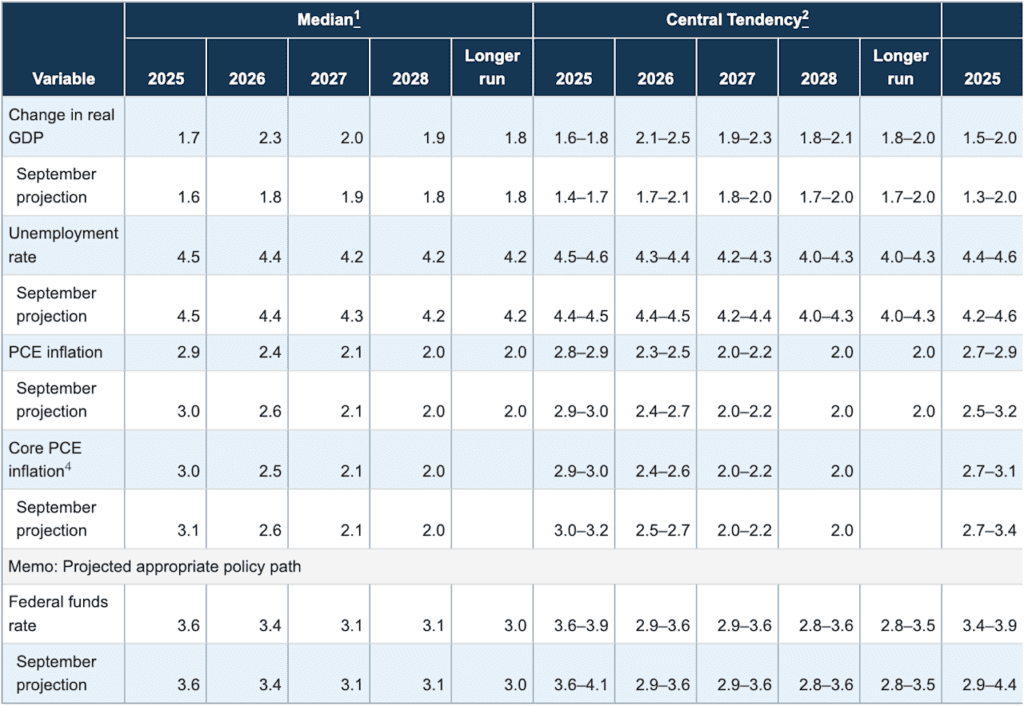

The Summary of Economic Projections (SEP) showed the median policymaker expects only one more rate cut in 2026 and another in 2027, keeping the long-run neutral rate at 3%. That outlook implies the Fed is nearing the end of its current easing cycle, with officials expecting rates to remain higher for longer than markets anticipate.

2025 – 3.625% (prior 3.625%)

2026 – 3.375% (prior 3.375%)

2027 – 3.125% (prior 3.125%)

2028 – 3.125% (prior 3.125%)

Longer run – 3.000% (prior 3.000%)

Swaps markets continue to price in about 50 basis points of easing next year, suggesting traders still expect a modest round of rate reductions despite the Fed’s cautious tone.

New Balance Sheet Policy: Treasury Purchases Resume

Alongside the rate decision, the Fed announced a significant shift in its balance sheet strategy, confirming it will begin purchasing $40 billion in Treasury bills starting December 12 to stabilize liquidity. This follows its earlier decision to end the runoff of securities this month, effectively pausing quantitative tightening.

The Committee said reserve balances have declined to levels that warrant renewed asset purchases to maintain “ample supply” of liquidity, a move reminiscent of the Fed’s short-term funding support in 2019. Purchases will “remain elevated for a few months” before gradually slowing, according to the implementation note.

Economic Outlook: Growth Up, Inflation Still Sticky

The Fed upgraded its 2026 GDP growth forecast to 2.3%, up from 1.8% in September, reflecting stronger-than-expected consumer demand and business investment. However, inflation remains a concern, with the core PCE gauge seen at 2.4% in 2026, still above the 2% target.

Unemployment is projected to rise slightly to 4.4%, consistent with a labor market that is cooling but not collapsing. The Fed also noted that job gains have slowed this year and that uncertainty around the economic outlook remains “elevated.”

Powell’s Final Months and Trump’s Influence

This decision comes as Chair Jerome Powell nears the end of his second term, with just three meetings left before President Donald Trump appoints his successor. Trump has made clear he wants a “dovish” Fed chair who supports aggressive rate cuts.

The leading candidate, according to prediction markets, is Kevin Hassett, head of the National Economic Council, who has argued that the Fed should act quickly to lower rates to boost growth. Other names on Trump’s shortlist include Kevin Warsh, Chris Waller, Michelle Bowman, and Rick Rieder of BlackRock.

The political backdrop adds another layer of uncertainty to the Fed’s future path, as markets brace for potentially looser monetary policy under a new chair aligned with Trump’s priorities.

Market Reaction: Calm but Focused on Powell

Markets took the decision largely in stride. The Dow Jones Industrial Average rose more than 300 points, while the S&P 500 added 0.3%, and the Nasdaq traded near flat. The 10-year Treasury yield dipped slightly, reflecting a mix of relief and caution as traders await Powell’s press conference.

Investors now expect Powell’s remarks, 1qaz scheduled shortly after the announcement, to provide the real direction. Analysts say his tone will determine whether markets interpret the Fed’s move as the start of a pause or simply a slowdown in the easing cycle.

In short: The Fed delivered a careful rate cut, paired with a balance sheet expansion, and maintained a hawkish outlook for 2026. Inflation remains above target, growth is steady, and political pressure on the central bank is rising.

All eyes now turn to Jerome Powell’s speech, which could shape market expectations for early 2026, and set the tone for his final months as Fed chair.