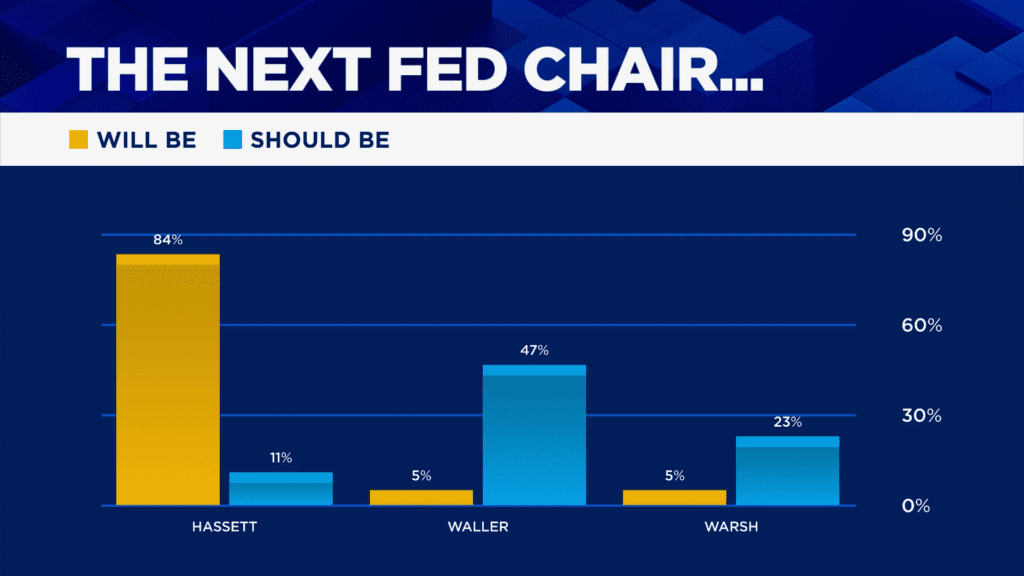

A new CNBC Fed Survey shows a sharp divide between expectations and preferences for the next Federal Reserve chair, and mainly in favouring Kevin Hasset.

According to the poll, 84% of respondents believe President Donald Trump will nominate Kevin Hassett, his top economic adviser and head of the National Economic Council, to succeed Jerome Powell. However, only 11% think Trump should do so, with 47% favoring Fed Governor Christopher Waller and 23% backing former Fed official Kevin Warsh.

Concerns center on Hassett’s independence and his alignment with Trump’s calls for rapid rate cuts. Roughly 76% expect the next Fed chair to be more dovish than Powell, while 51% believe the new leader will follow the president’s push for lower rates rather than act independently.

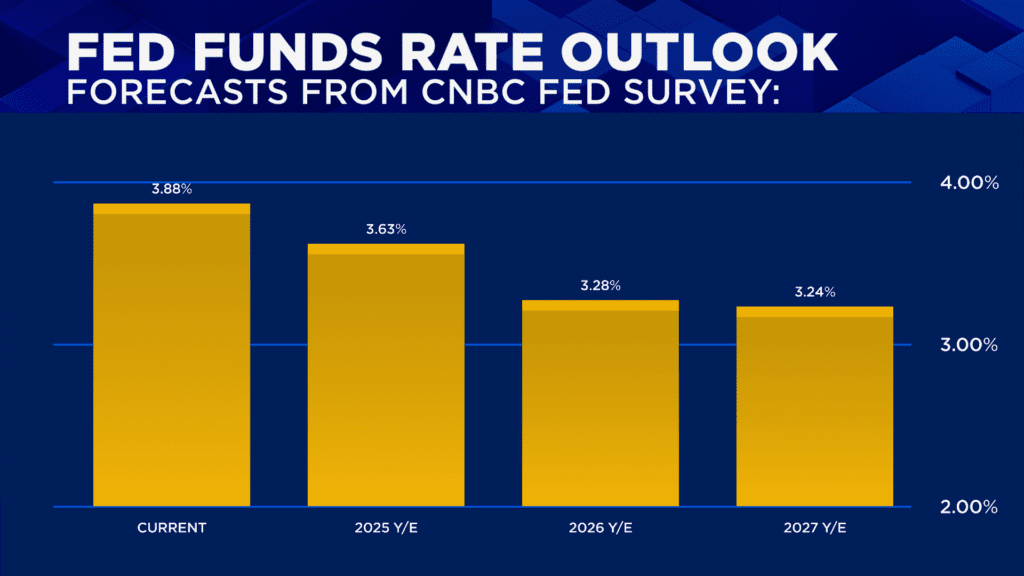

Ahead of this week’s meeting, most respondents forecast a 25-basis-point “hawkish cut” followed by a pause. While 87% expect a rate cut, less than half (45%) think the Fed should proceed.

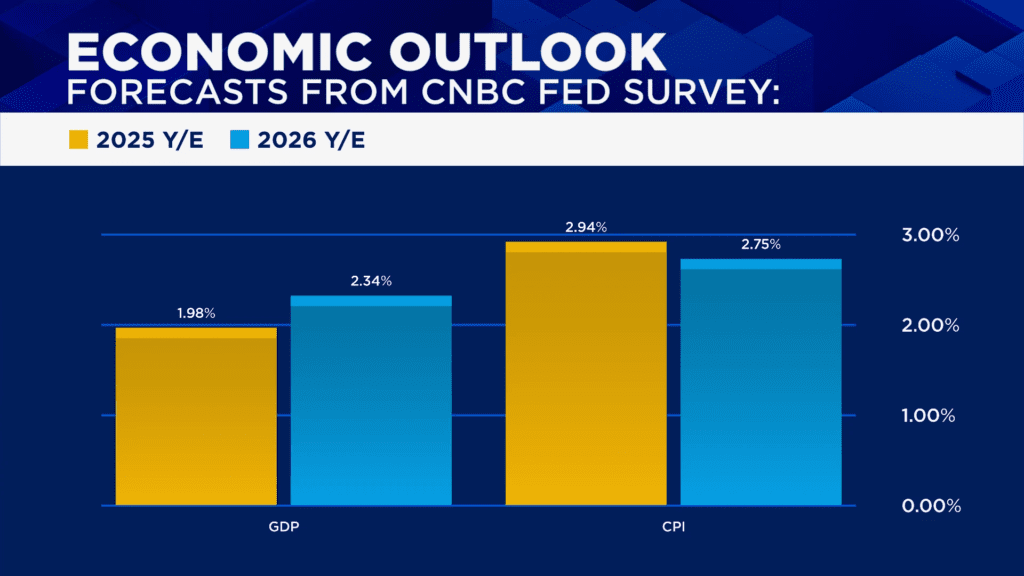

Economists warned of lingering inflation and potential risks from over-easing. “GDP is tracking at nearly 4%, inflation remains above target… it seems ill-advised to discount inflation risks,” said Richard Bernstein of Richard Bernstein Advisors.

Still, some argue the Fed is behind the curve. Allen Sinai of Decision Economics said a “preemptive 50 bp cut” would be appropriate given labor-market weakness.

The survey also revealed rising worries about persistent inflation and a potential AI bubble, with 90% of respondents calling AI stocks overvalued.

Despite those risks, investors remain upbeat, projecting a 6% S&P 500 gain in 2026 and another 6% in 2027, signaling optimism that markets can withstand political and monetary shifts ahead.

Related: Trump Says Next Fed Chair Must Cut Rates Immediately