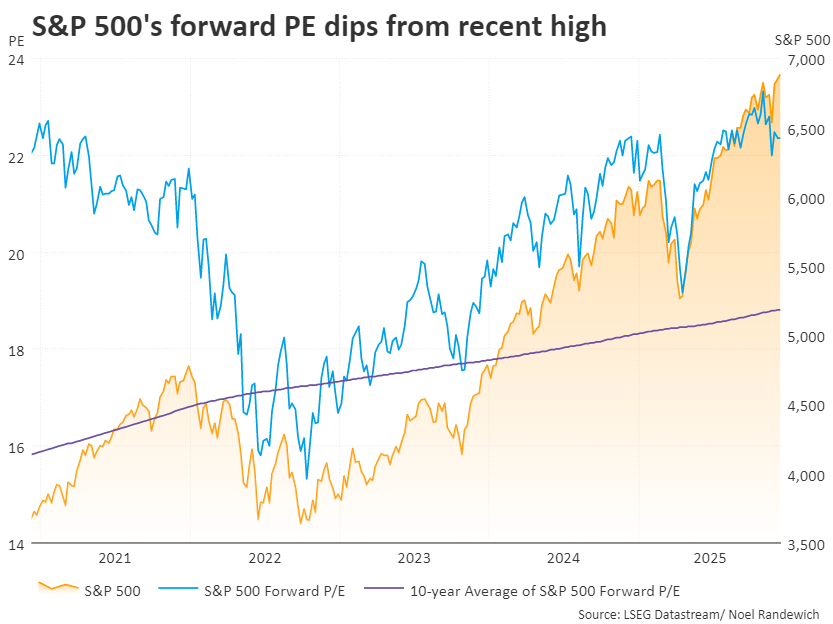

The Dow Jones Industrial Average and S&P 500 closed at record highs on Thursday, lifted by financials and materials, as investors shifted away from pricey AI and tech names following a softer-than-expected Federal Reserve stance.

The S&P 500 rose 0.21% to 6,902.19, marking its first record close since October 29, while the Dow surged 1.36% to 48,709.12, its best finish since mid-November. The Nasdaq Composite, however, slipped 0.25% to 23,597.26, dragged down by a steep drop in Oracle shares.

Oracle tumbled after the company warned of higher-than-expected annual spending, nearly $15 billion more than planned, sparking fears of overspending in the AI cloud race. The cost of insuring Oracle’s debt spiked, prompting concerns of another AI-driven bubble like the early 2000s dotcom era.

Despite tech weakness, value stocks outperformed growth, and small-caps in the Russell 2000 gained, signaling a broader market rotation. “We’re seeing small caps, cyclicals, and financials outperform as investors bet on global growth picking up,” said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments.

Financials and materials led the day, with JPMorgan, Goldman Sachs, and Visa rallying. Disney also climbed after announcing a $1 billion equity investment in OpenAI, helping to ease investor fears around the AI sector’s sustainability.

The move came a day after the Federal Reserve delivered its third rate cut of the year, lowering borrowing costs by 25 basis points and hinting at a potential pause. Investors were relieved that the Fed maintained its projection for two more cuts next year, balancing concerns over inflation with a cooling labor market.

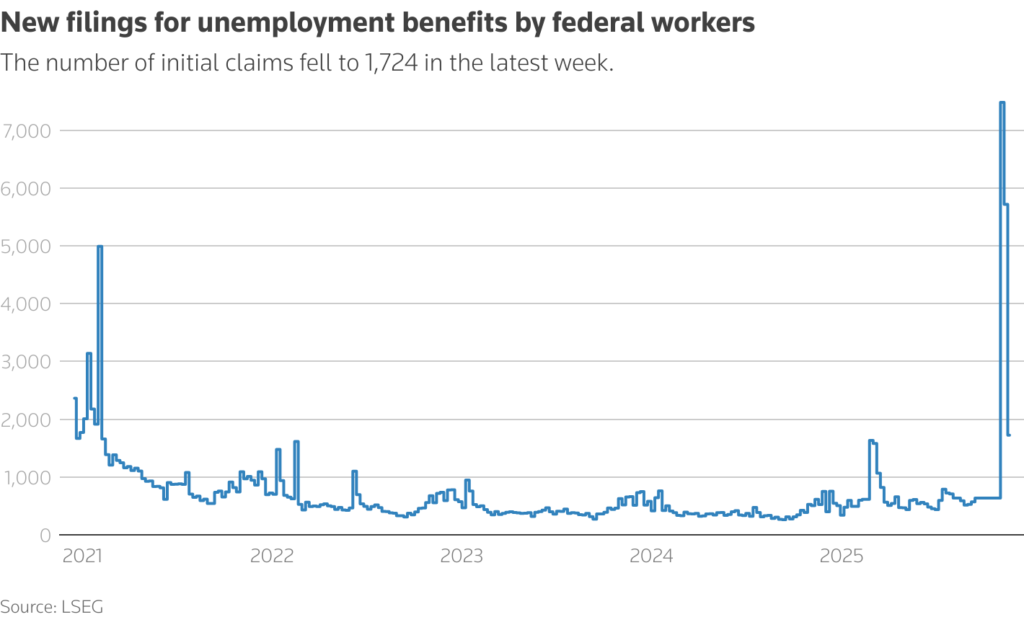

Jobless claims rose to 236,000, signaling some labor softness. Still, the market took Powell’s tone as reassuring, with traders betting on steady growth and manageable inflation into 2026.

Year-to-date, the S&P 500 is up 17%, the Nasdaq 22%, and the Dow 14%, as optimism over lower rates and resilient earnings continues to fuel Wall Street’s year-end rally.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Fed Powell Cuts Again: Here is why