European stock markets fell again on Wednesday as fears over trade tensions linked to Greenland continued to unsettle investors, even as several companies reported strong earnings.

The pan European STOXX 600 index dropped 0.3 percent, extending losses from earlier in the week. Bank and financial shares were among the weakest performers, each falling about 1 percent.

Markets have been under pressure since President Donald Trump threatened to raise tariffs on eight European countries unless the United States is allowed to buy Greenland. Investors are now waiting nervously for Trump’s speech later today at the World Economic Forum in Davos, hoping he may ease tensions (Trump Threatens Tariffs on 8 EU Countries Over Greenland Dispute)

So far, Trump has shown no sign of backing down, keeping markets on edge.

Earnings Help Limit the Damage

Despite the political worries, strong company results helped prevent bigger losses.

- Rio Tinto shares jumped 4.7 percent after beating expectations for iron ore and copper production

- Barry Callebaut rose 4.3 percent after naming a new chief executive

- InPost gained 1 percent as delivery volumes surged

Mining stocks were the best performing sector, rising more than 3 percent as gold prices hit a record high. Car stocks also rose slightly after several days of losses.

Inflation Data Adds to Uncertainty

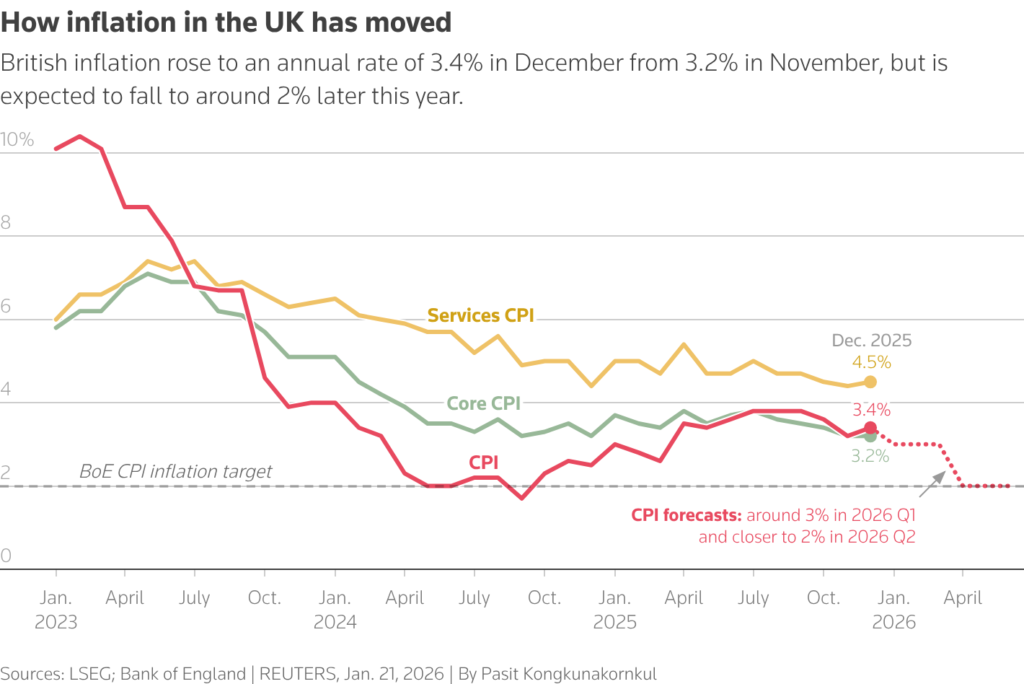

In the UK, inflation rose more than expected in December. While services inflation stayed in line with forecasts, the higher headline number suggests interest rates may stay high for longer.

Analysts said this could limit how quickly the Bank of England can cut rates, keeping borrowing costs elevated.

London’s main FTSE 100 index ended flat, showing how investors are balancing strong earnings against rising geopolitical and inflation risks.

For now, markets remain highly sensitive to political headlines, with Trump’s Davos speech expected to be a key moment for investor confidence.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.