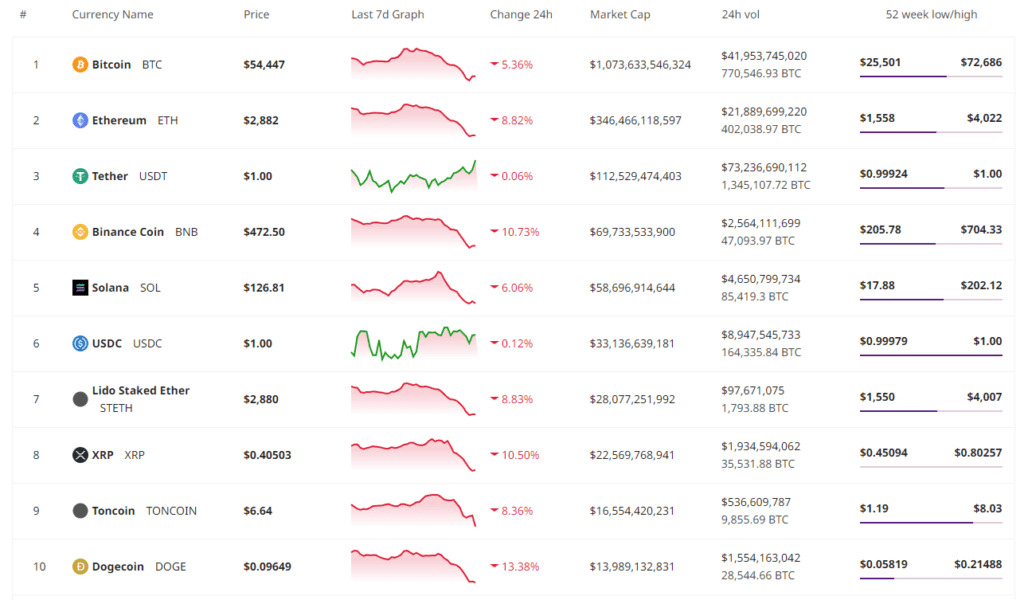

The global cryptocurrency market cap has dropped 8.6% in the past 24 hours, now standing at $2.08 trillion. Despite a rise in total trading volume to $147 billion, most major coins, including Bitcoin and Ethereum, saw significant declines. Bitcoin fell 5.4% to $54,447, and Ethereum dropped 8.8% to $2,882.

Key Factors for the Decline:

- Mt. Gox Transfers: The defunct crypto exchange transferred $2.7 billion worth of BTC to a new wallet and began creditor repayments, increasing market uncertainty.

- Government Actions: Germany’s recent Bitcoin sell-off faced criticism, adding to the market’s downward pressure.

- Broader Market Trends: The significant drops in top coins like Dogecoin, Binance Coin, and XRP reflect a general market downturn.

Individual Coin Performances:

- Fasttoken (FTN): Best performer with a 3.2% increase.

- Frax (FRAX): Slight increase of 0.2%.

- Core (CORE): Largest decline at 21.1%.

Other Developments:

- Zand Bank Partnership: Zand Bank in UAE partners with Taurus for comprehensive digital asset services.

- Bitget Fiat OTC Launch: Bitget introduces a new OTC platform supporting multiple currencies, aiming at institutional investors and professional traders.

- Imperial College I3-Lab: IOTA Foundation backs new research facility at Imperial College London with £1 million, focusing on circular economy and DLT innovation.

These events underscore the current volatility in the crypto market and highlight significant institutional moves within the industry.