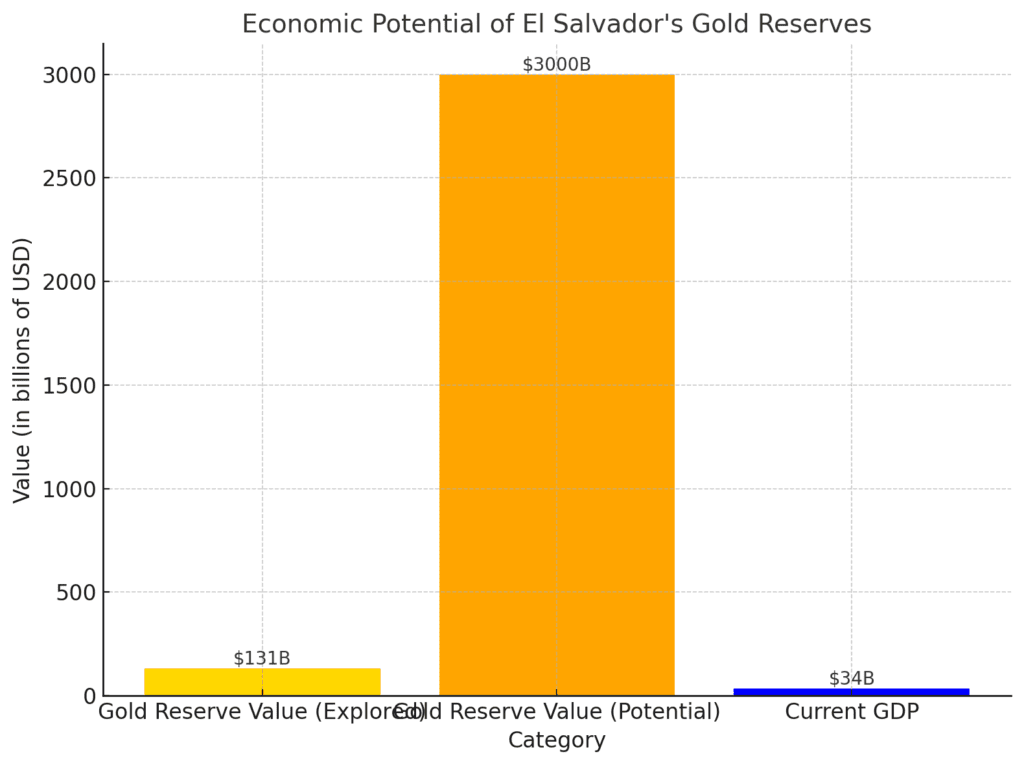

El Salvador, already in the global spotlight for its adoption of Bitcoin as legal tender, has unveiled a monumental discovery: untapped gold reserves potentially worth $3 trillion. This revelation could revolutionize the nation’s economy, though it comes with contentious debates over lifting a mining ban, ensuring environmental sustainability, and leveraging the wealth for strategic investments.

Gold Mining Ban Under Review

President Nayib Bukele, highlighting the unprecedented potential of El Salvador’s natural wealth, has called for the repeal of the 2017 metal mining ban. Current explorations have uncovered 50 million ounces of gold valued at $131 billion—nearly 380% of the nation’s GDP. If further explored, these reserves could exceed $3 trillion, roughly 8,800% of the GDP.

Bukele envisions responsible mining as a means to fund critical infrastructure projects, create jobs, and propel economic development. However, critics point to environmental risks and question the feasibility of extracting such vast reserves sustainably.

Bitcoin as the Future?

The discovery poses an intriguing challenge for El Salvador’s cryptocurrency ambitions. As the world’s first Bitcoin-legal-tender nation, some leaders suggest pivoting away from gold entirely. Bitcoin advocate Max Keiser proposed monetizing the reserves to buy Bitcoin, capitalizing on its capped supply and potential long-term value.

Keiser stated, “Gold is rapidly losing its value compared to Bitcoin. Now is the time to convert resources into a truly fixed asset.”

Balancing Wealth and Sustainability

President Bukele assures citizens that mining will be conducted with a sustainable framework. However, environmental groups remain skeptical. While gold mining could boost the economy, the risks of ecological damage and the dilution of global gold reserves are key concerns.

El Salvador faces pivotal questions:

- Should it mine gold or pivot entirely toward digital assets like Bitcoin?

- How should potential revenues be allocated to ensure sustainable economic growth?

This strategic decision could redefine the nation’s future and elevate it as a global economic leader.