Europe’s natural gas market is heading into 2026 with ample supply, softer demand, and falling price pressure, according to a new supply and demand outlook from Kpler Insight.

The key shift is on the LNG side, as rising Atlantic Basin supply, mainly from the US, continues to replace lost Russian pipeline volumes and reshapes Europe’s gas balance.

Prices: Bearish into 2026

European TTF gas prices are expected to ease further next year.

- 2025 average: $12.06/MMBtu

- 2026 forecast: $9.81/MMBtu, revised lower month on month

The downgrade reflects plentiful LNG supply, weaker Northeast Asia demand, soft European consumption, and rising expectations of a potential Russia–Ukraine peace deal, even though Russian gas phaseout plans remain intact.

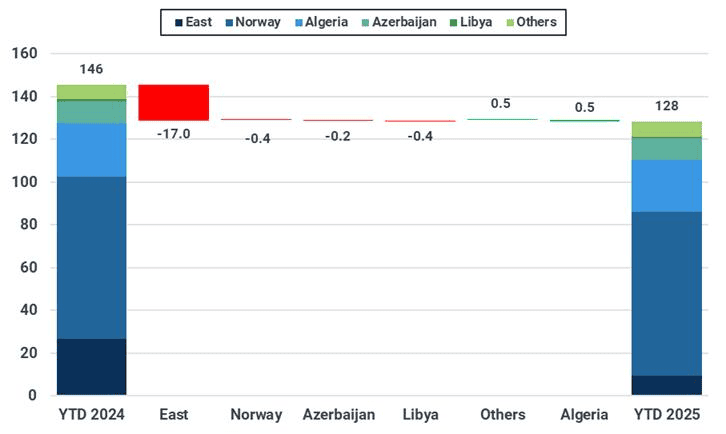

Pipeline gas: Slight recovery, Russia fades

- EU-27 pipeline imports fell 12% year on year in 2025 to around 140 bcm

- 2026 forecast: a modest rise to 142 bcm

Higher flows from Azerbaijan, driven by the Trans Adriatic Pipeline expansion, along with marginal increases from Norway and the UK, are expected to offset declining TurkStream volumes as Europe continues reducing reliance on Russian gas.

LNG imports: The backbone of supply

LNG remains the main growth driver.

- 2025 LNG imports: 127 million tonnes, up 25% y/y

- 2026 forecast: 145 million tonnes, up 19% y/y

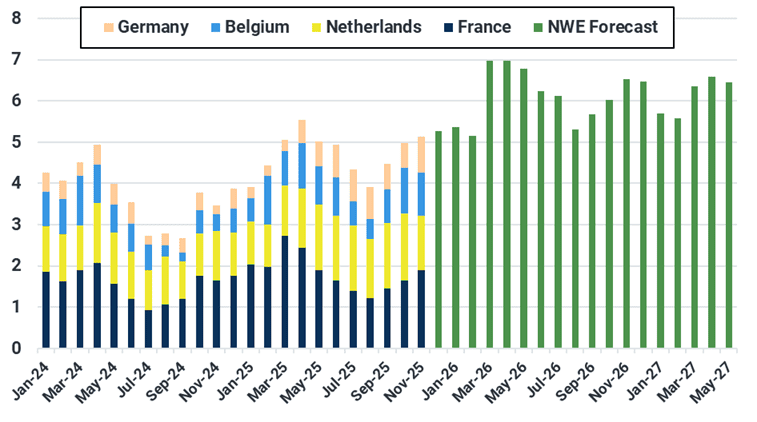

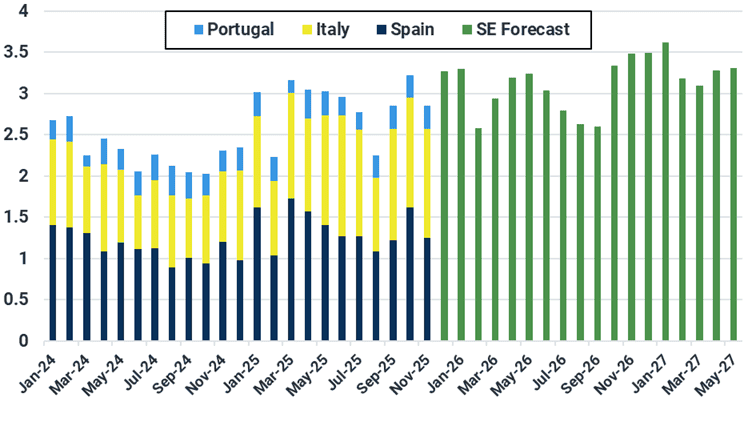

Growth is led by Northwest Europe, where imports are projected to jump nearly 30% next year as new regasification capacity comes online in Germany, Belgium, and the Netherlands. Southern Europe sees more moderate growth, while Turkey continues to boost imports as it positions itself as a regional gas hub.

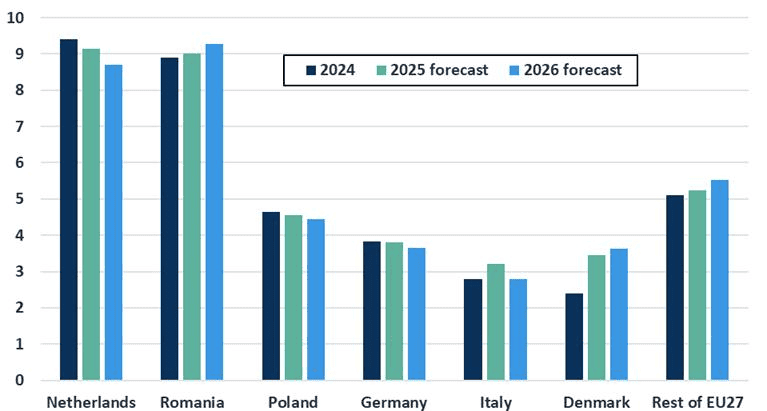

Domestic production: Flat

EU gas production is expected to remain broadly stable.

- 2025: 38.4 bcm

- 2026: 38 bcm

Dutch output supported 2025 gains, while Romania’s Neptune Deep field is expected to start ramping up in early 2027.

Demand: Weak but stabilizing

EU-27 gas demand is forecast at:

- 2025: 319.1 bcm, up 1.5% y/y

- 2026: 320.4 bcm, up just 0.4% y/y

Industrial demand remains soft, especially in Germany, while power-sector gas use continues to be displaced by renewables. Lower prices may support a modest recovery, but demand growth is expected to stay limited.

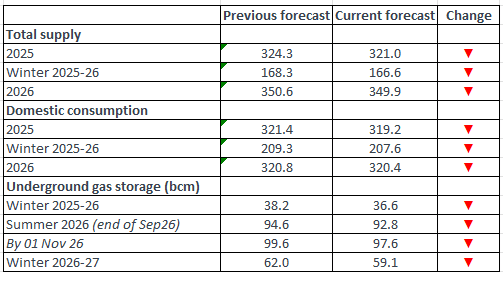

Storage outlook improves

EU gas storage ended November 2025 at 75% full, below last year.

Stocks are expected to:

- Fall to 36% by the end of winter 2025–26

- Rebuild strongly over summer 2026

- Reach 96% capacity by November 2026

Europe enters 2026 with strong LNG availability, resilient infrastructure, and easing price pressure, but weak demand and geopolitical uncertainty cap upside. The gas market is shifting from crisis management to balance and flexibility, with LNG firmly at the center of Europe’s energy security strategy.

More about: European natural gas outlook 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: European stocks retreat as early-2026 rally pauses on retail and tech weakness